Question: Tableau DA 8-1: Quick Study, Straight-line depreciation and book value LO P1 The company founder hires us as consultants and asks that we oversee the

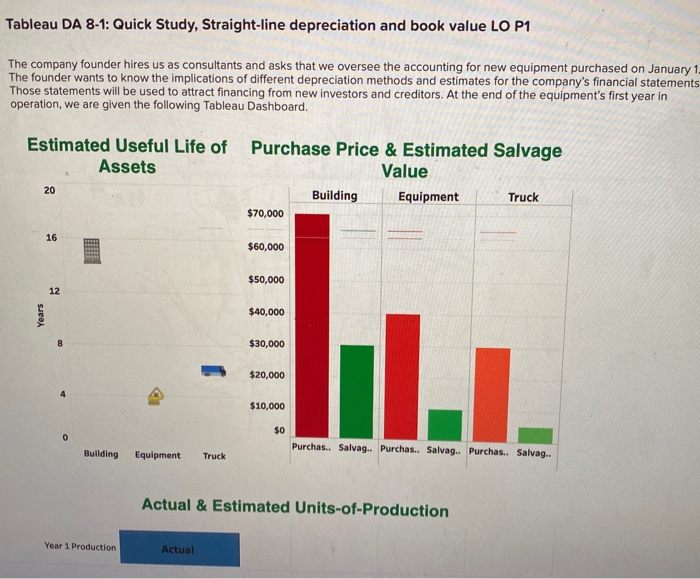

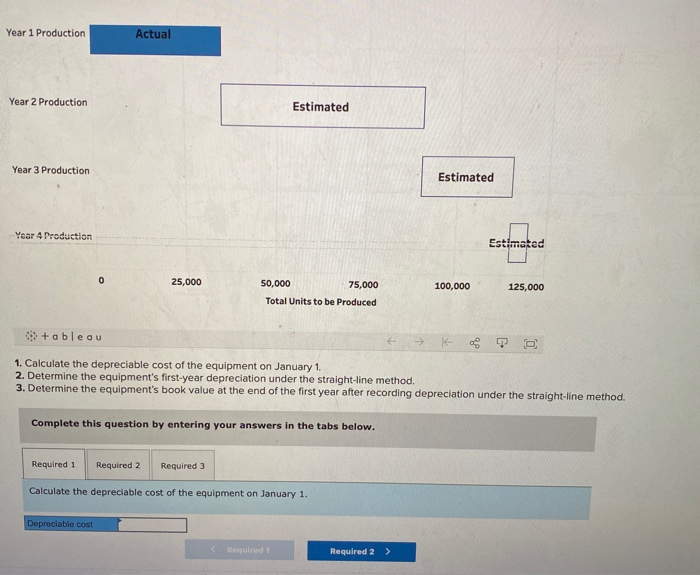

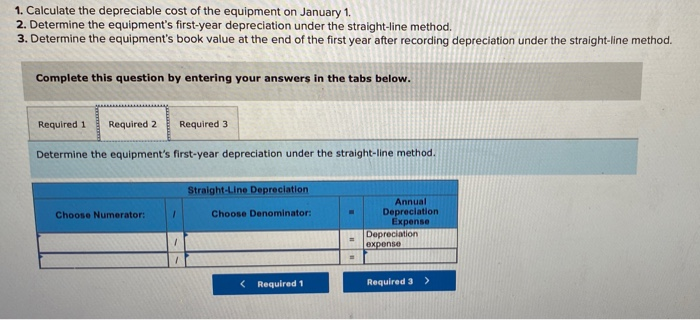

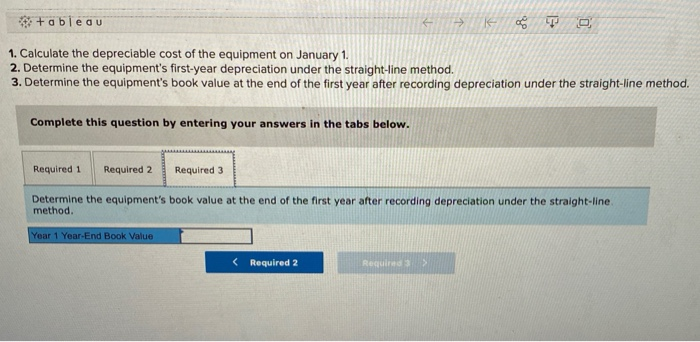

Tableau DA 8-1: Quick Study, Straight-line depreciation and book value LO P1 The company founder hires us as consultants and asks that we oversee the accounting for new equipment purchased on January 1 The founder wants to know the implications of different depreciation methods and estimates for the company's financial statements Those statements will be used to attract financing from new investors and creditors. At the end of the equipment's first year in operation, we are given the following Tableau Dashboard. Estimated Useful Life of Assets Purchase Price & Estimated Salvage Value Building Equipment Truck 20 $70,000 16 $60,000 $50,000 12 Years $40,000 8 $30,000 $20,000 $10,000 $0 0 Purchas.. Salvag. Purchas.. Salvag. Purchas.. Salvag.. Building Equipment Truck Actual & Estimated Units-of-Production Year 1 Production Actual Year 1 Production Actual Year 2 Production Estimated Year 3 Production Estimated Year 4 Production Estimated o 25,000 100,000 125,000 50,000 75,000 Total Units to be produced +ableau TO 1. Calculate the depreciable cost of the equipment on January 1 2. Determine the equipment's first-year depreciation under the straight-line method. 3. Determine the equipment's book value at the end of the first year after recording depreciation under the straight-line method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the depreciable cost of the equipment on January 1. Depreciable cost Required Required 2 > 1. Calculate the depreciable cost of the equipment on January 1. 2. Determine the equipment's first-year depreciation under the straight-line method. 3. Determine the equipment's book value at the end of the first year after recording depreciation under the straight-line method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine the equipment's first-year depreciation under the straight-line method. Straight-Line Depreciation Choose Numerator: Choose Denominator: Annual Depreciation Expense Depreciation expense tableau O 1. Calculate the depreciable cost of the equipment on January 1. 2. Determine the equipment's first-year depreciation under the straight-line method. 3. Determine the equipment's book value at the end of the first year after recording depreciation under the straight-line method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine the equipment's book value at the end of the first year after recording depreciation under the straight-line method. Year 1 Year-End Book Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts