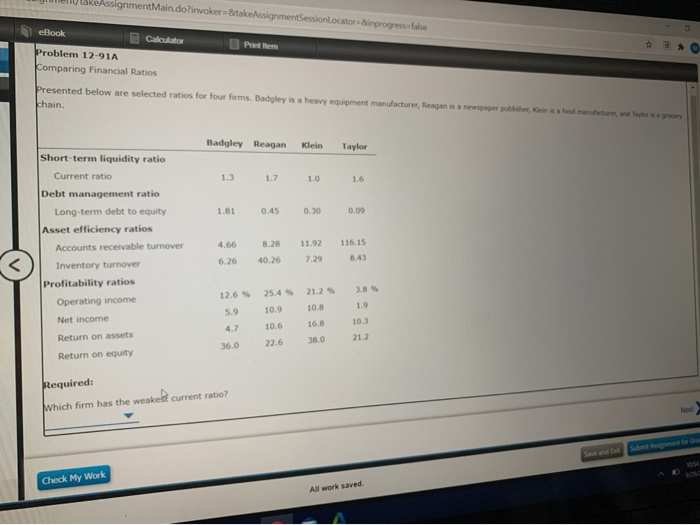

Question: takeAssignment Main dolinvoker=&takeAssignmentSession Locator Binprogress=false eBook Calculator Problem 12-91A Comparing Financial Ratios Presented below are selected ratios for four firms. Badgley is a heavy equipment

takeAssignment Main dolinvoker=&takeAssignmentSession Locator Binprogress=false eBook Calculator Problem 12-91A Comparing Financial Ratios Presented below are selected ratios for four firms. Badgley is a heavy equipment manufacturer, Reagan is a newspaper publier en stod matures, and every chain. Badgley Reagan Klein Taylor Short-term liquidity ratio Current ratio 1.3 1.7 1.0 1.6 1.81 0.45 0.30 0.09 4.66 8.28 11.92 7.29 116.15 8.43 6.26 40.26 Debt management ratio Long-term debt to equity Asset efficiency ratios Accounts receivable turnover Inventory turnover Profitability ratios Operating income Net income Return on assets 25.49 3.8 12.6 5.9 21.2 10.8 1.9 10.9 4.7 16.8 10.6 22.6 10.3 21.2 38.0 36.0 Return on equity Required: Which firm has the weaked current ratio? Check My Work All work saved Problem 12-91A Comparing Financial Ratios Presented below are selected ratios for four firms. Badgley is a heavy equipment manufactu chain. Badgley Reagan Klein Taylor Short-term liquidity ratio Current ratio 1.3 1.7 1.0 1.6 1.81 0.45 0.30 0.09 Debt management ratio Long-term debt to equity Asset efficiency ratios Accounts receivable turnover Inventory turnover Profitability ratios Operating income 4.66 8.28 11.92 116.15 6.26 40.26 7.29 8.43 12.6 % 25.4 % 21.2 % 3.8 % Net income 5.9 10.9 10.8 1.9 R Badgley sets 4.7 10.6 16.8 10.3 R Reagan uity 36.0 22.6 38.0 21.2 Klein Requ Taylor Whic the weakest current ratio? Check My Work All work saved. O takeAssignment Main dolinvoker=&takeAssignmentSession Locator Binprogress=false eBook Calculator Problem 12-91A Comparing Financial Ratios Presented below are selected ratios for four firms. Badgley is a heavy equipment manufacturer, Reagan is a newspaper publier en stod matures, and every chain. Badgley Reagan Klein Taylor Short-term liquidity ratio Current ratio 1.3 1.7 1.0 1.6 1.81 0.45 0.30 0.09 4.66 8.28 11.92 7.29 116.15 8.43 6.26 40.26 Debt management ratio Long-term debt to equity Asset efficiency ratios Accounts receivable turnover Inventory turnover Profitability ratios Operating income Net income Return on assets 25.49 3.8 12.6 5.9 21.2 10.8 1.9 10.9 4.7 16.8 10.6 22.6 10.3 21.2 38.0 36.0 Return on equity Required: Which firm has the weaked current ratio? Check My Work All work saved Problem 12-91A Comparing Financial Ratios Presented below are selected ratios for four firms. Badgley is a heavy equipment manufactu chain. Badgley Reagan Klein Taylor Short-term liquidity ratio Current ratio 1.3 1.7 1.0 1.6 1.81 0.45 0.30 0.09 Debt management ratio Long-term debt to equity Asset efficiency ratios Accounts receivable turnover Inventory turnover Profitability ratios Operating income 4.66 8.28 11.92 116.15 6.26 40.26 7.29 8.43 12.6 % 25.4 % 21.2 % 3.8 % Net income 5.9 10.9 10.8 1.9 R Badgley sets 4.7 10.6 16.8 10.3 R Reagan uity 36.0 22.6 38.0 21.2 Klein Requ Taylor Whic the weakest current ratio? Check My Work All work saved. O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts