Question: Tableau Dashboard Activity 8 - 2 LO 8 - 2 , 8 - 3 Aperol Industries started their business on January 1 st . On

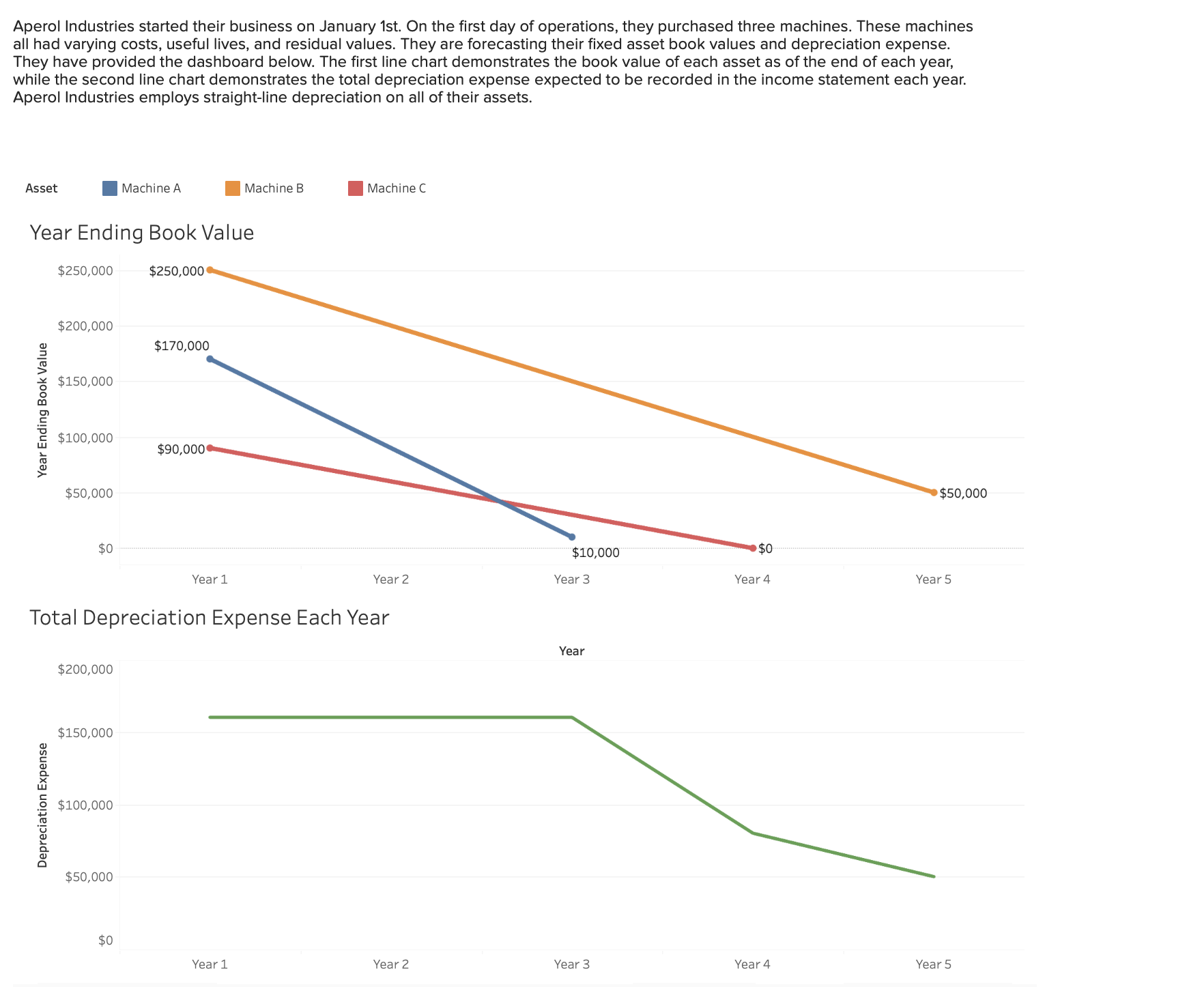

Tableau Dashboard Activity LO Aperol Industries started their business on January st On the first day of operations, they purchased three machines. These machines

all had varying costs, useful lives, and residual values. They are forecasting their fixed asset book values and depreciation expense.

They have provided the dashboard below. The first line chart demonstrates the book value of each asset as of the end of each year,

while the second line chart demonstrates the total depreciation expense expected to be recorded in the income statement each year.

Aperol Industries employs straightline depreciation on all of their assets.

Asset

Machine A

Machine B

Machine C

Y

Aperol Industries started their business on January st On the first day of operations, they purchased three machines. These machines all had varying costs, useful lives, and residual values. They are forecasting their fixed asset book values and depreciation expense. They have provided the dashboard below. The first line chart demonstrates the book value of each asset as of the end of each year, while the second line chart demonstrates the total depreciation expense expected to be recorded in the income statement each year. Aperol Industries employs straightline depreciation on all of their assets.Aperol Industries started their business on January st On the first day of operations, they purchased three machines. These machines

all had varying costs, useful lives, and residual values. They are forecasting their fixed asset book values and depreciation expense.

They have provided the dashboard below. The first line chart demonstrates the book value of each asset as of the end of each year,

while the second line chart demonstrates the total depreciation expense expected to be recorded in the income statement each year.

Aperol Industries employs straightline depreciation on all of their assets.

Asset Machine A Machine B C

Year Ending Book Value

Total Depreciation Expense Each YearRequired:

Using the dashboard above, fill out the following table:

Record the Year depreciation entry for each machine:

Journal entry

worksheet

Record the Year depreciation entry for machine A

Note: Enter debits before credits.

explanation QUESTIONS: Record the Year depreciation entry for each machine: Record the Year depreciation entry for machine A B & C It also asks for the purchase price, useful life, and residual value of each machine

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock