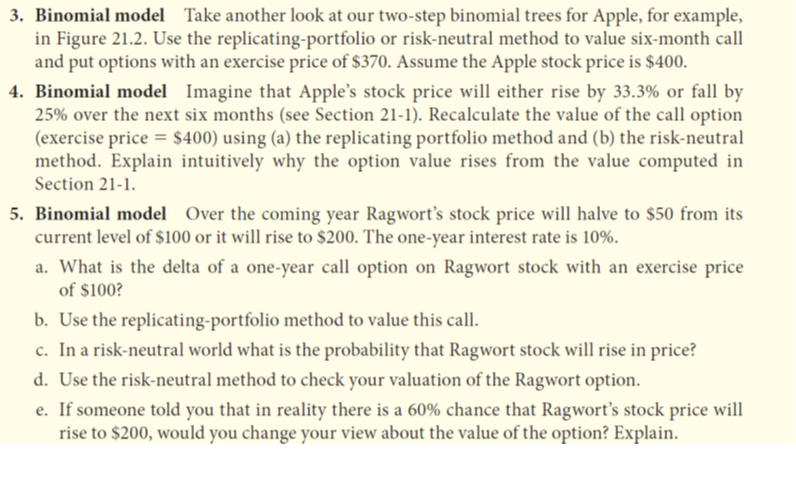

Question: Take another look at our two-step binomial trees for Apple, for example, in Figure 21.2. Use the replicating-portfolio or risk-neutral method to value six-month call

Take another look at our two-step binomial trees for Apple, for example, in Figure 21.2. Use the replicating-portfolio or risk-neutral method to value six-month call and put options with an exercise price of $370. Assume the Apple stock price is $400. Imagine that Apple's stock price will either rise by 33.3% or fall by 25% over the next six months (see Section 21-1). Recalculate the value of the call option (exercise price = $400) using the replicating portfolio method and the risk-neutral method. Explain intuitively why the option value rises from the value computed in Section 21-1. Over the coming year Ragwort's stock price will halve to $50 from its current level of $100 or it will rise to $200. The one-year interest rate is 10%. What is the delta of a one-year call option on Ragwort stock with an exercise price of$100? Use the replicating-portfolio method to value this call. In a risk-neutral world what is the probability that Ragwort stock will rise in price? Use the risk-neutral method to check your valuation of the Ragwort option. If someone told you that in reality there is a 60% chance that Ragwort's stock price will rise to $200, would you change your view about the value of the option? Explain. Take another look at our two-step binomial trees for Apple, for example, in Figure 21.2. Use the replicating-portfolio or risk-neutral method to value six-month call and put options with an exercise price of $370. Assume the Apple stock price is $400. Imagine that Apple's stock price will either rise by 33.3% or fall by 25% over the next six months (see Section 21-1). Recalculate the value of the call option (exercise price = $400) using the replicating portfolio method and the risk-neutral method. Explain intuitively why the option value rises from the value computed in Section 21-1. Over the coming year Ragwort's stock price will halve to $50 from its current level of $100 or it will rise to $200. The one-year interest rate is 10%. What is the delta of a one-year call option on Ragwort stock with an exercise price of$100? Use the replicating-portfolio method to value this call. In a risk-neutral world what is the probability that Ragwort stock will rise in price? Use the risk-neutral method to check your valuation of the Ragwort option. If someone told you that in reality there is a 60% chance that Ragwort's stock price will rise to $200, would you change your view about the value of the option? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts