Question: Tableau Dashboard Activity 9 - 2 ( Static ) Comparing Depreciation Methods and Calculating the Fixed Asset Turnover Ratio [ LO 9 - 3 ,

Tableau Dashboard Activity Static Comparing Depreciation Methods and Calculating the Fixed Asset Turnover Ratio LO LO LO

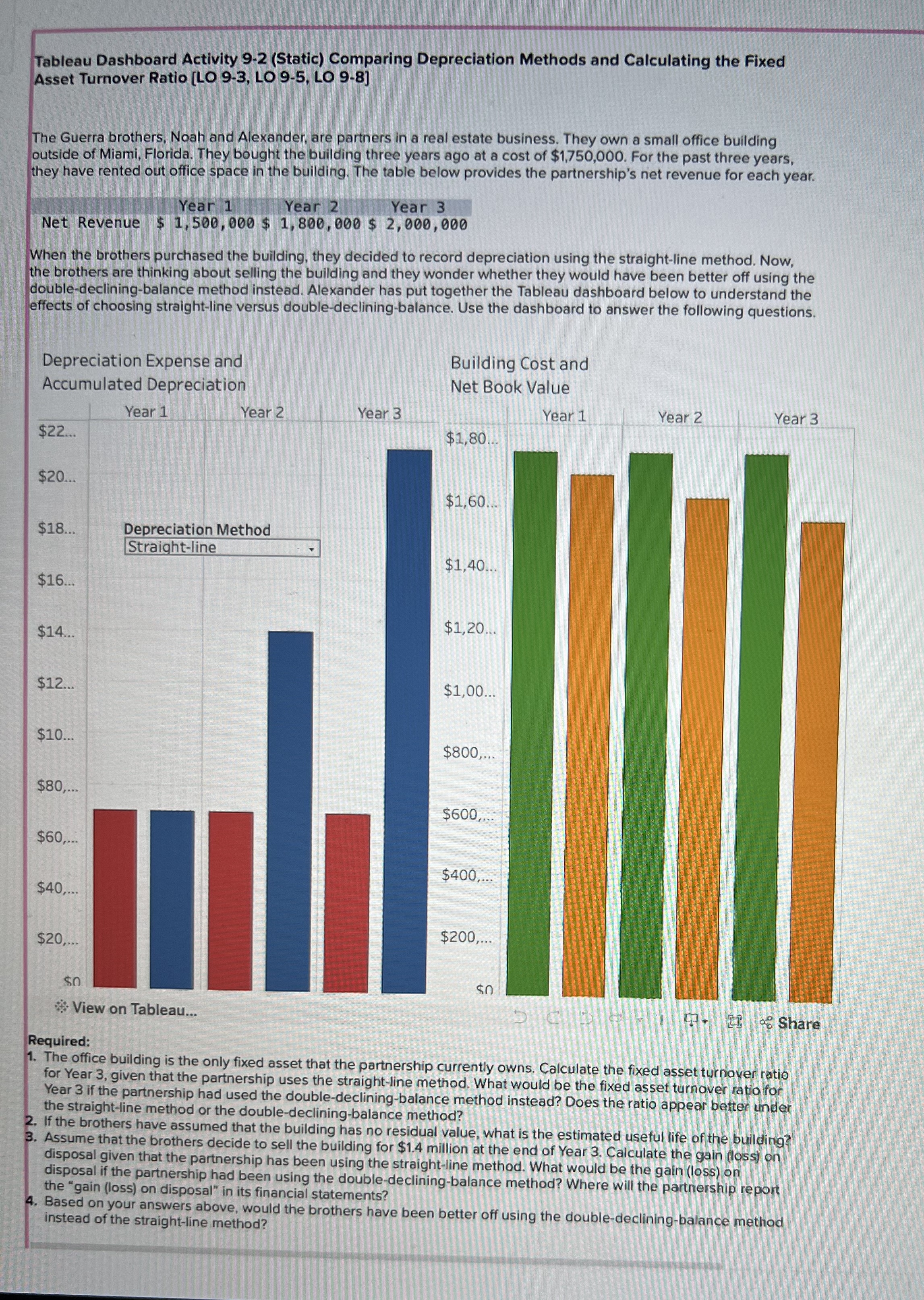

The Guerra brothers, Noah and Alexander, are partners in a real estate business. They own a small office building outside of Miami, Florida. They bought the building three years ago at a cost of $ For the past three years, they have rented out office space in the building. The table below provides the partnership's net revenue for each year.

tableYear Year Year Net Revenue,

When the brothers purchased the building, they decided to record depreciation using the straightline method. Now, the brothers are thinking about selling the building and they wonder whether they would have been better off using the doubledecliningbalance method instead. Alexander has put together the Tableau dashboard below to understand the effects of choosing straightline versus doubledecliningbalance. Use the dashboard to answer the following questions.

Depreciation Expense and Accumulated Depreciation

Required:

The office building is the only fixed asset that the partnership currently owns. Calculate the fixed asset turnover ratio for Year given that the partnership uses the straightline method. What would be the fixed asset turnover ratio for Year if the partnership had used the doubledecliningbalance method instead? Does the ratio appear better under the straightline method or the doubledecliningbalance method?

If the brothers have assumed that the building has no residual value, what is the estimated useful life of the building?

Assume that the brothers decide to sell the building for $ million at the end of Year Calculate the gain loss on disposal given that the partnership has been using the straightline method. What would be the gain loss on disposal if the partnership had been using the doubledecliningbalance method? Where will the partnership report the "gain loss on disposal" in its financial statements?

Based on your answers above, would the brothers have been better off using the doubledecliningbalance method instead of the straightline method?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock