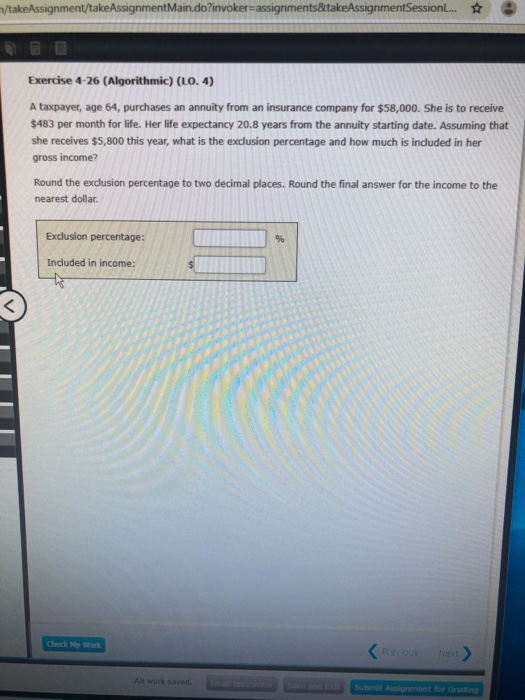

Question: /takeAssignment/takeAssignment Main.do?invoker=assignments&takeAssignmentSession... Exercise 4-26 (Algorithmic) (LO.4) A taxpayer, age 64, purchases an annuity from an insurance company for $58,000. She is to receive $483 per

/takeAssignment/takeAssignment Main.do?invoker=assignments&takeAssignmentSession... Exercise 4-26 (Algorithmic) (LO.4) A taxpayer, age 64, purchases an annuity from an insurance company for $58,000. She is to receive $483 per month for life. Her life expectancy 20.8 years from the annuity starting date. Assuming that she receives $5,800 this year, what is the exclusion percentage and how much is included in her gross income? Round the exclusion percentage to two decimal places. Round the final answer for the income to the nearest dollar Exclusion percentage: Included in income: /takeAssignment/takeAssignment Main.do?invoker=assignments&takeAssignmentSession... Exercise 4-26 (Algorithmic) (LO.4) A taxpayer, age 64, purchases an annuity from an insurance company for $58,000. She is to receive $483 per month for life. Her life expectancy 20.8 years from the annuity starting date. Assuming that she receives $5,800 this year, what is the exclusion percentage and how much is included in her gross income? Round the exclusion percentage to two decimal places. Round the final answer for the income to the nearest dollar Exclusion percentage: Included in income:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts