Question: Take Test: Test2 - ECO x @ Mail - Baker, Ethan C. X H Ethan Baker Experien x E myEKU Login Links | | x

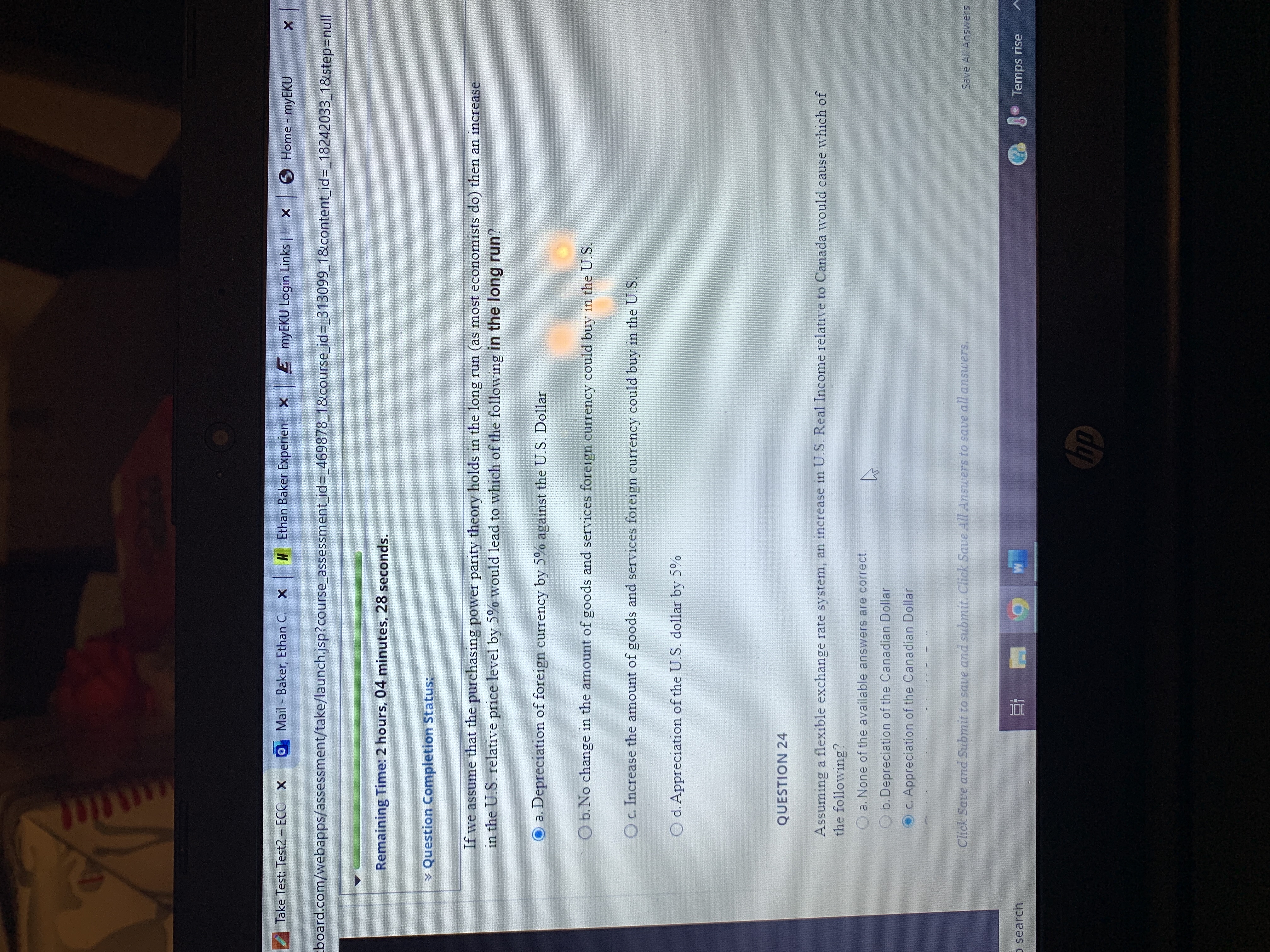

Take Test: Test2 - ECO x @ Mail - Baker, Ethan C. X H Ethan Baker Experien x E myEKU Login Links | | x 5 Home - myEKU X board.com/webapps/assessment/take/launch.jsp?course_assessment_id=_469878_1&course_id=_313099_1&content_id=_18242033_1&step=null Remaining Time: 2 hours, 04 minutes, 28 seconds. Question Completion Status: If we assume that the purchasing power parity theory holds in the long run (as most economists do) then an increase in the U.S. relative price level by 5% would lead to which of the following in the long run? a. Depreciation of foreign currency by 5% against the U.S. Dollar O b. No change in the amount of goods and services foreign currency could buy in the U.S. c. Increase the amount of goods and services foreign currency could buy in the U.S. O d. Appreciation of the U.S. dollar by 5% QUESTION 24 Assuming a flexible exchange rate system, an increase in U.S. Real Income relative to Canada would cause which of the following? O a. None of the available answers are correct. O b. Depreciation of the Canadian Dollar c. Appreciation of the Canadian Dollar Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers search w Temps rise hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts