Question: Take Home Assignment 3 ( THA 3 ) - Trial Balance Reporting, Consolidating Worksheets & Consolidated Financial Statements Fall 2 0 2 4

Take Home Assignment THA

Trial Balance Reporting, Consolidating Worksheets

& Consolidated Financial Statements

Fall

Design & Objectives

THA is designed to reinforce the consolidation process and the preparation of consolidated financial statements using trial balances that are common starting point in practice.BackgroundA schedule of intercompany transactions and balances are listed below.

Project Assignments

Assignment Prepare and Complete Consolidating Worksheet

Prepare the parent company Exmore Coffee journal entry required to recognize the subsidiary earnings Belle Haven Coffee Trial balance schedules of Exmore Coffee and Belle Haven Coffee are listed below

Assignment Prepare a Consolidated Earnings Statement and Balance Sheet

Using the consolidating worksheet results of Assignment prepare a consolidated earnings statement and balance sheet. The format of the financial statements should follow the format in the Trial Balance Reporting Handout Handout TBR including headings, account groupings including spelling subtotals and totals.

Schedules Months Ending

Exmore Coffee Co Trial BalanceTHA Grading Composition and Potential DeductionsIncluded on page

Project TurnIn Checklist

Please assemble in the following order

Journal entry from Assignment

Consolidating Worksheets for Earnings Statement and Balance Sheet

Consolidated Earnings Statement

Consolidated Balance Sheet

BAC THAW : PM

Trial Balance of Exmore Coffee Co

Months Ending

tableAccountsDebit,CreditDelmarva Bank checking account,Delmarva Bank money market account,Accounts Receivable,Allowance for uncollectible accounts,InventoryLandBuildingEquipmentConstruction in progress,,Accumulated Depreciation,Advance receivable Belle Haven Coffee Investment Belle Haven Coffee beginning balance as of Accounts payable,,crued payroll and benef,,Accrued payables other,,Revolving credit loans committed for yearsNote Payable due in yearsDeferred tax liability long termCommon stock shares, par $Additional paid in capital,,Retained earningslossbeginning balance as of

See Next Page

THA: PM

Exmor

Trial Balance of Exmore Coffee Co

Months Ending

Accounts

Sales coffee retail

tableDebitCredit

Sales roasted beans

Sales food

Allowance for returns beans

Allowance for returns roasted beans

Cost of goods sold coffee

Cost of goods sold beans

Cost goods sold other

Selling expenses

tableProfessional fees,

Depreciation Buildings

Depreciation Equipment

Bad debt expense

Administrative salaries

Other SG&A expenses

Interest income money market

Interest expense note payable

Interest expense revolving credit

Equity earningsBelle Haven Coffee to be determined

Income tax provision

Total

Trial Balance of Belle Haven Coffee Co

Months Ending

tableMonths Ending Debit,Credit Months Ending,AccountsSilver Beach Bank checichey market account,Silver Beach Bank money,,Accounts Receivable accounts,Allowance for uncolle Coffee Beans,Inventory RoLandBuildingEquipment in progress,,Construction in progress,Accumulated Depreciation,GoodwillAccounts payable,,Accrued payroll and benefits,,Accrued payables other,,Deferred tax liability longAdvance payable Exmore shares, par $Common paid in capital,,Additional paidingslossbeginning balance as of

See Next Page

Belle Ha

A THA: PM

Trial Balance of Belle Haven Coffee Co

Months Ending

tableDebit,CreditAccountsSales coffee retail,,Sales food,Cost of goods sold coffee,Cost of goods sold food,Selling expenses,Professional fees,Depreciation Buildings,Depreciation Equipment,Bad debt expense,Administrative salaries,Other SG&A expenses,,Interest income money market,Income tax provision,Total

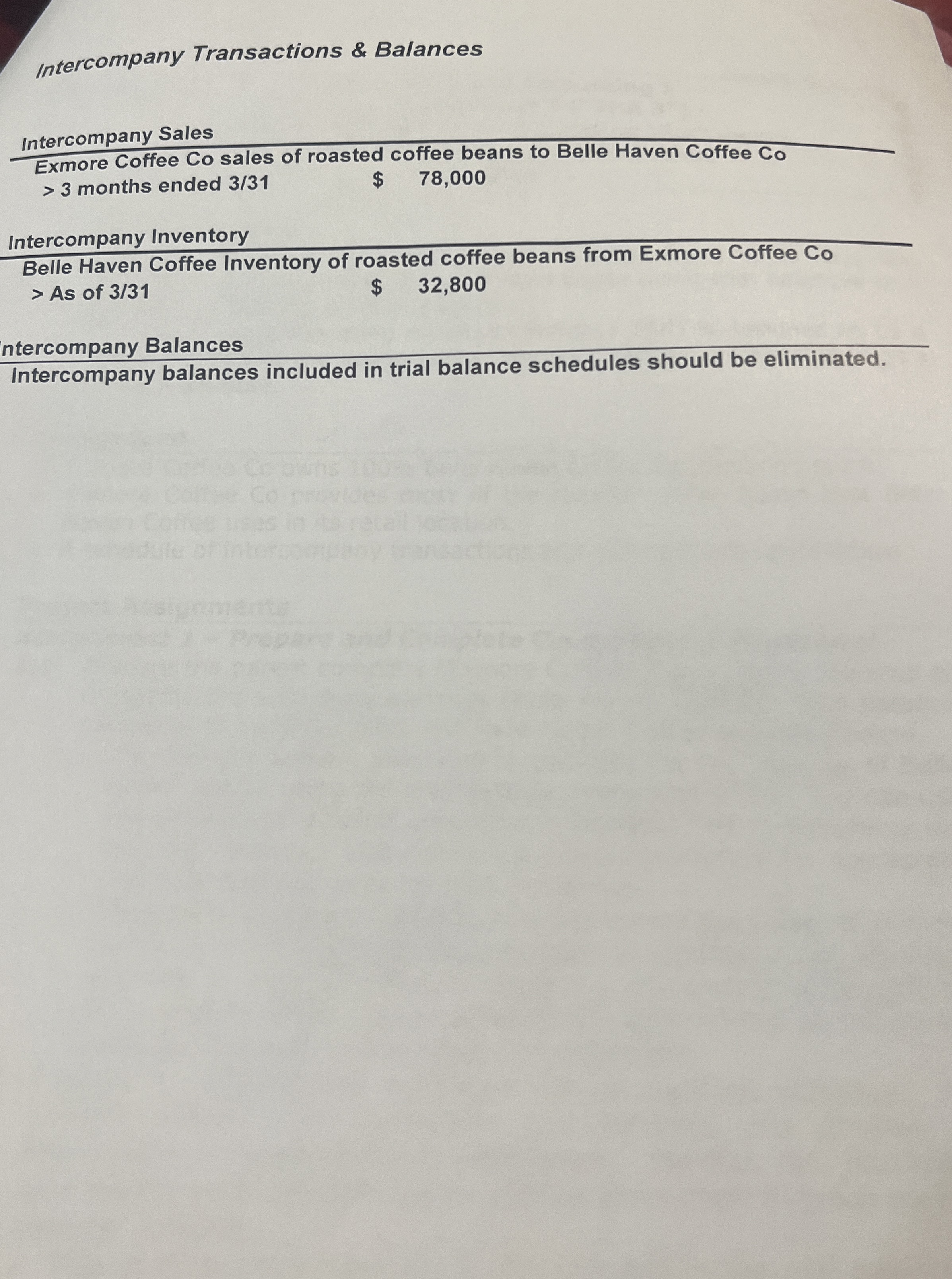

Intercompany Transactions & Balances

Intercompany Sales

Exmore Coffee Co sales of roasted coffee beans to Belle Haven Coffee Co

months ended

$

Intercompany Inventor

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock