Question: Task 1 Background You are employed by Complete Business Services who provide accounting and bookkeeping services to their clients. You are managing one of the

Task 1

Background

You are employed by Complete Business Services who provide accounting and bookkeeping services to their clients. You are managing one of the clients and have been provided with the following information and tasks:

On 31 December 2017, Clayton Textiles Pty Ltd purchased the following fixed assets:

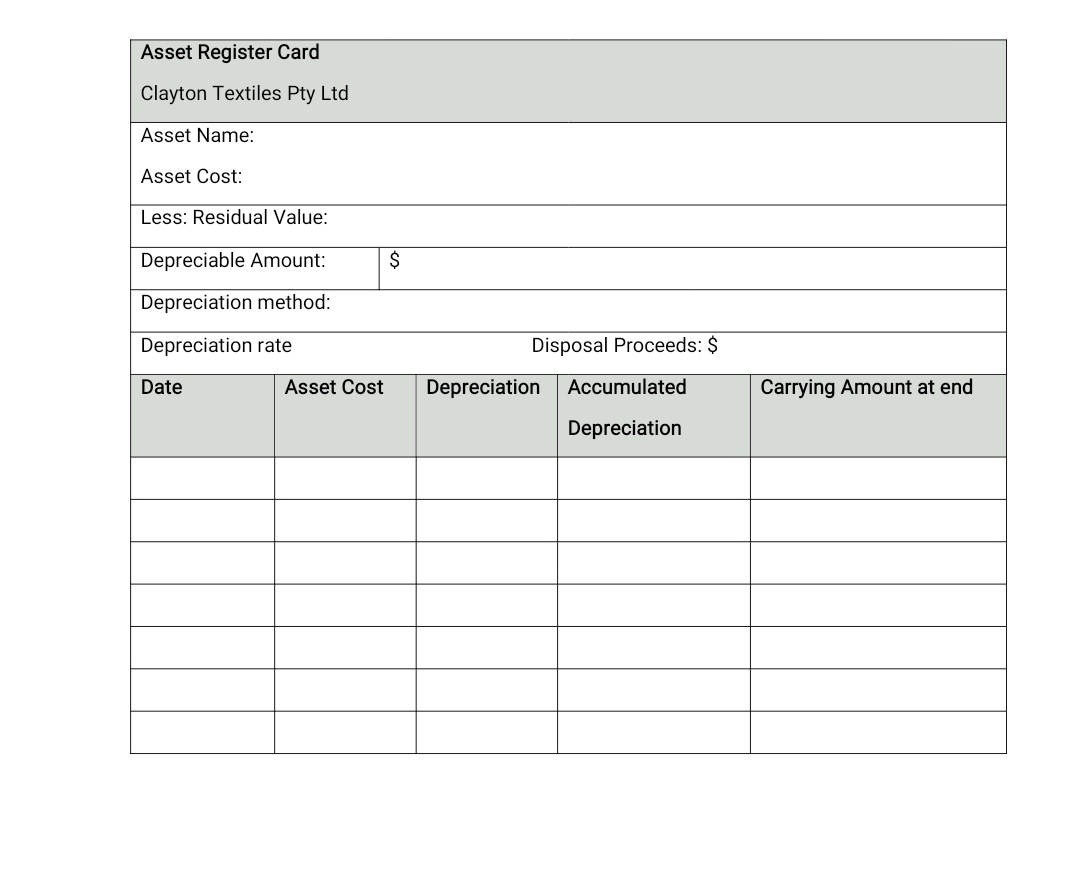

- Computer equipment on credit for $80,000 plus GST.

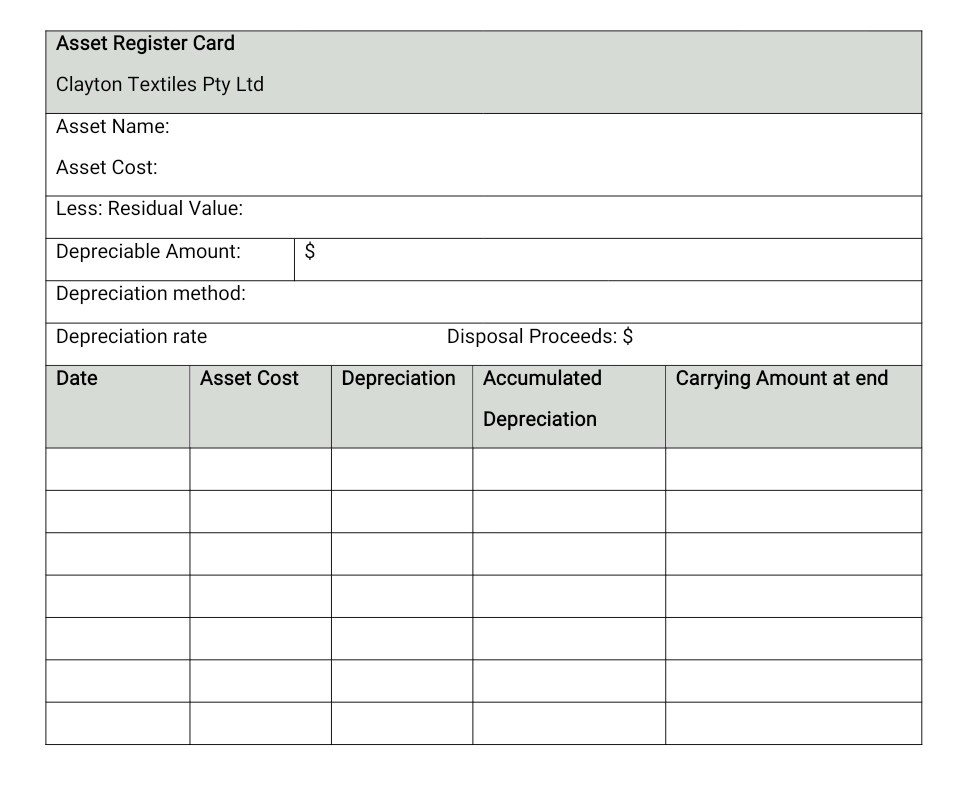

- Textile Weaving equipment for $40000 plus GST.

- Factory land for $100,000 plus GST.

The computer equipment has been sold during the year on 30/9/2020 for $18000 plus GST.

The rate of depreciation is 30% for computer equipment. The useful life of the textile weaving equipment is 5 years

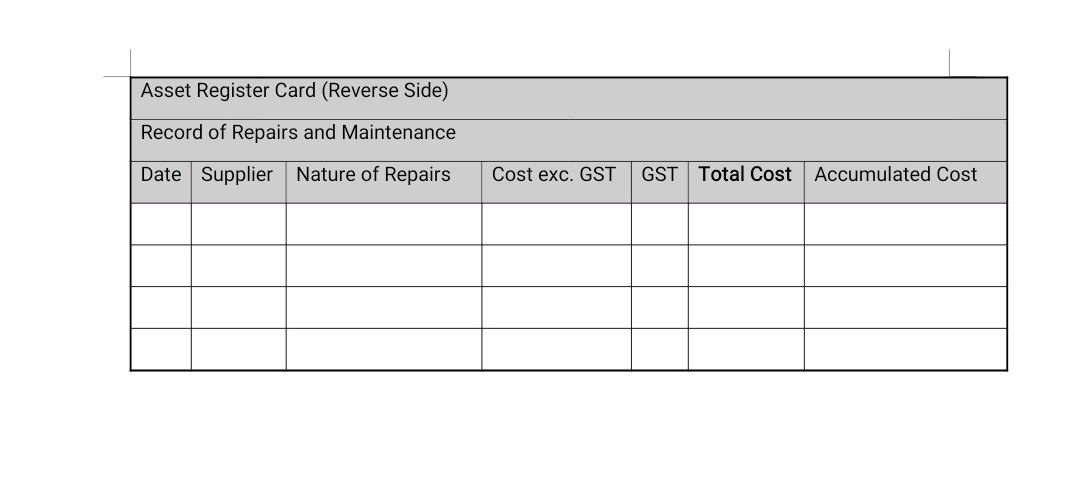

The servicing fee for computer equipment is $550 including GST incurred every year on 1st December.

Organisational Policies and Procedures for Clayton Textiles Pty Ltd state the following for depreciation:

- All computer equipment must be sold within three years of purchase

- Any equipment purchased should be serviced every year and the service fee should be recorded on the asset register card.

- The land will be recorded at cost and will not be depreciated. A separate asset register card need not to be maintained for the same.

- Depreciation on computer equipment should be calculated using the diminishing balance method

- The profit / loss needs to be clearly recorded on the asset register card at the time of disposal

- Depreciation on textile equipment should be calculated using the straight-line method

Complete the following tasks with the above-mentioned information. The Asset register templates have been provided to you:

a)Create and maintain a detailed Asset Register Card with complete depreciation schedule for the above fixed assets. Record the depreciation and disposal of the non-current assets as per the above organisational Policy and Procedures information and in accordance with legislative requirements

To assist with completing the Asset Register Cards for this task, you will need to:

Calculate depreciation for the financial years ended 30 June 2018, 2019 and 2020 for the textile equipment.

Calculate depreciation on the computer equipment for the financial years ended 30 June 2018, 2019 and 2020.

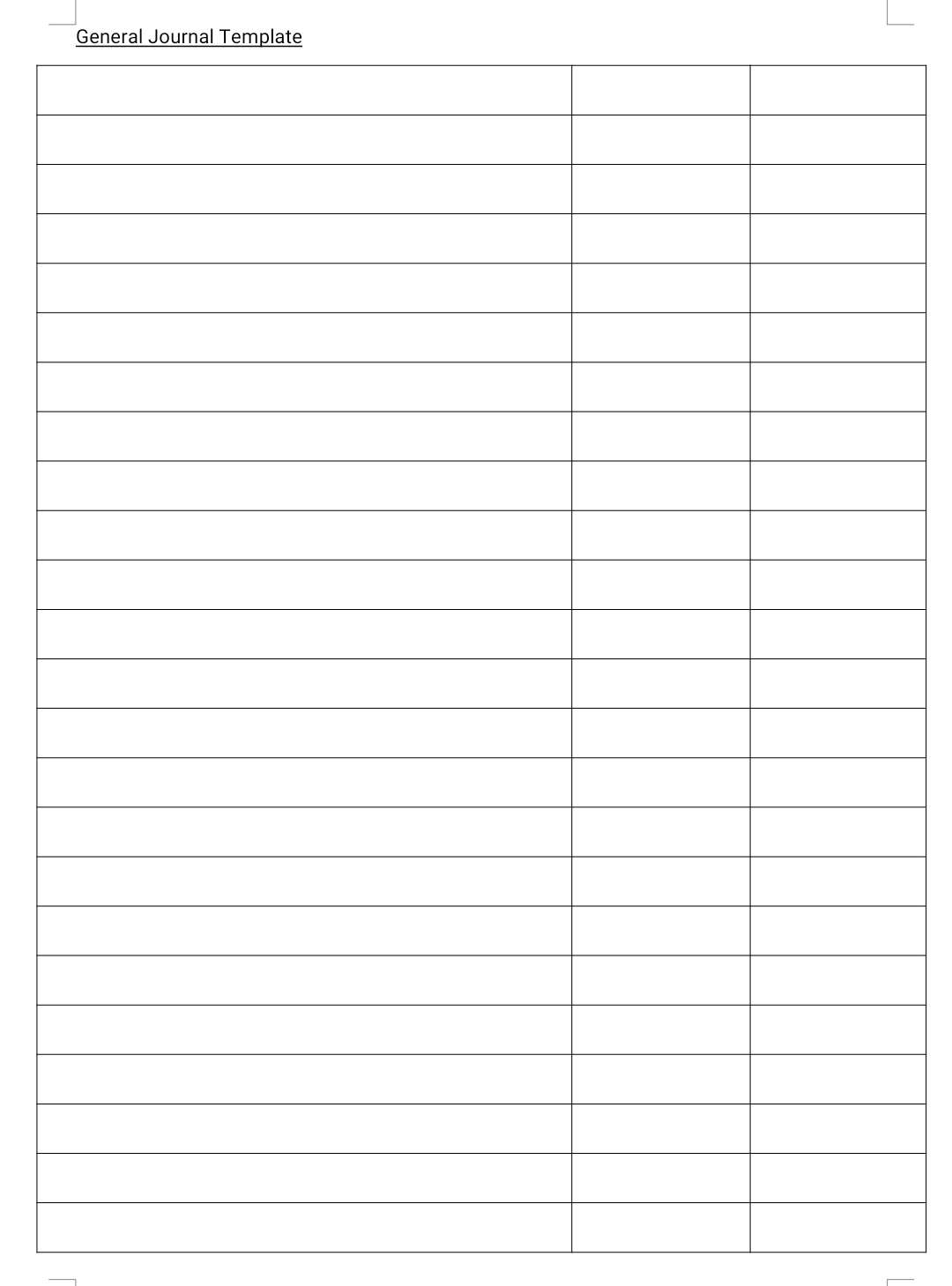

b)Complete the general journal entries for the disposal of assets along with recording of profit/loss on sale of the asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts