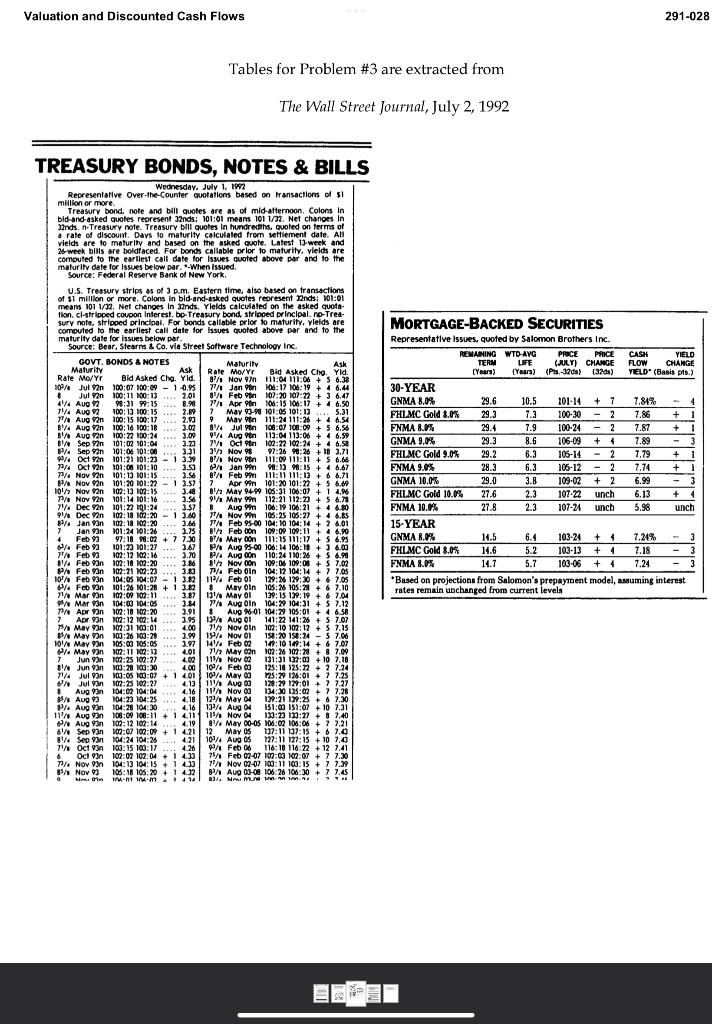

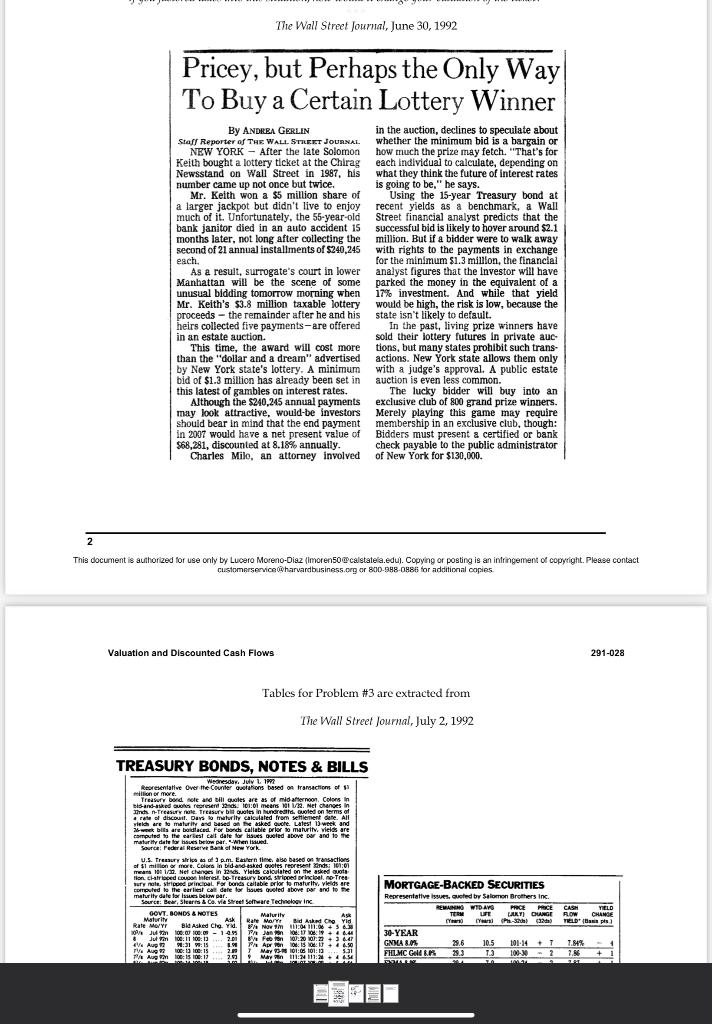

Question: Tables for Problem #3 are extracted from The Wall Street Journal, July 2, 1992 TREASURY BONDS, NOTES & BILLS million or more. Treasury bond, note

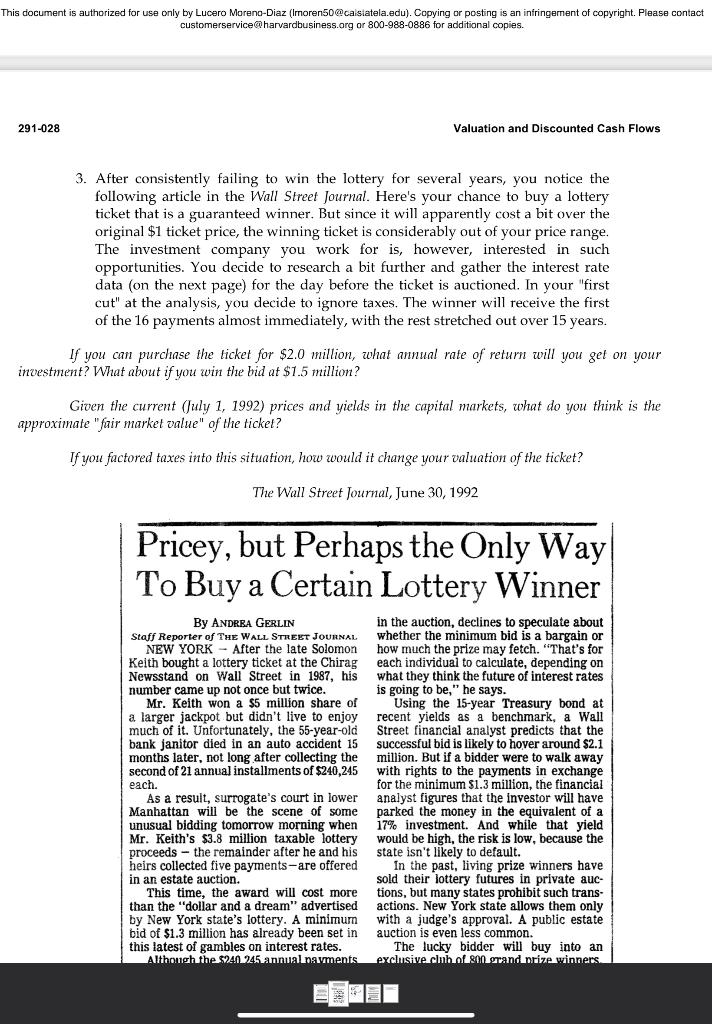

Tables for Problem \#3 are extracted from The Wall Street Journal, July 2, 1992 TREASURY BONDS, NOTES \& BILLS million or more. Treasury bond, note and bill quotes are as of mid-atternoon. Colons in bid-and-asked quoles represent 32nds: 101:01 mears 1011/32. Net changes in 3tinds. n-Treasury note. Treasury bill quotes in hundredths, ouoted on terms of a rate of discoutat. Days to maturity caiculated from seitiement date. Aft 2f-week bilis are bolidiaced. For bonds callable prlor to maturity, vielos are computed to the earliest call date for issues quoted above par and to the maluriky date for issues below par. "-When lssued U.5. Treasury strips as of 3 p.m. Eastern time, also based on fransactions of $1 million or mere. Colons in bid-and-istied quotes reoresent J2nds: 101:01 then. cl-strioped coupon interest, bo-Treasury bond, stripped princlpal. re-Tred- sury note, stripoed princloal. For bonds caltable prior io maturity, vields are maturity date for issues below par. Source: Bear, stearns 4 Co. via street sottware Technology inc. This document is authorized for use only by Lucero Moreno-Diaz (Imoren50@caistatela.edu). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 8009880886 for additional copies. 291028 Valuation and Discounted Cash Flows 3. After consistently failing to win the lottery for several years, you notice the following article in the Wall Street Journal. Here's your chance to buy a lottery ticket that is a guaranteed winner. But since it will apparently cost a bit over the original $1 ticket price, the winning ticket is considerably out of your price range. The investment company you work for is, however, interested in such opportunities. You decide to research a bit further and gather the interest rate data (on the next page) for the day before the ticket is auctioned. In your "first cut" at the analysis, you decide to ignore taxes. The winner will receive the first of the 16 payments almost immediately, with the rest stretched out over 15 years. If you can purchase the ticket for $2.0 million, what annual rate of return will you get on your investment? What about if you win the bid at $1.5 million? Given the current (July 1, 1992) prices and yields in the capital markets, what do you think is the approximate "fair market value" of the ticket? If you factored taxes into this situation, how would it change your valuation of the ticket? The Wall Street Journal, June 30,1992 The Wall Street Journal, June 30, 1992 Pricey, but Perhaps the Only Way To Buy a Certain Lottery Winner By ANDRR GeRLIN in the auction, declines to speculate about staff Reporter of ThE WALL. STrexr Jounsx. Whether the minimum bid is a bargain or Keith bought a lottery ticket at the Chirag each indlvidual to calculate, depending on Newsstand on Wall Street in 1987, his what they think the future of interest rates number came up not once but twice. is going to be," he says. Mr. Keith won a $5 million share of Using the 15-year Treasury bond at a larger jackpot but didn't live to enjoy recent yields as a benchmark, a Wall much of it. Unfortunately, the 55 -year-old bank janitor died in an auto accident 15 successful bid is likely to hover around $2.1 months later, not long after collecting the million. But if a bidder were to walk away second of 21 annual installments of $240,245 with rights to the payments in exchange each. As a result, surrogate's court in lower analyst figures that the investor will have Manhattan will be the scene of some parked the money in the equivalent of a unusual bidding tomorrow morning when 17% investment. And while that yield Mr. Keith's $3.8 million taxable lottery would be high, the risk is low, because the proceeds - the remainder after he and his state isn't likely to default. heirs collected five payments - are offered In the past, living prize winners have in an estate auction. This time, the award will cost more their lottery futures in private auc- tions, but many states prohibit such transthan the "dollar and a dream" advertised actions. New York state allows them only by New York state's lottery. A minimum with a judge's approval. A public estate bid of $1.3 million has already been set in auction is even less common. this latest of gambles on interest rates. The lucky bidder will buy into an Although the $240,245 annual payments may look attractive, would-be investors Merely club of 800 grand prize winners. should bear in mind that the end payment membership in an exclusive club, though: in 2007 would have a net present value of Bidders must present a certified or bank $68,281, discounted at 8.18% annually. check payable to the public administrator Charles Milo, an attorney involved of New York for $130,000. Valuation and Discounted Cash Flows 291028 Tables for Problem #3 are extracted from The Wall Street Journal, July 2, 1992 TREASURY BONDS, NOTES \& BILLS Tables for Problem \#3 are extracted from The Wall Street Journal, July 2, 1992 TREASURY BONDS, NOTES \& BILLS million or more. Treasury bond, note and bill quotes are as of mid-atternoon. Colons in bid-and-asked quoles represent 32nds: 101:01 mears 1011/32. Net changes in 3tinds. n-Treasury note. Treasury bill quotes in hundredths, ouoted on terms of a rate of discoutat. Days to maturity caiculated from seitiement date. Aft 2f-week bilis are bolidiaced. For bonds callable prlor to maturity, vielos are computed to the earliest call date for issues quoted above par and to the maluriky date for issues below par. "-When lssued U.5. Treasury strips as of 3 p.m. Eastern time, also based on fransactions of $1 million or mere. Colons in bid-and-istied quotes reoresent J2nds: 101:01 then. cl-strioped coupon interest, bo-Treasury bond, stripped princlpal. re-Tred- sury note, stripoed princloal. For bonds caltable prior io maturity, vields are maturity date for issues below par. Source: Bear, stearns 4 Co. via street sottware Technology inc. This document is authorized for use only by Lucero Moreno-Diaz (Imoren50@caistatela.edu). Copying or posting is an infringement of copyright. Please contact customerservice@harvardbusiness.org or 8009880886 for additional copies. 291028 Valuation and Discounted Cash Flows 3. After consistently failing to win the lottery for several years, you notice the following article in the Wall Street Journal. Here's your chance to buy a lottery ticket that is a guaranteed winner. But since it will apparently cost a bit over the original $1 ticket price, the winning ticket is considerably out of your price range. The investment company you work for is, however, interested in such opportunities. You decide to research a bit further and gather the interest rate data (on the next page) for the day before the ticket is auctioned. In your "first cut" at the analysis, you decide to ignore taxes. The winner will receive the first of the 16 payments almost immediately, with the rest stretched out over 15 years. If you can purchase the ticket for $2.0 million, what annual rate of return will you get on your investment? What about if you win the bid at $1.5 million? Given the current (July 1, 1992) prices and yields in the capital markets, what do you think is the approximate "fair market value" of the ticket? If you factored taxes into this situation, how would it change your valuation of the ticket? The Wall Street Journal, June 30,1992 The Wall Street Journal, June 30, 1992 Pricey, but Perhaps the Only Way To Buy a Certain Lottery Winner By ANDRR GeRLIN in the auction, declines to speculate about staff Reporter of ThE WALL. STrexr Jounsx. Whether the minimum bid is a bargain or Keith bought a lottery ticket at the Chirag each indlvidual to calculate, depending on Newsstand on Wall Street in 1987, his what they think the future of interest rates number came up not once but twice. is going to be," he says. Mr. Keith won a $5 million share of Using the 15-year Treasury bond at a larger jackpot but didn't live to enjoy recent yields as a benchmark, a Wall much of it. Unfortunately, the 55 -year-old bank janitor died in an auto accident 15 successful bid is likely to hover around $2.1 months later, not long after collecting the million. But if a bidder were to walk away second of 21 annual installments of $240,245 with rights to the payments in exchange each. As a result, surrogate's court in lower analyst figures that the investor will have Manhattan will be the scene of some parked the money in the equivalent of a unusual bidding tomorrow morning when 17% investment. And while that yield Mr. Keith's $3.8 million taxable lottery would be high, the risk is low, because the proceeds - the remainder after he and his state isn't likely to default. heirs collected five payments - are offered In the past, living prize winners have in an estate auction. This time, the award will cost more their lottery futures in private auc- tions, but many states prohibit such transthan the "dollar and a dream" advertised actions. New York state allows them only by New York state's lottery. A minimum with a judge's approval. A public estate bid of $1.3 million has already been set in auction is even less common. this latest of gambles on interest rates. The lucky bidder will buy into an Although the $240,245 annual payments may look attractive, would-be investors Merely club of 800 grand prize winners. should bear in mind that the end payment membership in an exclusive club, though: in 2007 would have a net present value of Bidders must present a certified or bank $68,281, discounted at 8.18% annually. check payable to the public administrator Charles Milo, an attorney involved of New York for $130,000. Valuation and Discounted Cash Flows 291028 Tables for Problem #3 are extracted from The Wall Street Journal, July 2, 1992 TREASURY BONDS, NOTES \& BILLS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts