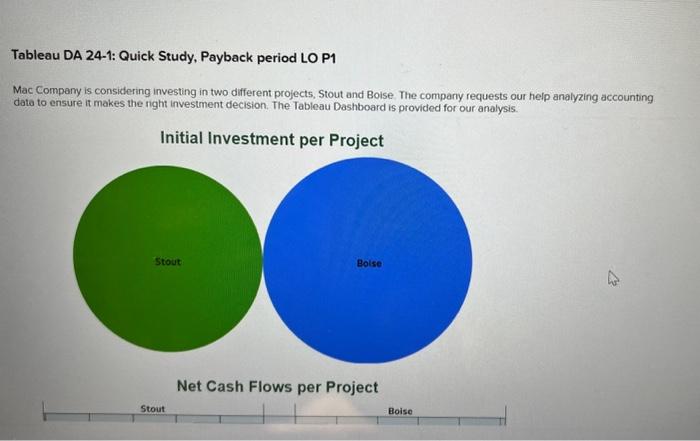

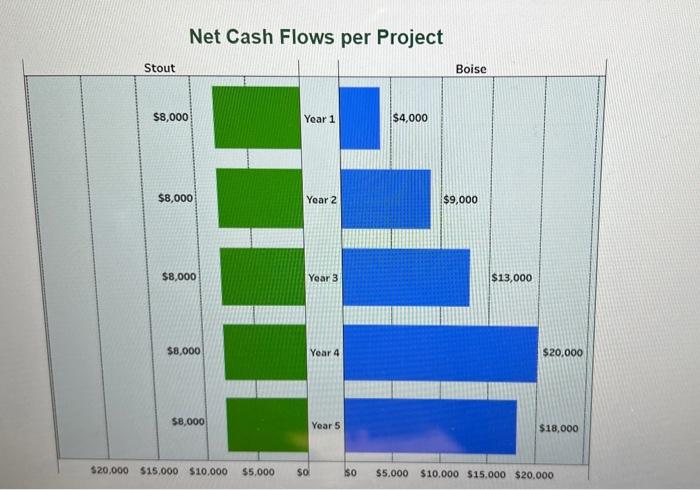

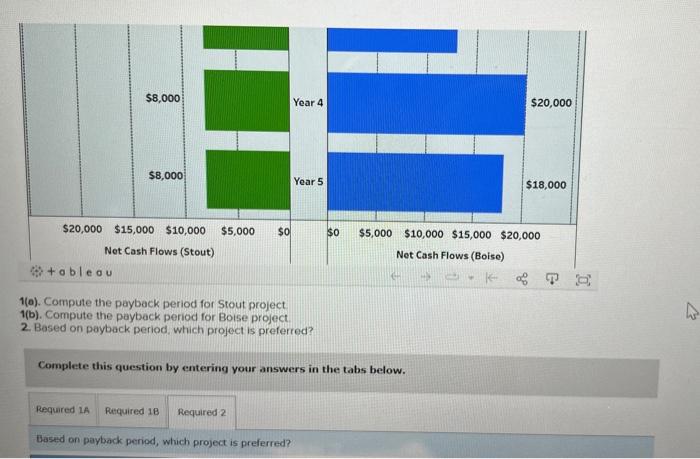

Question: Tableau DA 24-1: Quick Study, Payback period LO P1 Mac Company is considering investing in two different projects, Stout and Boise. The company requests our

Tableau DA 24-1: Quick Study, Payback period LO P1 Mac Company is considering investing in two different projects, Stout and Boise. The company requests our help analyzing accounting data to ensure it makes the night investment decision. The Tableau Dashboard is provided for our analysis. Net Cash Flows per Project 1(o). Compute the payback period for Stout project 1(b). Compute the payback period for Boise project 2. Based on payback period, which project is preferred? Complete this question by entering your answers in the tabs below. Based on payback period, which project is preferred? Tableau DA 24-1: Quick Study, Payback period LO P1 Mac Company is considering investing in two different projects, Stout and Boise. The company requests our help analyzing accounting data to ensure it makes the night investment decision. The Tableau Dashboard is provided for our analysis. Net Cash Flows per Project 1(o). Compute the payback period for Stout project 1(b). Compute the payback period for Boise project 2. Based on payback period, which project is preferred? Complete this question by entering your answers in the tabs below. Based on payback period, which project is preferred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts