Question: Tandy Teck manufactures an electronic component for a high-end computer. The company currently sells 50,000 units a year at a price of $300 per unit.

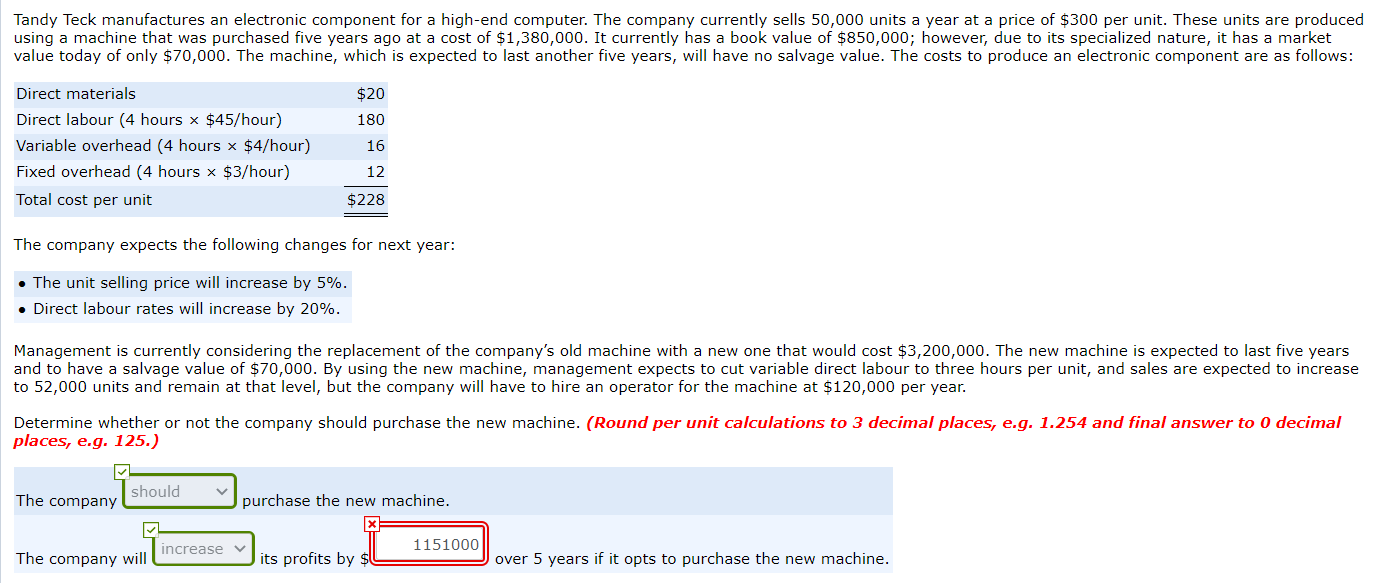

Tandy Teck manufactures an electronic component for a high-end computer. The company currently sells 50,000 units a year at a price of $300 per unit. These units are produced using a machine that was purchased five years ago at a cost of $1,380,000. It currently has a book value of $850,000; however, due to its specialized nature, it has a market value today of only $70,000. The machine, which is expected to last another five years, will have no salvage value. The costs to produce an electronic component are as follows: Direct materials Direct labour (4 hours x $45/hour) Variable overhead (4 hours x $4/hour) Fixed overhead (4 hours x $3/hour) Total cost per unit $20 180 16 12 $228 The company expects the following changes for next year: The unit selling price will increase by 5%. . Direct labour rates will increase by 20%. Management is currently considering the replacement of the company's old machine with a new one that would cost $3,200,000. The new machine is expected to last five years and to have a salvage value of $70,000. By using the new machine, management expects to cut variable direct labour to three hours per unit, and sales are expected to increase to 52,000 units and remain at that level, but the company will have to hire an operator for the machine at $120,000 per year. Determine whether or not the company should purchase the new machine. (Round per unit calculations to 3 decimal places, e.g. 1.254 and final answer to 0 decimal places, e.g. 125.) should The company purchase the new machine. increase 1151000 The company will its profits by $ over 5 years if it opts to purchase the new machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts