Question: Task 1 . 1 : Georgian Auto Body bought a shop from an existing business on June 1 5 with cash. The purchase includes the

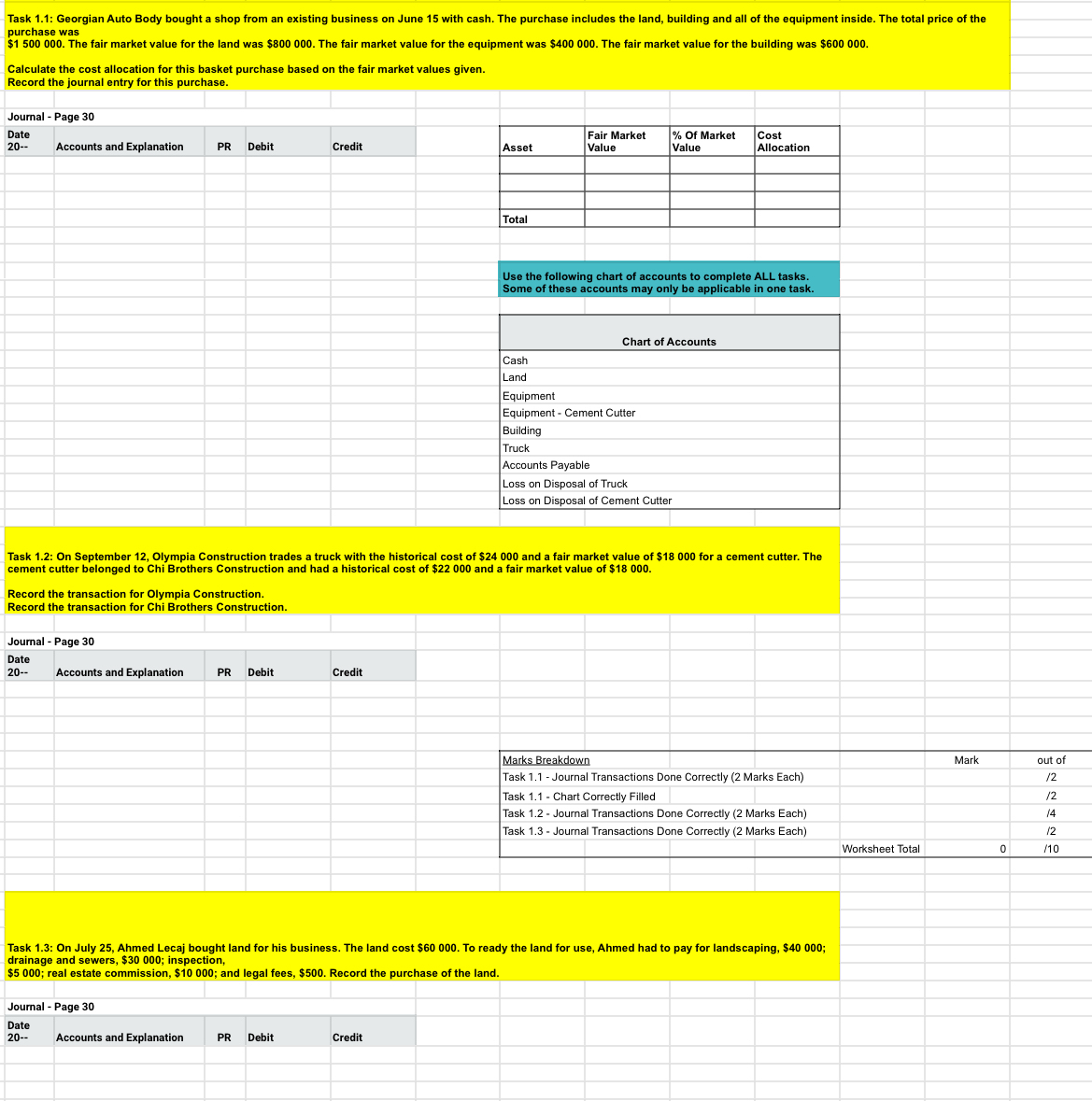

Task : Georgian Auto Body bought a shop from an existing business on June with cash. The purchase includes the land, building and all of the equipment inside. The total price of the purchase was

$ The fair market value for the land was $ The fair market value for the equipment was $ The fair market value for the building was $

Calculate the cost allocation for this basket purchase based on the fair market values given.

Record the journal entry for this purchase.

Journal Page

Date

Accounts and Explanation

tablePRDebit,Credit,Asset,tableFair MarketValuetable Of MarketValuetableCostAllocationTotal,,,tableUse the following chart of accounts to complete ALL tasks.Some of these accounts may only be applicable in one task.Chart of AccountsCashLandEquipmentEquipment Cement CutterBuildingTruckAccounts PayableLoss on Disposal of TruckLoss on Disposal of Cement Cutter

Task : On September Olympia Construction trades a truck with the historical cost of $ and a fair market value of $ for a cement cutter. The cement cutter belonged to Chi Brothers Construction and had a historical cost of $ and a fair market value of $

Record the transaction for Olympia Construction.

Record the transaction for Chi Brothers Construction.

tableJournalPage tableDateAccounts and Explanation,PRDebit,Credit,,,

tabletableMarks BreakdownTask Journal Transactions Done Correctly Marks EachMark,out of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock