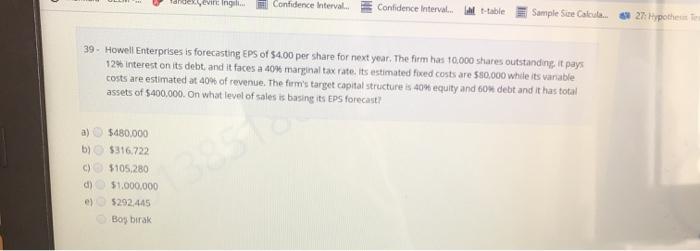

Question: tardexovin Ingi... Confidence interval Confidence Intervaltable Sample Se Calea 27 Hypothet 39. Howell Enterprises is forecasting EPS of 54.00 per share for next year. The

tardexovin Ingi... Confidence interval Confidence Intervaltable Sample Se Calea 27 Hypothet 39. Howell Enterprises is forecasting EPS of 54.00 per share for next year. The firm has 10.000 shares outstanding it pays 12% interest on its debt and it faces a 40% marginal tax rate its estimated fixed costs are 550,000 while its varable costs are estimated at 40% of revenue. The firm's target capital structure is on equity and 60 debt and it has total assets of $400,000. On what level of sales is basing its EPS forecast a) $480.000 b) $316.722 C) $105,280 d) 51,000,000 el 5292.445 Bog birak

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts