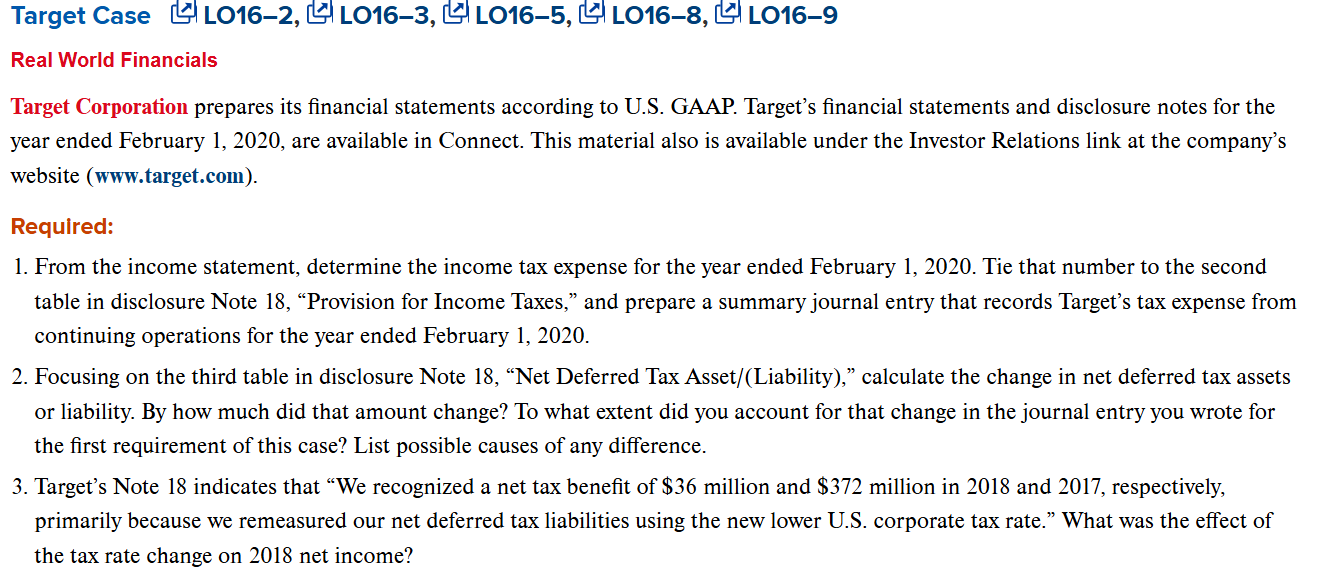

Question: Target Case LO 1 6 - 2 , LO 1 6 - 3 , LO 1 6 - 5 , LO 1 6 - 8

Target Case LO LO LO LO LO Real World Financials Target Corporation prepares its financial statements according to US GAAP. Target's financial statements and disclosure notes for the year ended February are available in Connect. This material also is available under the Investor Relations link at the company's website wwwtarget.com Required: From the income statement, determine the income tax expense for the year ended February Tie that number to the second table in disclosure Note "Provision for Income Taxes," and prepare a summary journal entry that records Target's tax expense from continuing operations for the year ended February Focusing on the third table in disclosure Note "Net Deferred Tax AssetLiability calculate the change in net deferred tax assets or liability. By how much did that amount change? To what extent did you account for that change in the journal entry you wrote for the first requirement of this case? List possible causes of any difference. Target's Note indicates that We recognized a net tax benefit of $ million and $ million in and respectively, primarily because we remeasured our net deferred tax liabilities using the new lower US corporate tax rate." What was the effect of the tax rate change on net income?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock