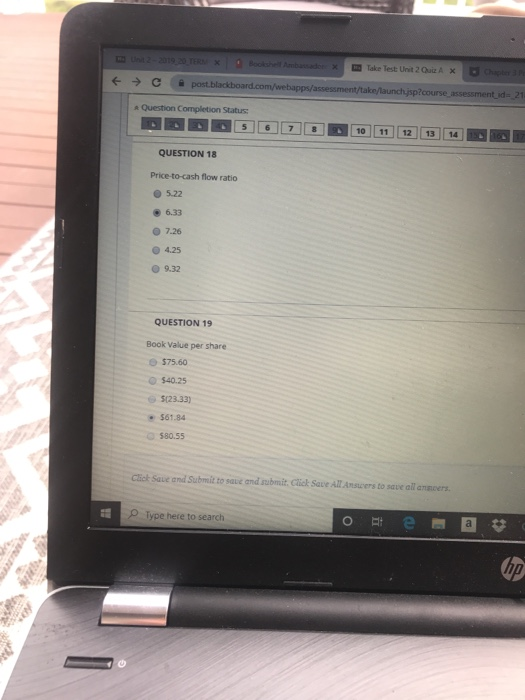

Question: Take Test Unit 2 Ou A X . post blackboard.com/webapps/assessment/take/aunch.jsp?course assessmentid=21 Question Completion Status: 5 6 10 11 12 13 14 QUESTION 18 Price-to-cash flow

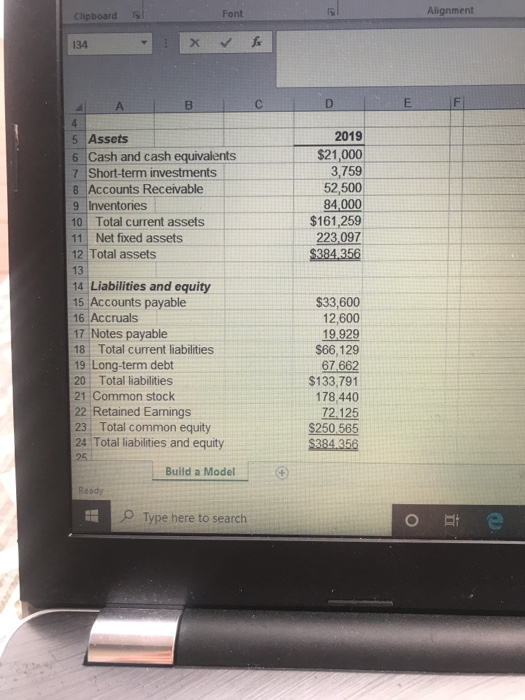

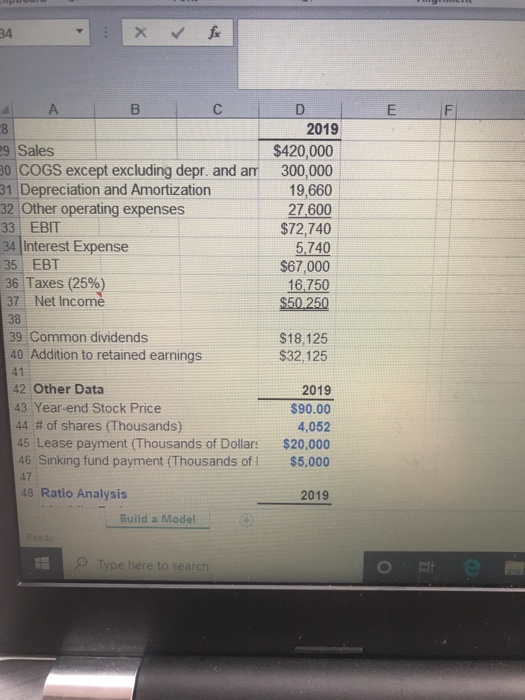

Take Test Unit 2 Ou A X . post blackboard.com/webapps/assessment/take/aunch.jsp?course assessmentid=21 Question Completion Status: 5 6 10 11 12 13 14 QUESTION 18 Price-to-cash flow ratio 5.22 6.33 7.26 4.25 9.32 QUESTION 19 Book Value per share $75.60 $40.25 5123.33) $61.84 $80.55 Chet Saue and Submit to sout and submit. Click Save ATA to save alles Type here to search ER WW hp Clipboard 5 Font Alignment 134 X D E 2019 $21,000 3,759 52,500 84,000 $161,259 223,097 $384.356 B 4 5 Assets 6 Cash and cash equivalents 7 Short-term investments 8 Accounts Receivable 9 Inventories 10 Total current assets 11 Net fixed assets 12 Total assets 13 14 Liabilities and equity 15 Accounts payable 16 Accruals 17 Notes payable 18 Total current liabilities 19 Long-term debt 20 Total liabilities 21 Common stock 22 Retained Earnings 23 Total common equity 24 Total liabilities and equity 25 Build a Model $33,600 12,600 19.929 $66,129 67,662 $133,791 178,440 72.125 $250,565 $384.356 Ready Type here to search o et e 34 A B E F D 2019 $420,000 300,000 19,660 27,600 $72,740 5,740 $67,000 16.750 $50.250 29 Sales 30 COGS except excluding depr. and am 31 Depreciation and Amortization 32 Other operating expenses 33 EBIT 34 Interest Expense 35 EBT 36 Taxes (25%) 37 Net Income 38 39 Common dividends 40 Addition to retained earnings 41 42 Other Data 43 Year-end Stock Price 44 # of shares (Thousands) 45 Lease payment (Thousands of Dollars 46 Sinking fund payment (Thousands of 47 48 Ratio Analysis $18,125 $32,125 2019 $90.00 4,052 $20,000 $5,000 2019 Build a Model Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts