Question: Take a case company (as shown below) and compute the relevant financial ratios (including efficiency, leverage, value and other ratios) that best describe the performance

Take a case company (as shown below) and compute the relevant financial ratios (including efficiency, leverage, value and other ratios) that best describe the performance of the company and write a short report summarizing your results.

NOTE: Financial ratios are common ratios, quick ratios, cash ratios, inventory turnover, receivable turnover, days' sales in inventory, days' sales in receivable, total debt ratio, long term debt ratio, times interest earned ratios, and cash coverage ratios

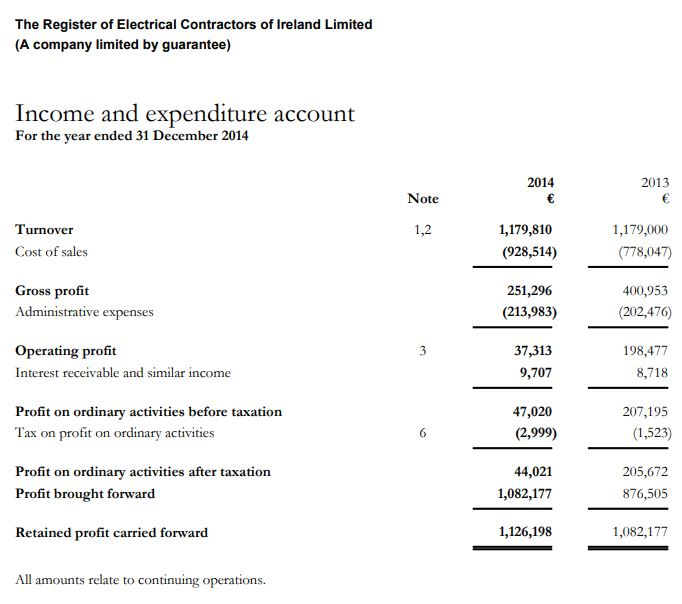

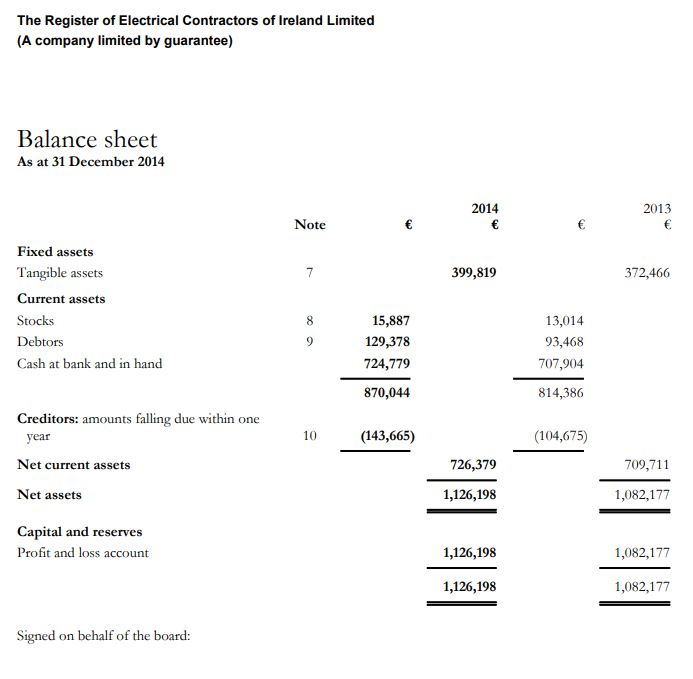

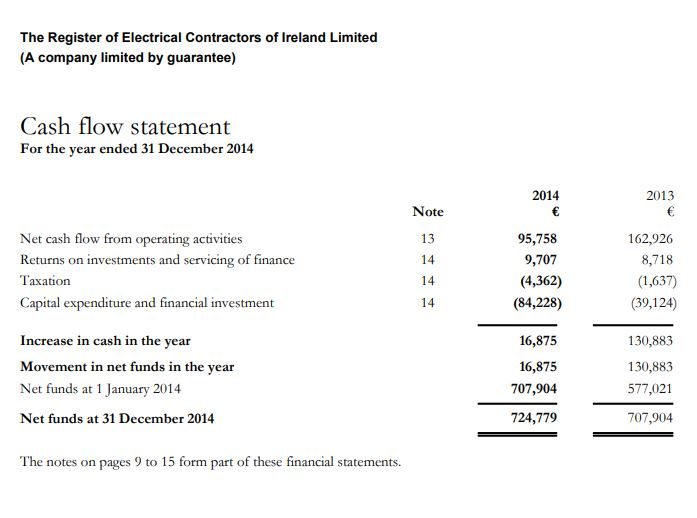

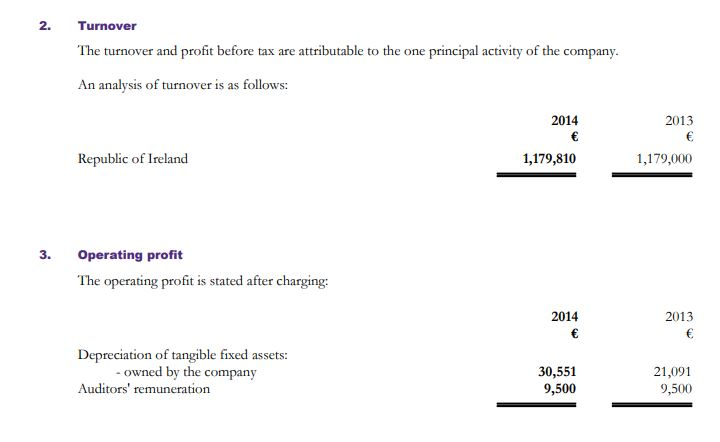

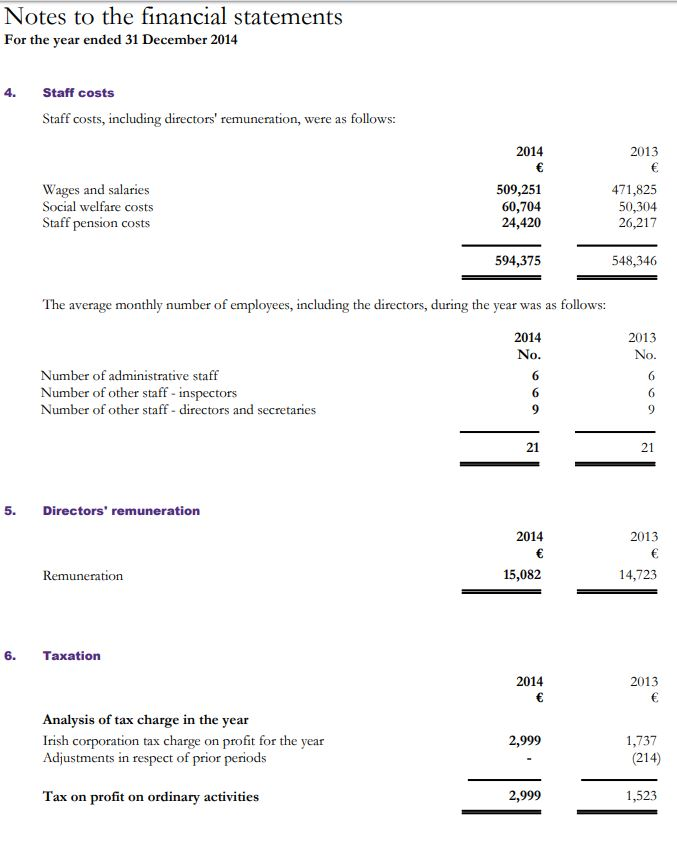

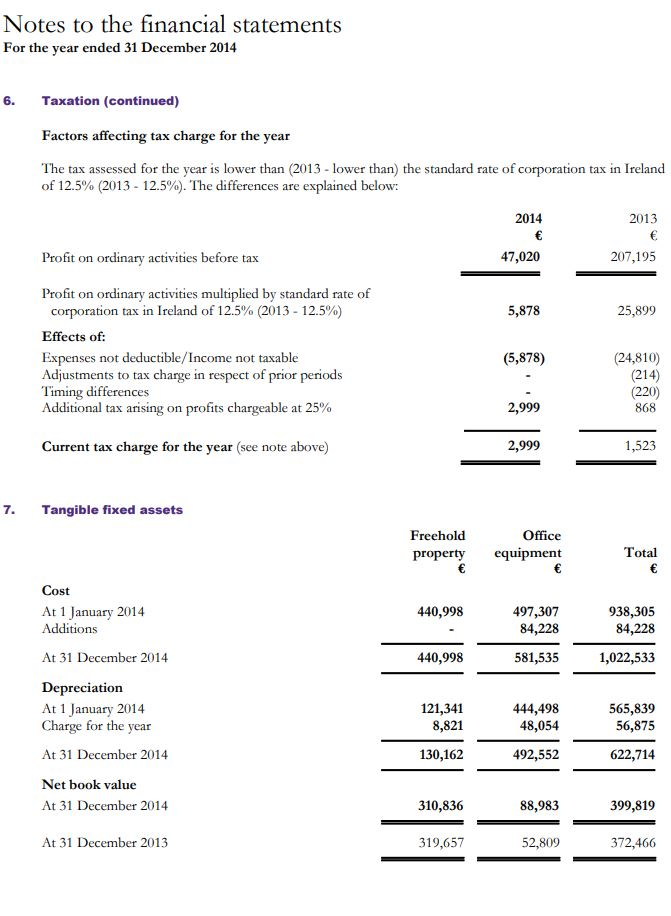

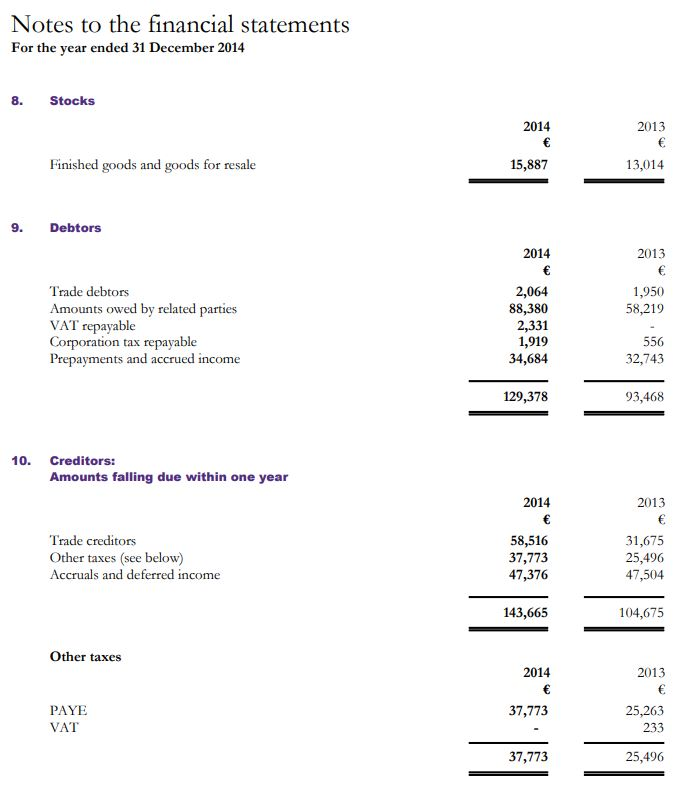

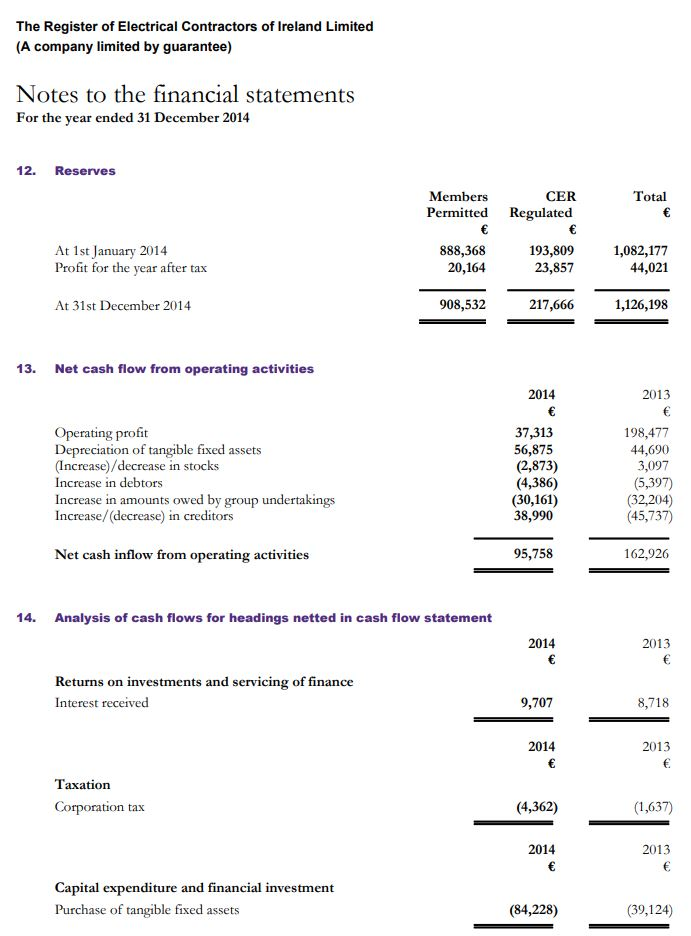

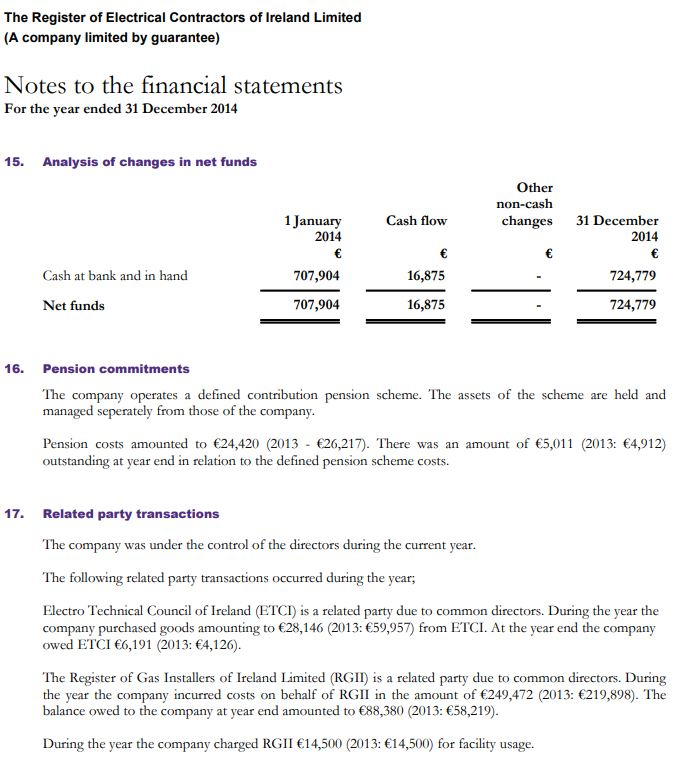

The Register of Electrical Contractors of Ireland Limited (A company limited by guarantee) Income and expenditure account For the year ended 31 December 2014 2014 2013 Note Turnover Cost of sales 1,179,810 (928,514) 1,179,000 (778,047) Gross profit Administrative expenses 251,296 (213,983) 400,953 (202,476) Operating profit Interest receivable and similar income 37,313 9,707 198,477 8,718 Profit on ordinary activities before taxation Tax on profit on ordinary activities 47,020 (2,999) 207,195 (1,523) Profit on ordinary activities after taxation Profit brought forward 44,021 1,082,177 205,672 876,505 Retained profit carried forward 1,126,198 1,082,177 All amounts relate to continuing operations. The Register of Electrical Contractors of Ireland Limited (A company limited by guarantee) Balance sheet As at 31 December 2014 2014 2014 Note 2013 Fixed assets Tangible assets 399,819 372,466 Current assets Stocks Debtors Cash at bank and in hand 15,887 129,378 724,779 13,014 93,468 707,904 870,044 814,386 Creditors: amounts falling due within one year 10 (143,665) (104,675) Net current assets 726,379 709,711 Net assets 1,126,198 1,082,177 Capital and reserves Profit and loss account 1,126,198 1,082,177 1,126,198 1,082,177 Signed on behalf of the board: The Register of Electrical Contractors of Ireland Limited (A company limited by guarantee) Cash flow statement For the year ended 31 December 2014 2014 2013 Note 162,926 8,718 Net cash flow from operating activities Returns on investments and servicing of finance Taxation Capital expenditure and financial investment 95,758 9,707 (4,362) (84,228) (1,637) (39,124) 130,883 Increase in cash in the year Movement in net funds in the year Net funds at 1 January 2014 16,875 16,875 707,904 130,883 577,021 Net funds at 31 December 2014 724,779 707,904 The notes on pages 9 to 15 form part of these financial statements Turnover The turnover and profit before tax are attributable to the one principal activity of the company. An analysis of turnover is as follows: 2014 2013 Republic of Ireland 1,179,810 1,179,000 3. Operating profit The operating profit is stated after charging: 2014 2013 Depreciation of tangible fixed assets: -owned by the company Auditors' remuneration 30,551 9,500 21,091 9,500 Notes to the financial statements For the year ended 31 December 2014 Staff costs Staff costs, including directors' remuneration, were as follows: 2014 2013 Wages and salaries Social welfare costs Staff pension costs 509,251 60,704 24,420 471,825 50,304 26,217 594,375 548,346 The average monthly number of employees, including the directors, during the year was as follows: 2014 2013 No. Number of administrative staff Number of other staff - inspectors Number of other staff - directors and secretaries 5. Directors' remuneration 2014 2013 Remuneration 15,082 14,723 6. Taxation 2014 2013 Analysis of tax charge in the year Irish corporation tax charge on profit for the year Adjustments in respect of prior periods 2,999 1,737 (214) Tax on profit on ordinary activities 2,999 1,523 Notes to the financial statements For the year ended 31 December 2014 6. Taxation (continued) Factors affecting tax charge for the year The tax assessed for the year is lower than (2013 - lower than the standard rate of corporation tax in Ireland of 12.5% (2013 - 12.5%). The differences are explained below: 2014 2013 Profit on ordinary activities before tax 47,020 207,195 5,878 25,899 Profit on ordinary activities multiplied by standard rate of corporation tax in Ireland of 12.5% (2013 - 12.5%) Effects of: Expenses not deductible/Income not taxable Adjustments to tax charge in respect of prior periods Timing differences Additional tax arising on profits chargeable at 25% (5,878) (24,810) (214) (220) 868 2,999 Current tax charge for the year (see note above) 2,999 1,523 7. Tangible fixed assets Freehold property Office equipment Total Cost At 1 January 2014 Additions 440,998 497,307 84,228 938,305 84,228 At 31 December 2014 440,998 581,535 1,022,533 Depreciation At 1 January 2014 Charge for the year 121,341 8,821 444,498 48,054 565,839 56,875 At 31 December 2014 130,162 492,552 622,714 Net book value At 31 December 2014 310,836 88,983 399,819 At 31 December 2013 319,657 52,809 372,466 Notes to the financial statements For the year ended 31 December 2014 8. Stocks 2014 2013 Finished goods and goods for resale 15,887 13,014 9. Debtors 2014 2013 Trade debtors Amounts owed by related parties VAT repayable Corporation tax repayable Prepayments and accrued income 2,064 88,380 2,331 1,950 58,219 1,919 556 32,743 34,684 129,378 93,468 10. Creditors: Amounts falling due within one year 2014 2013 Trade creditors Other taxes (see below) Accruals and deferred income 58,516 37,773 47,376 31,675 25,496 47,504 143,665 104,675 Other taxes 2014 2013 37,773 PAYE VAT 25,263 233 37,773 25,496 The Register of Electrical Contractors of Ireland Limited (A company limited by guarantee) Notes to the financial statements For the year ended 31 December 2014 12. Reserves Total Members Permitted CER Regulated At 1st January 2014 Profit for the year after tax 888,368 20,164 193,809 23,857 1,082,177 44,021 At 31st December 2014 908,532 217,666 1,126,198 13. Net cash flow from operating activities 2014 2013 Operating profit Depreciation of tangible fixed assets (Increase)/decrease in stocks Increase in debtors Increase in amounts owed by group undertakings Increase/ decrease) in creditors 37,313 56,875 (2,873) (4,386) (30,161) 38,990 198,477 44,690 3,097 (5,397) (32,204) (45,737) Net cash inflow from operating activities 95,758 162,926 14. Analysis of cash flows for headings netted in cash flow statement 2014 2013 Returns on investments and servicing of finance Interest received 9,707 8,718 2014 2013 Taxation Corporation tax (4,362) (1,637) 2014 2013 Capital expenditure and financial investment Purchase of tangible fixed assets (84,228) (39,124) The Register of Electrical Contractors of Ireland Limited (A company limited by guarantee) Notes to the financial statements For the year ended 31 December 2014 15. Analysis of changes in net funds Other non-cash changes Cash flow 1 January 2014 31 December 2014 Cash at bank and in hand 707,904 724,779 79,90 16,875 16,875 707,904 1697 Net funds 724,779 16. Pension commitments The company operates a defined contribution pension scheme. The assets of the scheme are held and managed seperately from those of the company. Pension costs amounted to 24,420 (2013 - 26,217). There was an amount of 5,011 (2013: 4,912) outstanding at year end in relation to the defined pension scheme costs. 17. Related party transactions The company was under the control of the directors during the current year. The following related party transactions occurred during the year, Electro Technical Council of Ireland (ETCI) is a related party due to common directors. During the year the company purchased goods amounting to 28,146 (2013: 59,957) from ETCI. At the year end the company owed ETCI 6,191 (2013: 4,126). The Register of Gas Installers of Ireland Limited (RGII) is a related party due to common directors. During the year the company incurred costs on behalf of RGII in the amount of 249,472 (2013: 219,898). The balance owed to the company at year end amounted to 88,380 (2013: 58,219). During the year the company charged RGII 14,500 (2013: 14,500) for facility usage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts