Question: Take a Test - Mustafa Rabboh - Google Chrome - 0 X mathxl.com/Student/PlayerTest.aspx?testld=230325404¢erwin=yes INFO240_10FA21 Mustafa Rabboh & | 11/07/21 11:14 PM Question 7 of 15

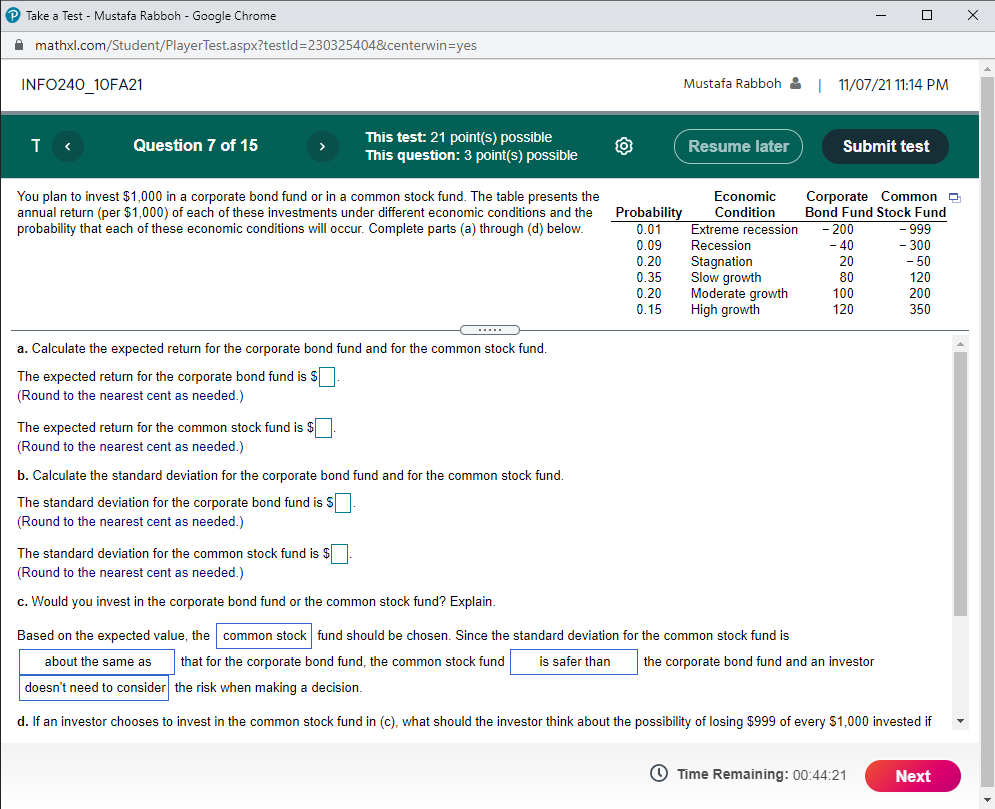

Take a Test - Mustafa Rabboh - Google Chrome - 0 X mathxl.com/Student/PlayerTest.aspx?testld=230325404¢erwin=yes INFO240_10FA21 Mustafa Rabboh & | 11/07/21 11:14 PM Question 7 of 15 This test: 21 point(s) possible This question: 3 point(s) possible Resume later Submit test You plan to invest $1,000 in a corporate bond fund or in a common stock fund. The table presents the Economic Corporate Common annual return (per $1,000) of each of these investments under different economic conditions and the Probability Condition Bond Fund Stock Fund probability that each of these economic conditions will occur. Complete parts (a) through (d) below. 0.01 Extreme recession - 200 - 999 0.09 Recession - 40 - 300 0.20 Stagnation 20 - 50 0.35 Slow growth 80 120 0.20 Moderate growth 100 200 0.15 High growth 120 350 a. Calculate the expected return for the corporate bond fund and for the common stock fund. The expected return for the corporate bond fund is $. Round to the nearest cent as needed.) The expected return for the common stock fund is $ Round to the nearest cent as needed.) b. Calculate the standard deviation for the corporate bond fund and for the common stock fund. The standard deviation for the corporate bond fund is $]. (Round to the nearest cent as needed.) The standard deviation for the common stock fund is $. Round to the nearest cent as needed.) c. Would you invest in the corporate bond fund or the common stock fund? Explain. Based on the expected value, the | common stock fund should be chosen. Since the standard deviation for the common stock fund is bout the same as that for the corporate bond fund, the common stock fund is safer than the corporate bond fund and an investor doesn't need to consider the risk when making a decision. d. If an investor chooses to invest in the common stock fund in (c), what should the investor think about the possibility of losing $999 of every $1,000 invested if Time Remaining: 00:44:21 Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts