Question: Take me to the text Christopher Lee is preparing his balance sheet and income statement for the month ended April 30, 2019. Use the

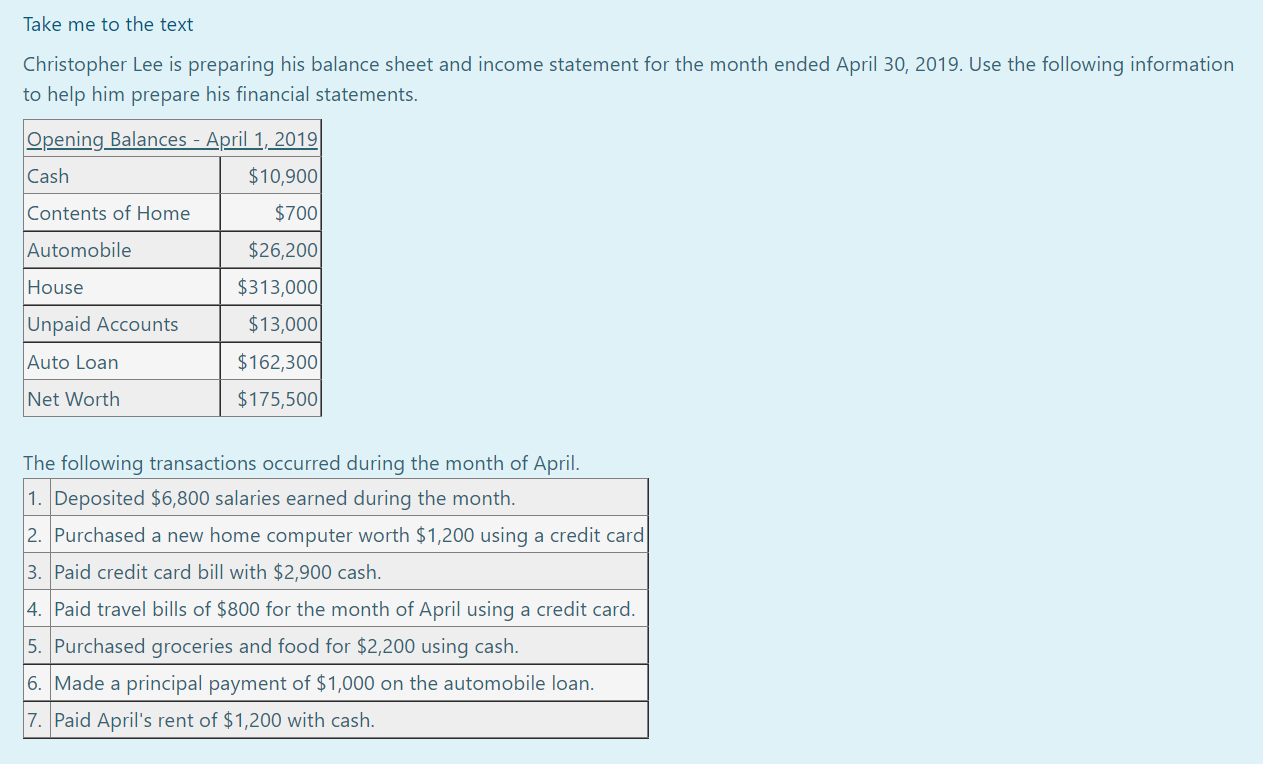

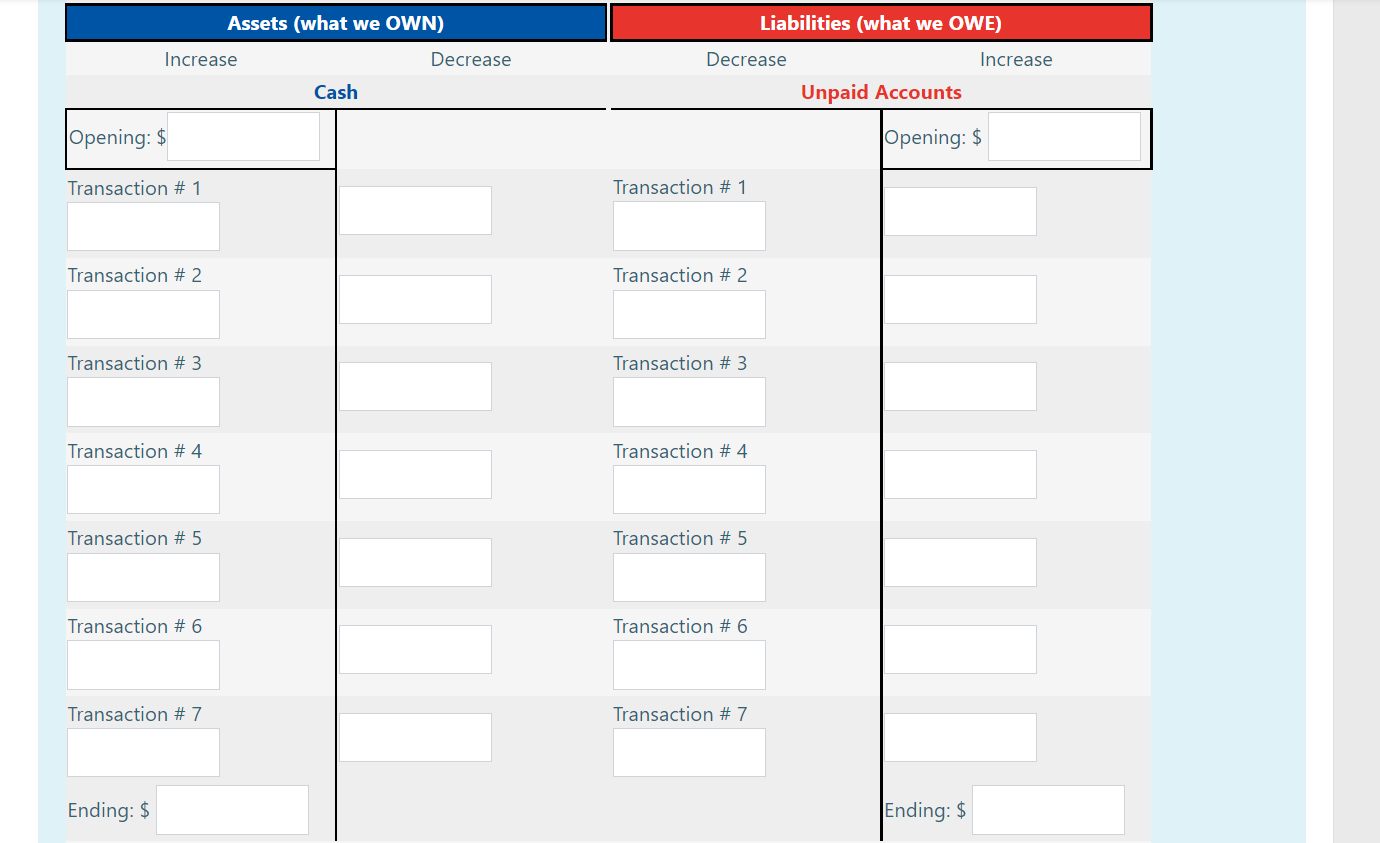

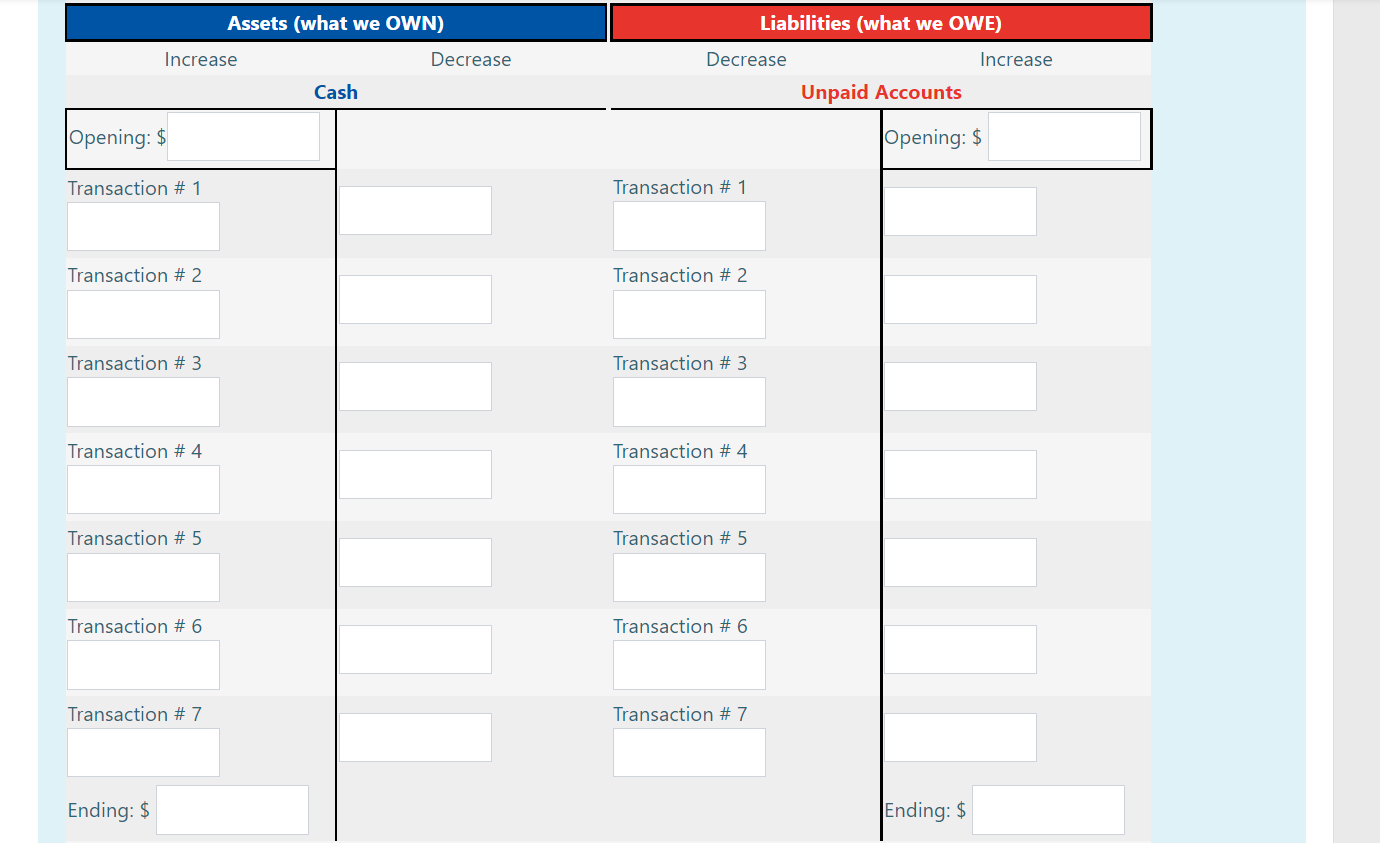

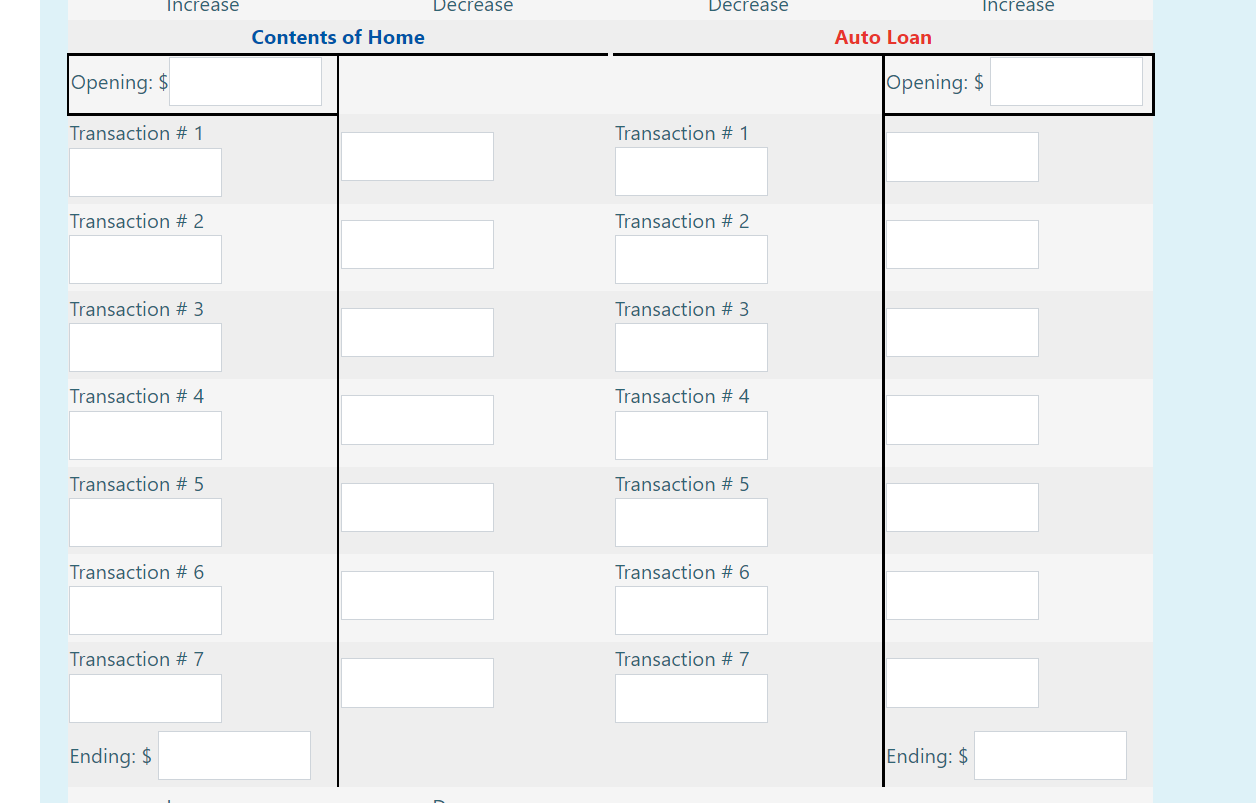

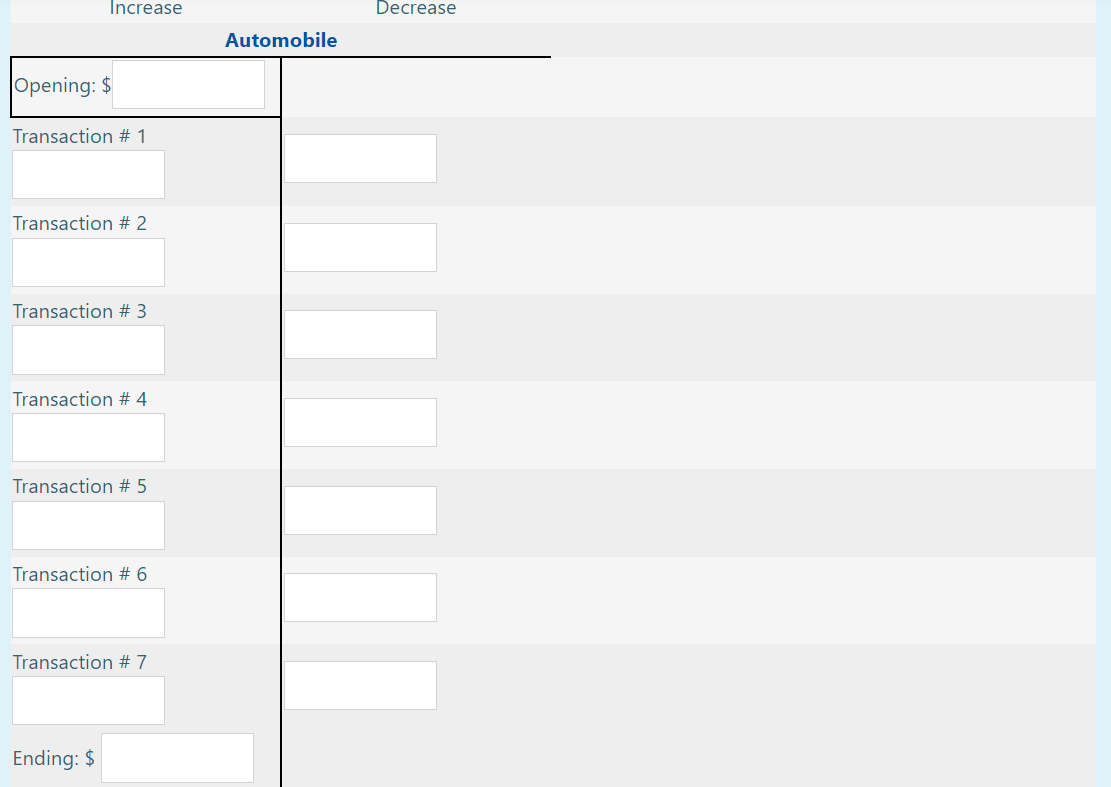

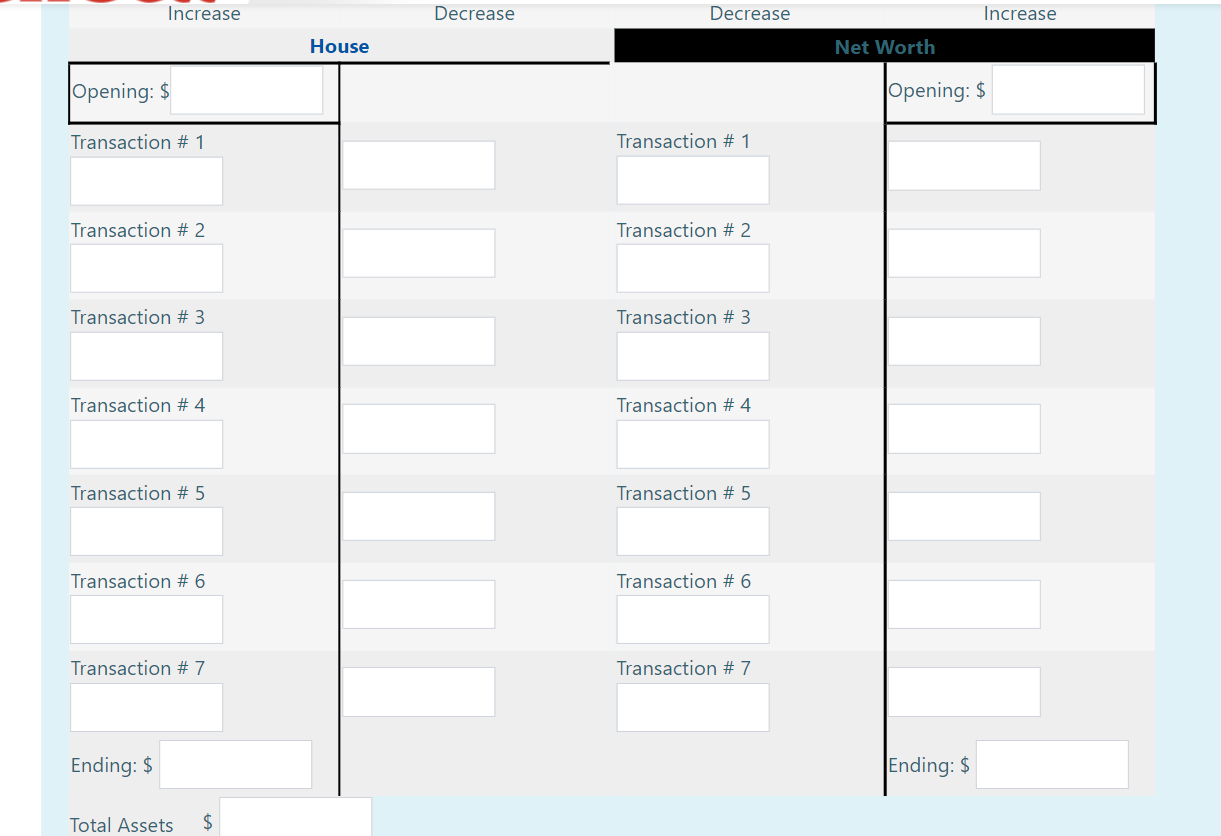

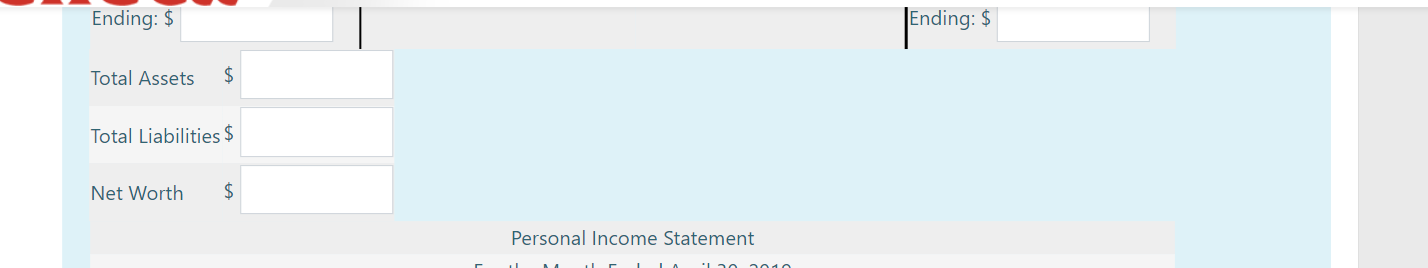

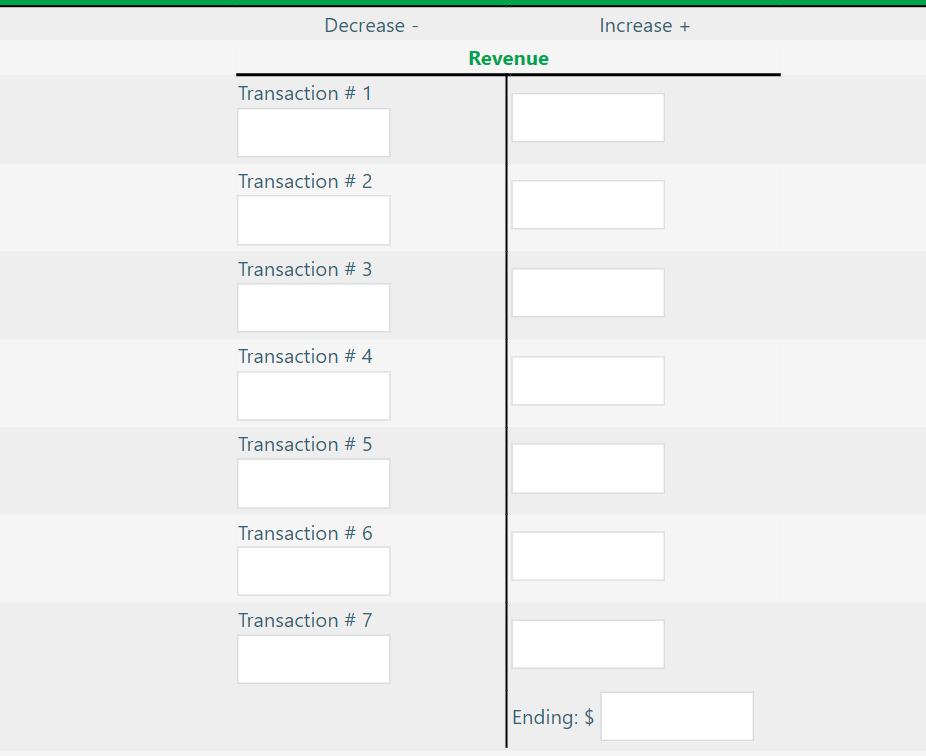

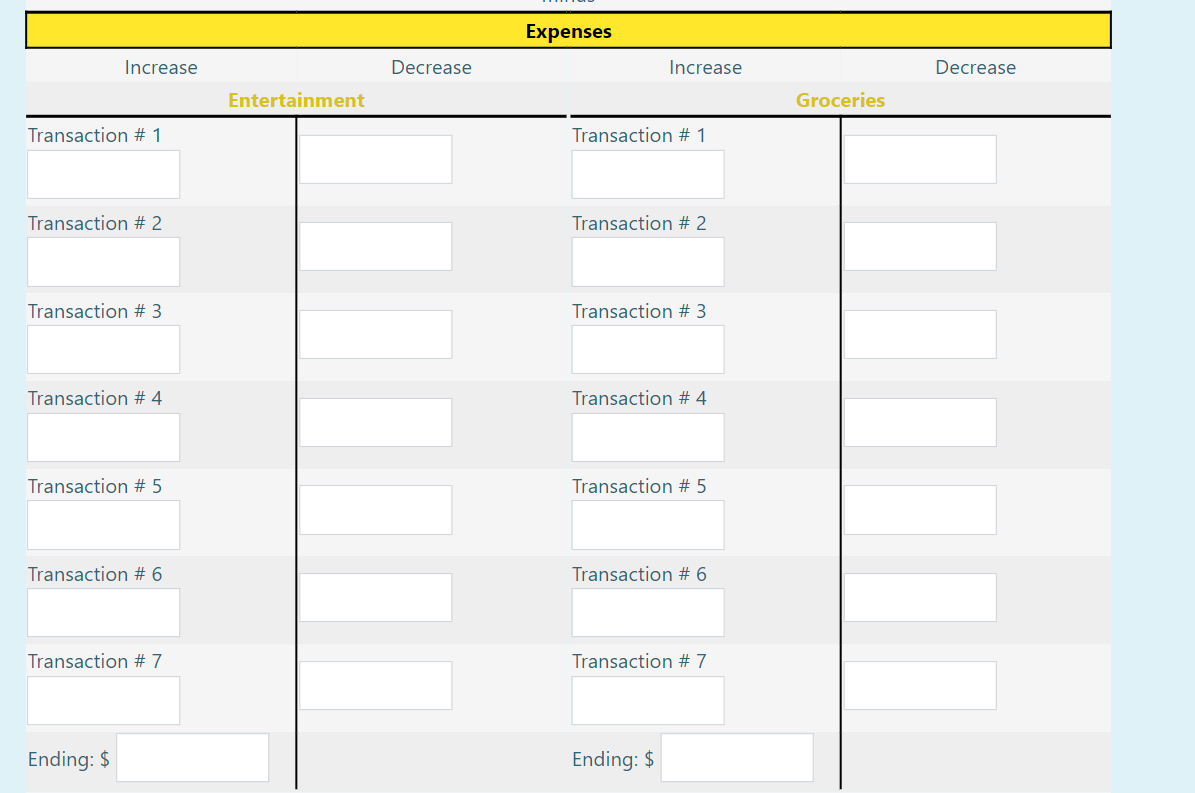

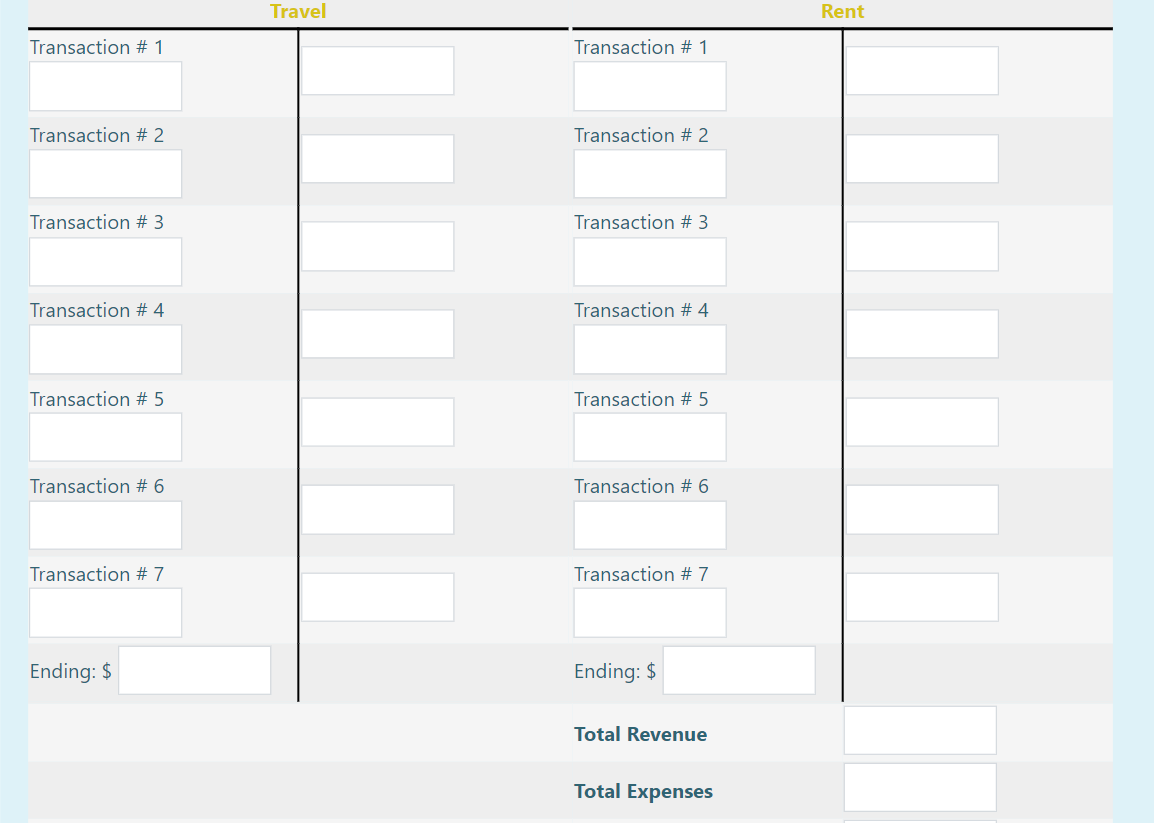

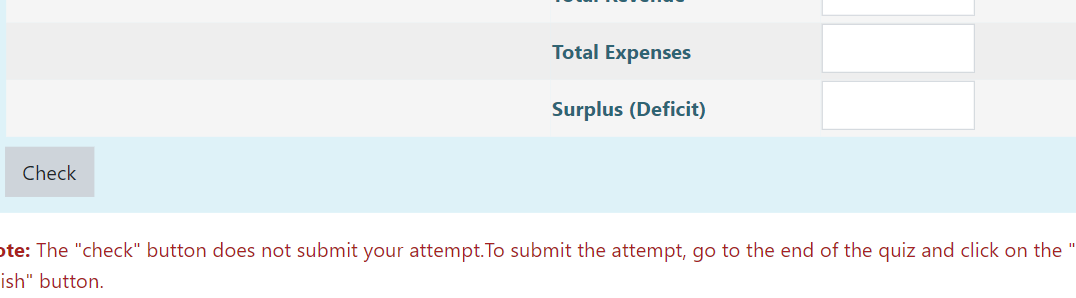

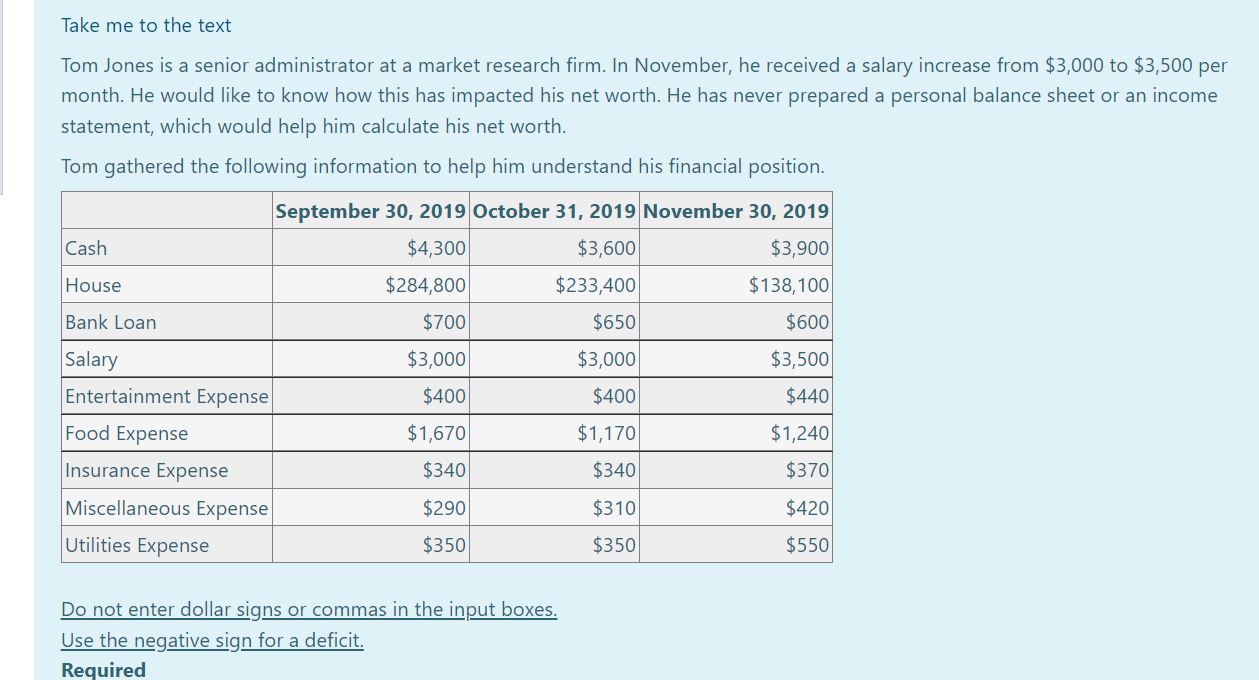

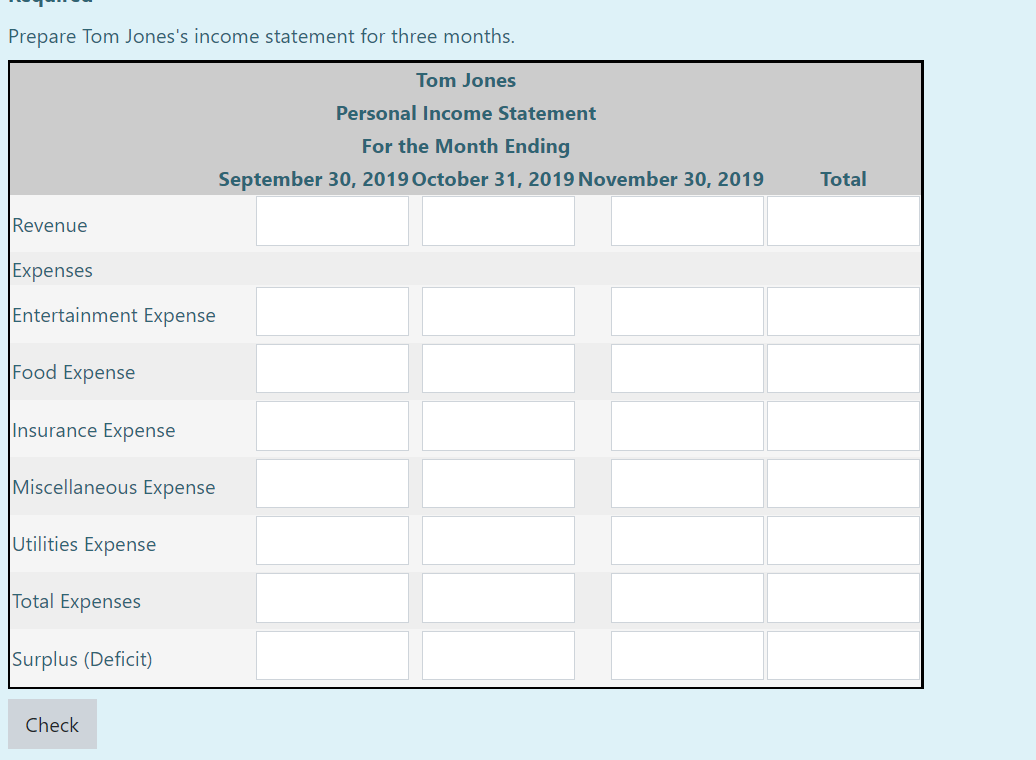

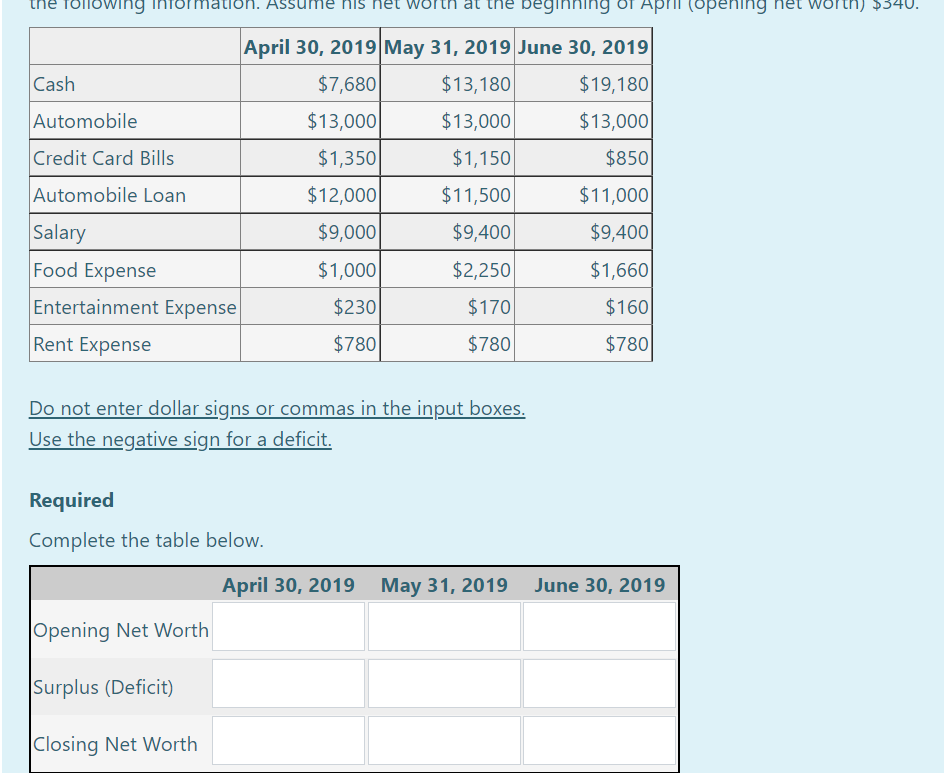

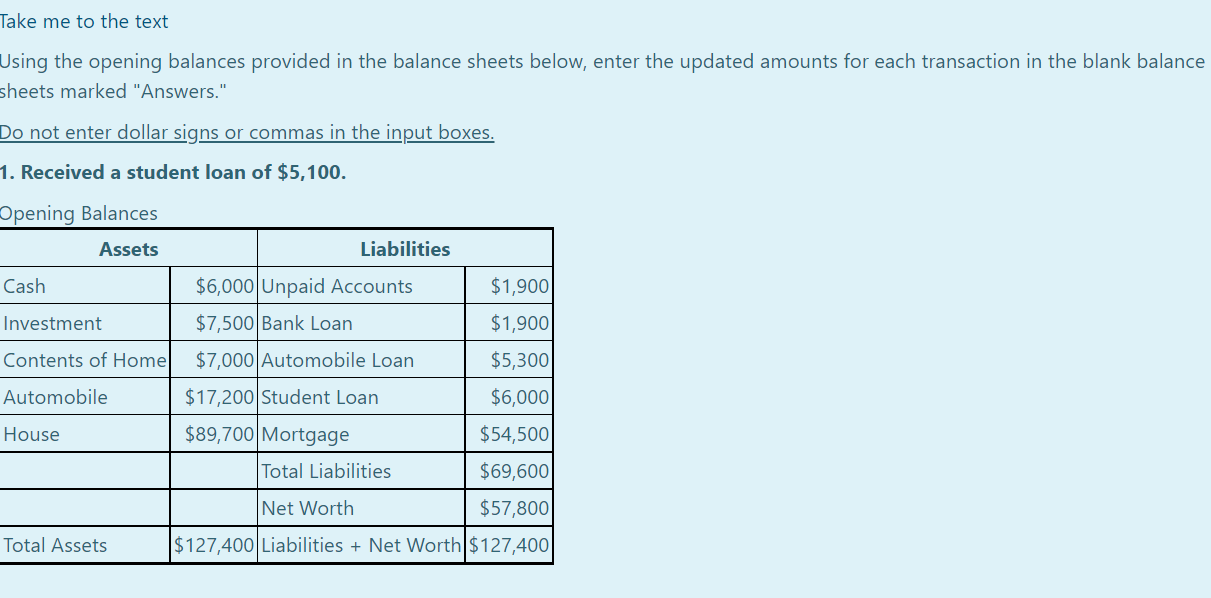

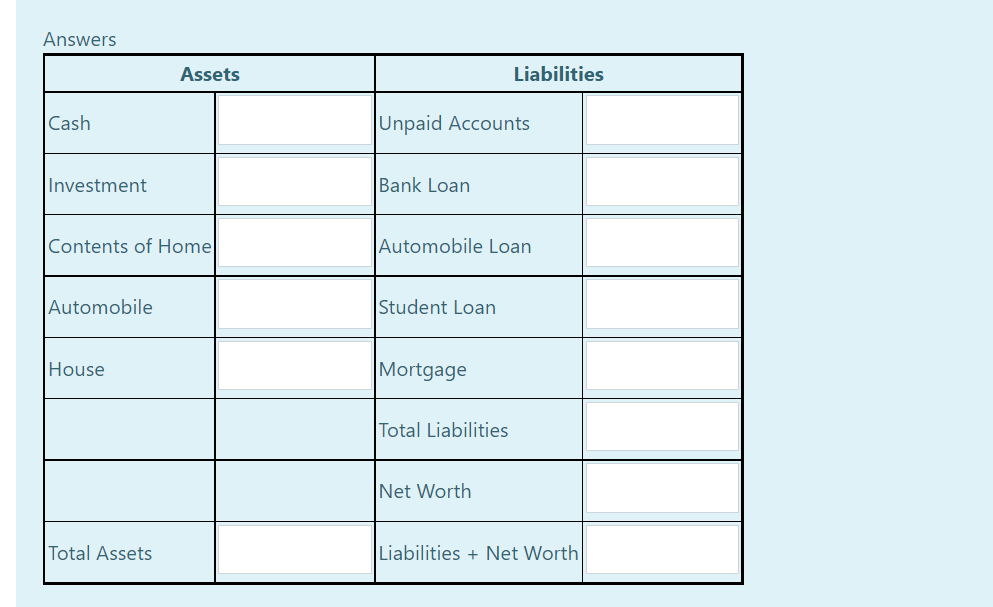

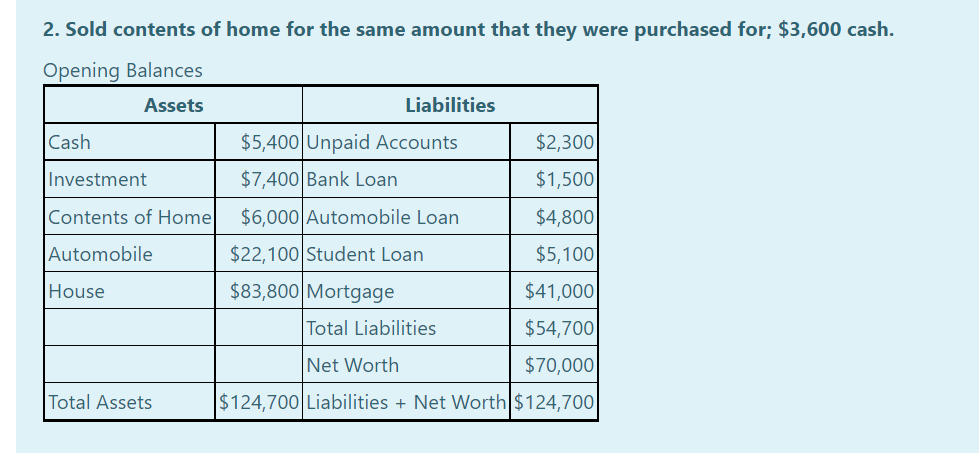

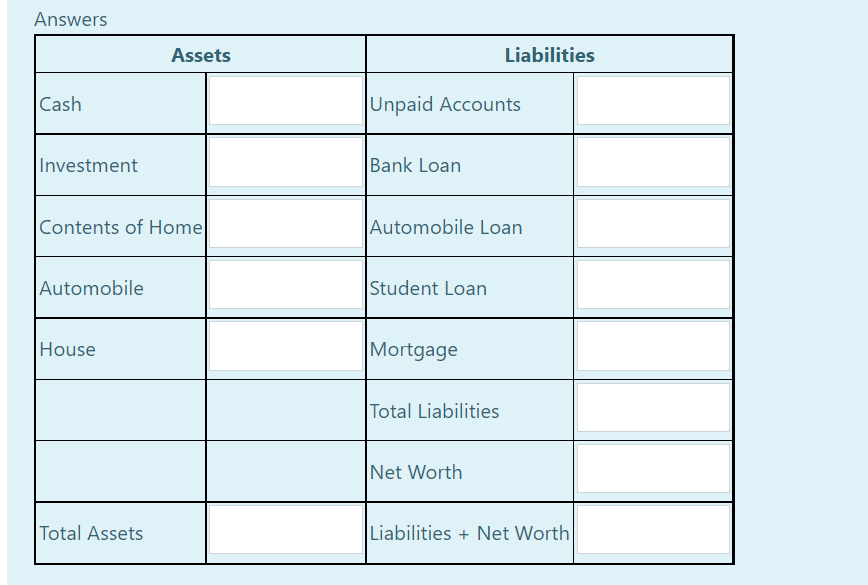

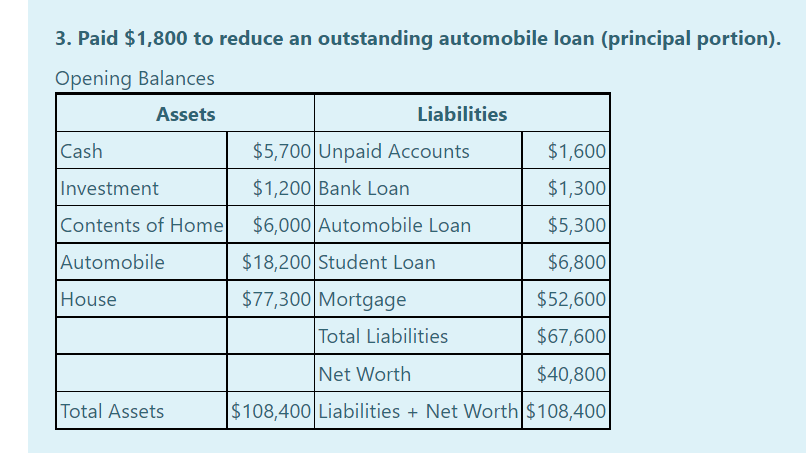

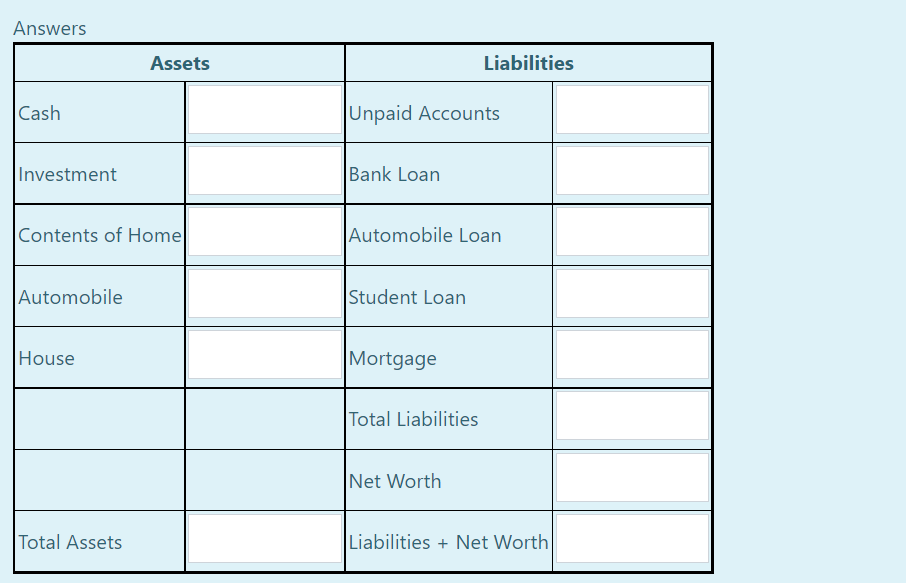

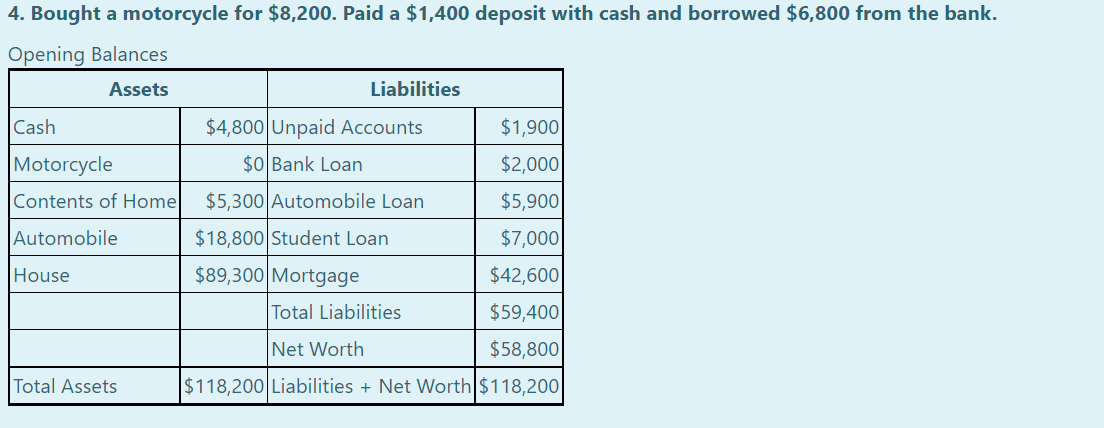

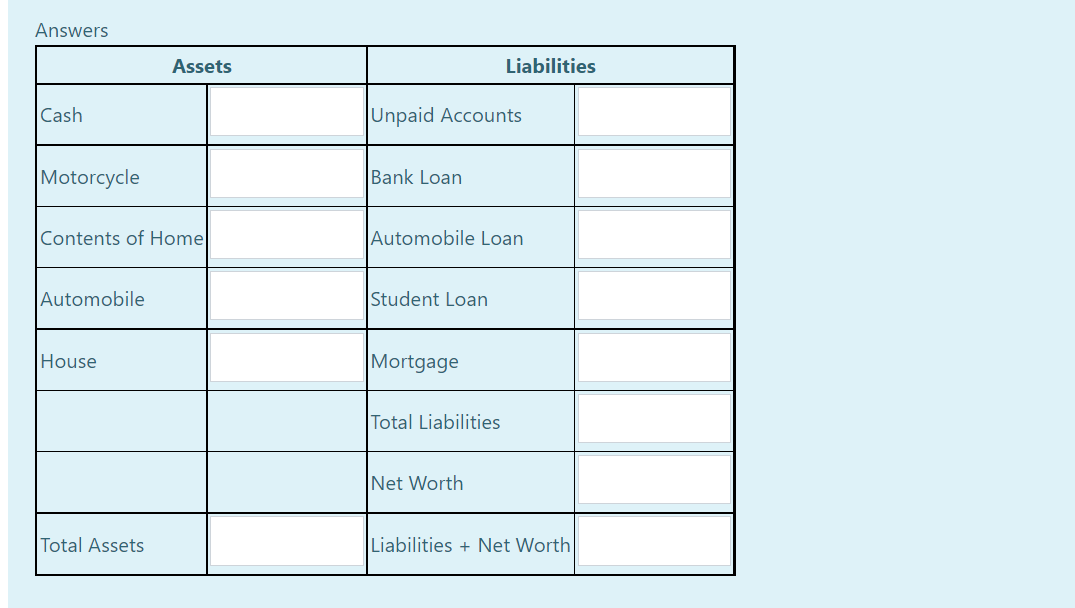

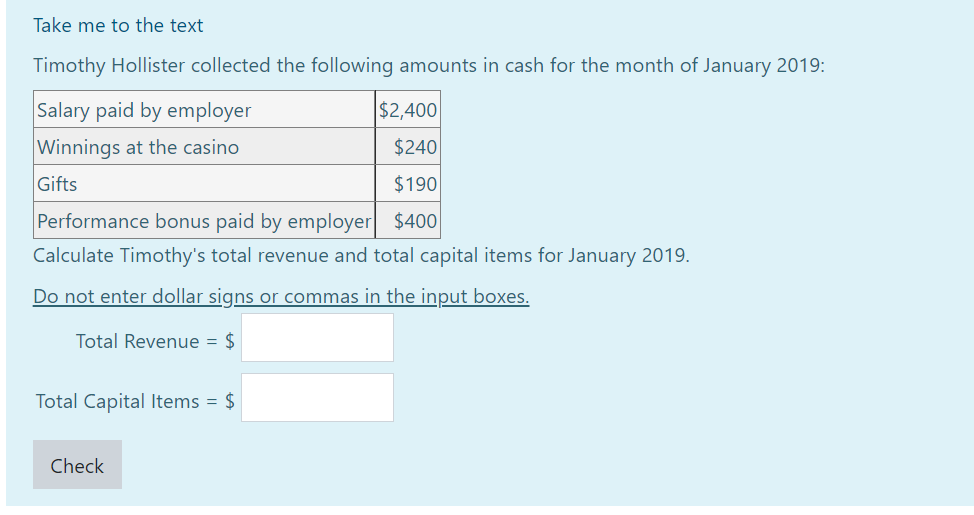

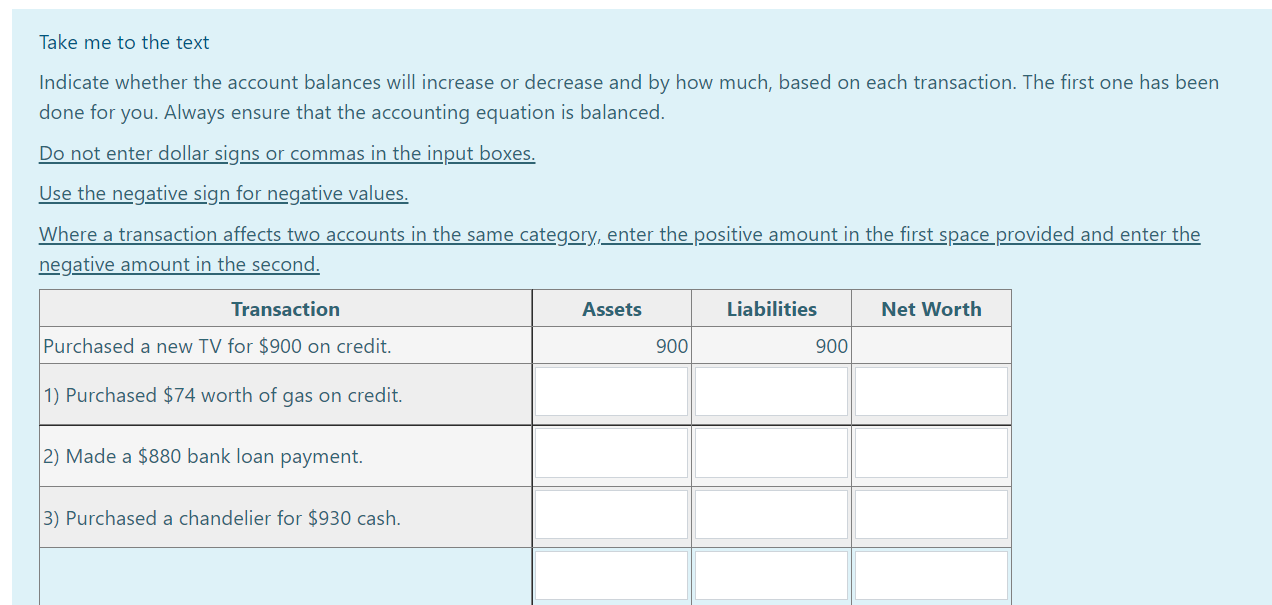

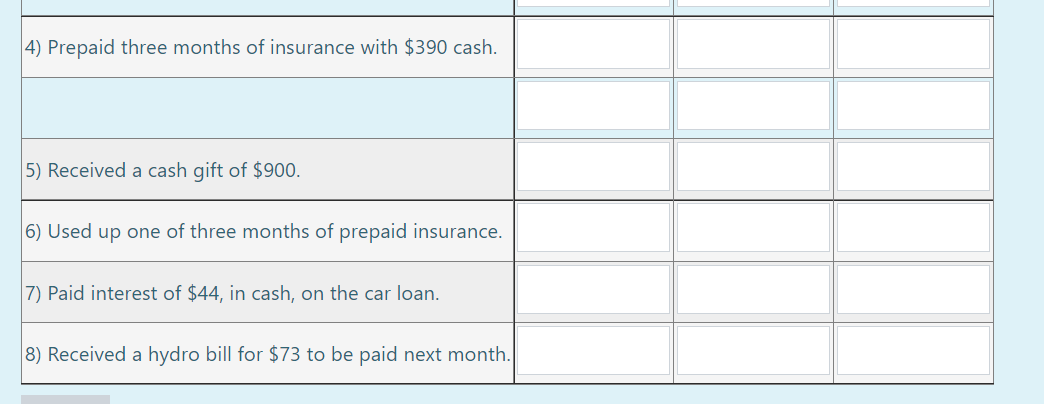

Take me to the text Christopher Lee is preparing his balance sheet and income statement for the month ended April 30, 2019. Use the following information to help him prepare his financial statements. Opening Balances - April 1, 2019 Cash $10,900 Contents of Home $700 Automobile House Unpaid Accounts Auto Loan Net Worth $26,200 $313,000 $13,000 $162,300 $175,500 The following transactions occurred during the month of April. 1. Deposited $6,800 salaries earned during the month. 2. Purchased a new home computer worth $1,200 using a credit card 3. Paid credit card bill with $2,900 cash. 4. Paid travel bills of $800 for the month of April using a credit card. 5. Purchased groceries and food for $2,200 using cash. 6. Made a principal payment of $1,000 on the automobile loan. 7. Paid April's rent of $1,200 with cash. Opening: $ Transaction # 1 Increase Transaction # 2 Transaction # 3 Transaction #4 Transaction # 5 Transaction # 6 Transaction #7 Ending: $ Assets (what we OWN) Cash Decrease Decrease Transaction # 1 Transaction # 2 Transaction # 3 Transaction #4 Transaction # 5 Transaction #6 Liabilities (what we OWE) Transaction #7 Unpaid Accounts Increase Opening: $ Ending: $ Opening: $ Transaction # 1 Increase Transaction # 2 Transaction # 3 Transaction #4 Transaction # 5 Transaction # 6 Transaction #7 Ending: $ Assets (what we OWN) Cash Decrease Decrease Transaction # 1 Transaction # 2 Transaction # 3 Transaction #4 Transaction # 5 Transaction #6 Liabilities (what we OWE) Transaction #7 Unpaid Accounts Increase Opening: $ Ending: $ Increase Opening: $ Transaction # 1 Transaction # 2 Transaction # 3 Transaction #4 Transaction # 5 Transaction # 6 Transaction #7 Ending: $ Contents of Home Decrease Decrease Transaction # 1 Transaction # 2 Transaction # 3 Transaction #4 Transaction # 5 Transaction # 6 Transaction #7 Auto Loan Increase Opening: $ Ending: $ Increase Opening: $ Transaction #1 Transaction # 2 Transaction # 3 Transaction #4 Transaction #5 Transaction #6 Transaction #7 Ending: $ Automobile Decrease Increase Opening: $ Transaction # 1 Transaction # 2 Transaction # 3 Transaction #4 Transaction # 5 Transaction # 6 Transaction #7 Ending: $ Total Assets $ House Decrease Decrease Transaction # 1 Transaction # 2 Transaction # 3 Transaction #4 Transaction # 5 Transaction #6 Transaction #7 Net Worth Increase Opening: $ Ending: $ Ending: $ Total Assets $ Total Liabilities $ Net Worth $ Personal Income Statement Ending: $ Decrease - Transaction # 1 Transaction # 2 Transaction # 3 Transaction #4 Transaction # 5 Transaction # 6 Transaction # 7 Revenue Ending: $ Increase + Increase Transaction # 1 Transaction # 2 Transaction # 3 Transaction #4 Transaction #5 Transaction # 6 Transaction #7 Ending: $ Entertainment Decrease Expenses Increase Transaction # 1 Transaction # 2 Transaction # 3 Transaction #4 Transaction # 5 Transaction # 6 Transaction #7 Ending: $ Groceries Decrease Transaction # 1 Transaction # 2 Transaction # 3 Transaction #4 Transaction # 5 Transaction # 6 Transaction #7 Ending: $ Travel Transaction #1 Transaction # 2 Transaction # 3 Transaction #4 Transaction # 5 Transaction #6 Transaction #7 Ending: $ Total Revenue Total Expenses Rent Check Total Expenses Surplus (Deficit) ote: The "check" button does not submit your attempt. To submit the attempt, go to the end of the quiz and click on the " ish" button. Take me to the text Tom Jones is a senior administrator at a market research firm. In November, he received a salary increase from $3,000 to $3,500 per month. He would like to know how this has impacted his net worth. He has never prepared a personal balance sheet or an income statement, which would help him calculate his net worth. Tom gathered the following information to help him understand his financial position. Cash House Bank Loan Salary Entertainment Expense Food Expense Insurance Expense Miscellaneous Expense Utilities Expense September 30, 2019 October 31, 2019 November 30, 2019 $4,300 $3,600 $3,900 $284,800 $233,400 $138,100 $600 $3,500 $440 $700 $3,000 $400 $1,670 $340 $290 $350 Do not enter dollar signs or commas in the input boxes. Use the negative sign for a deficit. Required $650 $3,000 $400 $1,170 $340 $310 $350 $1,240 $370 $420 $550 Prepare Tom Jones's income statement for three months. Tom Jones Personal Income Statement For the Month Ending September 30, 2019 October 31, 2019 November 30, 2019 Revenue Expenses Entertainment Expense Food Expense Insurance Expense Miscellaneous Expense Utilities Expense Total Expenses Surplus (Deficit) Check Total the following Cash Automobile Credit Card Bills Automobile Loan Salary Food Expense Entertainment Expense Rent Expense at beginning April (Opening April 30, 2019 May 31, 2019 June 30, 2019 $7,680 $13,180 $19,180 $13,000 $13,000 $13,000 $1,350 $1,150 $850 $12,000 $11,500 $9,000 $9,400 $1,000 $2,250 $230 $170 $780 $780 Do not enter dollar signs or commas in the input boxes. Use the negative sign for a deficit. Required Complete the table below. Opening Net Worth Surplus (Deficit) Closing Net Worth $11,000 $9,400 $1,660 $160 $780 April 30, 2019 May 31, 2019 June 30, 2019 worth Take me to the text Using the opening balances provided in the balance sheets below, enter the updated amounts for each transaction in the blank balance sheets marked "Answers." Do not enter dollar signs or commas in the input boxes. 1. Received a student loan of $5,100. Opening Balances Assets Cash Investment Contents of Home Automobile House Total Assets Liabilities $6,000 Unpaid Accounts $7,500 Bank Loan $7,000 Automobile Loan $17,200 Student Loan $89,700 Mortgage $1,900 $1,900 $5,300 $6,000 $54,500 $69,600 $57,800 $127,400 Liabilities + Net Worth $127,400 Total Liabilities Net Worth Answers Cash Investment Contents of Home Automobile House Assets Total Assets Unpaid Accounts Bank Loan Automobile Loan Student Loan Mortgage Liabilities Total Liabilities Net Worth Liabilities+ Net Worth 2. Sold contents of home for the same amount that they were purchased for; $3,600 cash. Opening Balances Assets Cash Investment Contents of Home Automobile House Total Assets Liabilities $5,400 Unpaid Accounts $7,400 Bank Loan $6,000 Automobile Loan $22,100 Student Loan $83,800 Mortgage $2,300 $1,500 $4,800 $5,100 $41,000 $54,700 $70,000 $124,700 Liabilities + Net Worth $124,700 Total Liabilities Net Worth Answers Cash Investment Contents of Home Automobile House Assets Total Assets Unpaid Accounts Bank Loan Automobile Loan Student Loan Mortgage Liabilities Total Liabilities Net Worth Liabilities + Net Worth 3. Paid $1,800 to reduce an outstanding automobile loan (principal portion). Opening Balances Assets Cash Investment Contents of Home Automobile House Total Assets Liabilities $5,700 Unpaid Accounts $1,200 Bank Loan $6,000 Automobile Loan $18,200 Student Loan $77,300 Mortgage $1,600 $1,300 $5,300 $6,800 $52,600 $67,600 $40,800 $108,400 Liabilities + Net Worth $108,400 Total Liabilities Net Worth Answers Cash Investment Contents of Home Automobile House Assets Total Assets Unpaid Accounts Bank Loan Automobile Loan Student Loan Mortgage Liabilities Total Liabilities Net Worth Liabilities + Net Worth 4. Bought a motorcycle for $8,200. Paid a $1,400 deposit with cash and borrowed $6,800 from the bank. Opening Balances Assets Cash Motorcycle Contents of Home Automobile House Total Assets Liabilities $4,800 Unpaid Accounts $0 Bank Loan $1,900 $2,000 $5,900 $7,000 $42,600 $59,400 $58,800 $118,200 Liabilities + Net Worth $118,200 $5,300 Automobile Loan $18,800 Student Loan $89,300 Mortgage Total Liabilities Net Worth Answers Cash Motorcycle Contents of Home Automobile House Assets Total Assets Unpaid Accounts Bank Loan Automobile Loan Student Loan Mortgage Liabilities Total Liabilities Net Worth Liabilities + Net Worth Take me to the text Timothy Hollister collected the following amounts in cash for the month of January 2019: Salary paid by employer Winnings at the casino Gifts $2,400 $240 $190 Performance bonus paid by employer $400 Calculate Timothy's total revenue and total capital items for January 2019. Do not enter dollar signs or commas in the input boxes. Total Revenue = $ Total Capital Items = $ Check Take me to the text Indicate whether the account balances will increase or decrease and by how much, based on each transaction. The first one has been done for you. Always ensure that the accounting equation is balanced. Do not enter dollar signs or commas in the input boxes. Use the negative sign for negative values. Where a transaction affects two accounts in the same category, enter the positive amount in the first space provided and enter the negative amount in the second. Transaction Purchased a new TV for $900 on credit. 1) Purchased $74 worth of gas on credit. 2) Made a $880 bank loan payment. 3) Purchased a chandelier for $930 cash. Assets 900 Liabilities 900 Net Worth 4) Prepaid three months of insurance with $390 cash. 5) Received a cash gift of $900. 6) Used up one of three months of prepaid insurance. 7) Paid interest of $44, in cash, on the car loan. 8) Received a hydro bill for $73 to be paid next month.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts