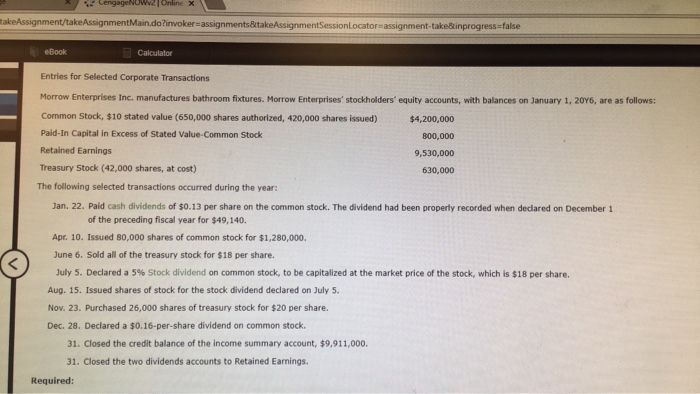

Question: takeAssignment/takeAssignmentMain.do?invoker-assignments&takeAssignmentSessionLocator-assignment-take&inprogress-false eBook Entries for Selected Corporate Transactions Morrow Enterprises Inc. manufactures bathroom fixtures. Morrow Enterprises' stockholders' equity accounts, with balances on January 1, 20Y6, are

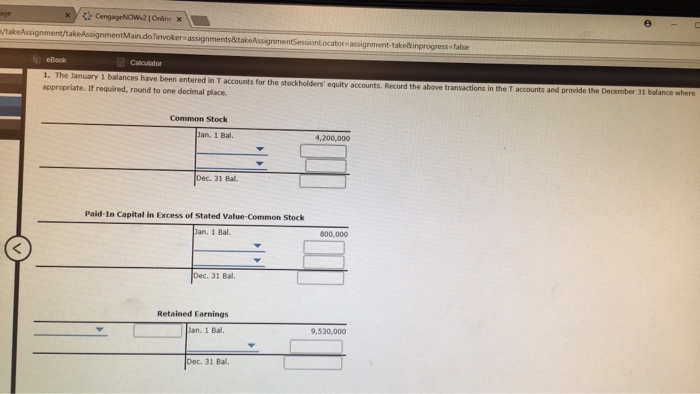

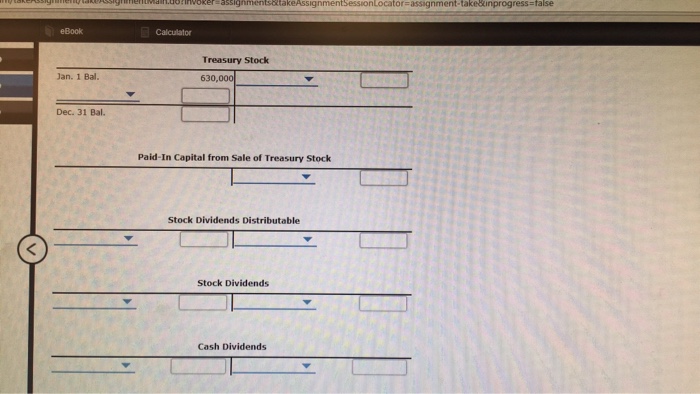

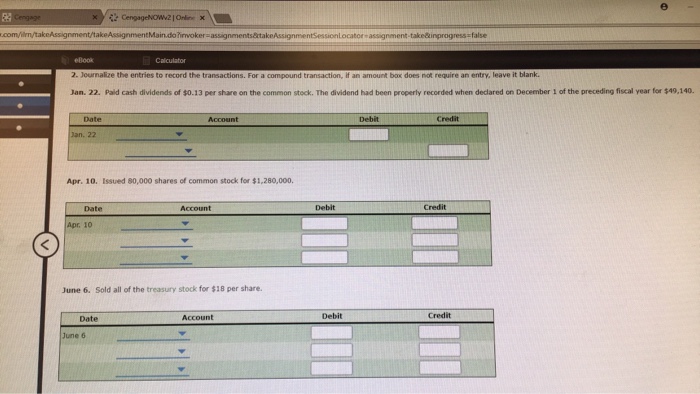

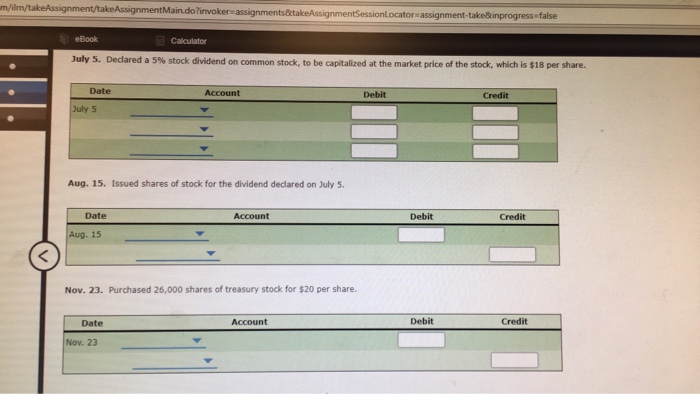

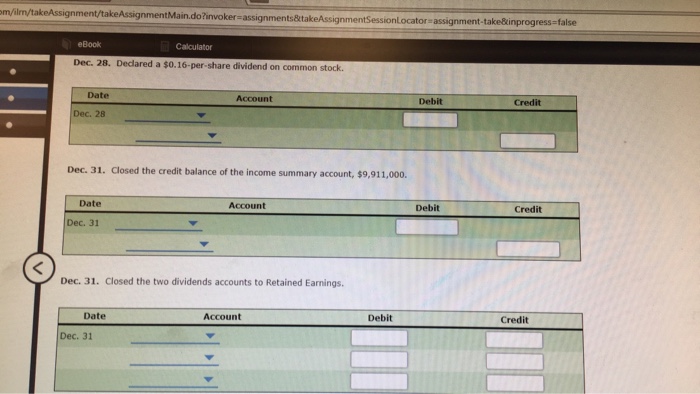

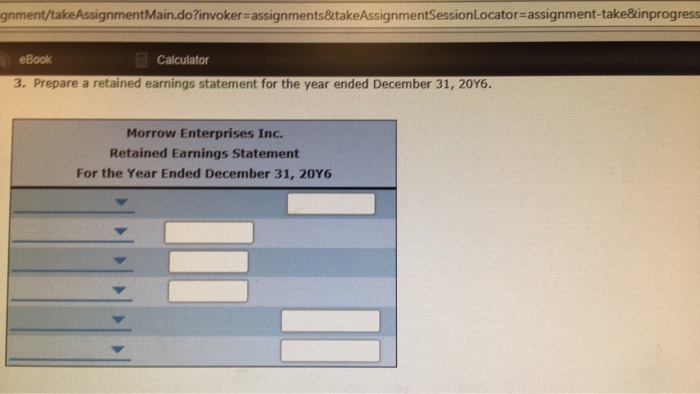

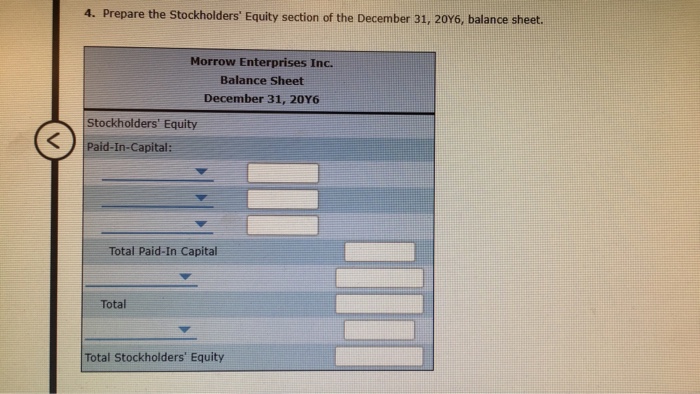

takeAssignment/takeAssignmentMain.do?invoker-assignments&takeAssignmentSessionLocator-assignment-take&inprogress-false eBook Entries for Selected Corporate Transactions Morrow Enterprises Inc. manufactures bathroom fixtures. Morrow Enterprises' stockholders' equity accounts, with balances on January 1, 20Y6, are as follows: Common Stock, $10 stated value (650,000 shares authorized, 420,000 shares issued) Paid-In Capital in Excess of Stated Value-Common Stock Retained Earnings Treasury Stock (42,000 shares, at cost) The following selected transactions occurred during the year: Calculator $4,200,000 800,000 9,530,000 630,000 Jan. 22. Paid cash dividends of $0.13 per share on the common stock. The dividend had been properly recorded when dedared on December 1 of the preceding fiscal year for $49,140 Apr. 10. Issued 80,000 shares of common stock for $1,280,000. June 6. Sold all of the treasury stock for $18 per share. July 5, Declared a 5% Stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share. Aug. 15. Issued shares of stock for the stock dividend declared on July 5 Nov. 23. Purchased 26,000 shares of treasury stock for $20 per share. Dec. 28. Declared a $0.16-per-share dividend on common stock. 31. Closed the credit balance of the income summary account, $9,911,000. 31. Closed the two dividends accounts to Retained Earnings. Required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts