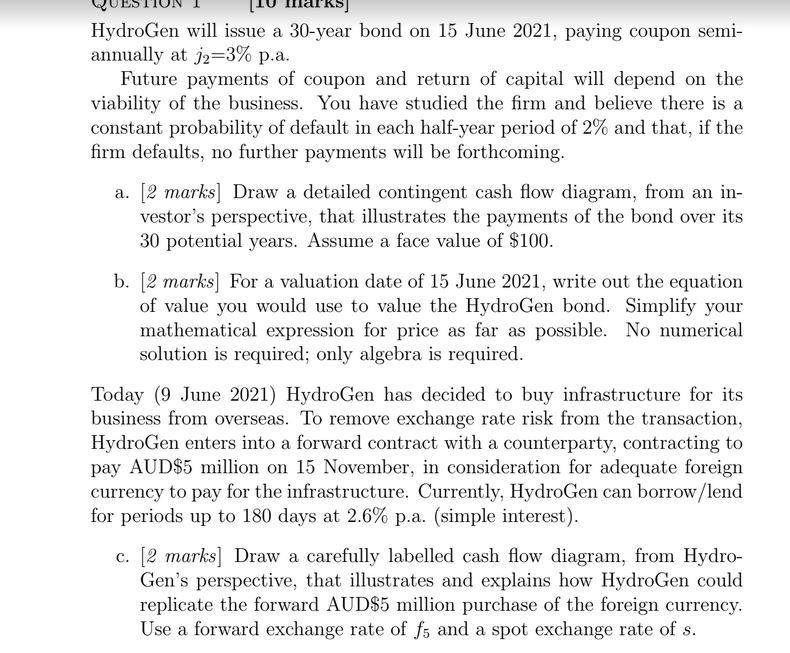

Question: Talks HydroGen will issue a 30-year bond on 15 June 2021, paying coupon semi- annually at j2=3% p.a. Future payments of coupon and return of

Talks HydroGen will issue a 30-year bond on 15 June 2021, paying coupon semi- annually at j2=3% p.a. Future payments of coupon and return of capital will depend on the viability of the business. You have studied the firm and believe there is a constant probability of default in each half-year period of 2% and that, if the firm defaults, no further payments will be forthcoming. [2 marks] Draw a detailed contingent cash flow diagram, from an in- vestor's perspective, that illustrates the payments of the bond over its 30 potential years. Assume a face value of $100. b. [2 marks] For a valuation date of 15 June 2021, write out the equation of value you would use to value the HydroGen bond. Simplify your mathematical expression for price as far as possible. No numerical solution is required; only algebra is required. Today (9 June 2021) HydroGen has decided to buy infrastructure for its business from overseas. To remove exchange rate risk from the transaction, HydroGen enters into a forward contract with a counterparty, contracting to pay AUD$5 million on 15 November, in consideration for adequate foreign currency to pay for the infrastructure. Currently, HydroGen can borrow/lend for periods up to 180 days at 2.6% p.a. (simple interest). c. [2 marks] Draw a carefully labelled cash flow diagram, from Hydro- Gen's perspective, that illustrates and explains how HydroGen could replicate the forward AUD$5 million purchase of the foreign currency. Use a forward exchange rate of fs and a spot exchange rate of s. Talks HydroGen will issue a 30-year bond on 15 June 2021, paying coupon semi- annually at j2=3% p.a. Future payments of coupon and return of capital will depend on the viability of the business. You have studied the firm and believe there is a constant probability of default in each half-year period of 2% and that, if the firm defaults, no further payments will be forthcoming. [2 marks] Draw a detailed contingent cash flow diagram, from an in- vestor's perspective, that illustrates the payments of the bond over its 30 potential years. Assume a face value of $100. b. [2 marks] For a valuation date of 15 June 2021, write out the equation of value you would use to value the HydroGen bond. Simplify your mathematical expression for price as far as possible. No numerical solution is required; only algebra is required. Today (9 June 2021) HydroGen has decided to buy infrastructure for its business from overseas. To remove exchange rate risk from the transaction, HydroGen enters into a forward contract with a counterparty, contracting to pay AUD$5 million on 15 November, in consideration for adequate foreign currency to pay for the infrastructure. Currently, HydroGen can borrow/lend for periods up to 180 days at 2.6% p.a. (simple interest). c. [2 marks] Draw a carefully labelled cash flow diagram, from Hydro- Gen's perspective, that illustrates and explains how HydroGen could replicate the forward AUD$5 million purchase of the foreign currency. Use a forward exchange rate of fs and a spot exchange rate of s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts