Question: Task 1 - BAS Registration and TASA When registered with the Tax Practitioners Board (TPB) you must comply with the Tax Agent Services Act 2009

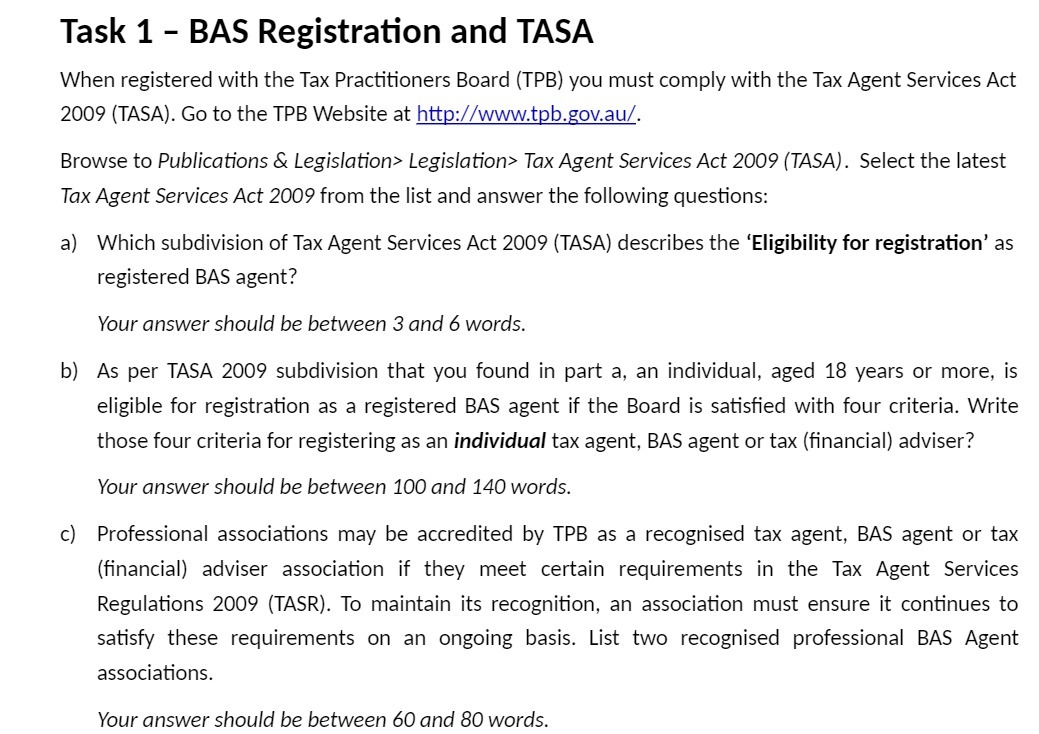

Task 1 - BAS Registration and TASA When registered with the Tax Practitioners Board (TPB) you must comply with the Tax Agent Services Act 2009 (TASA). Go to the TPB Website at http://www.tpb.gov.au/. Browse to Publications & Legislation> Legislation> Tax Agent Services Act 2009 (TASA). Select the latest Tax Agent Services Act 2009 from the list and answer the following questions: a) Which subdivision of Tax Agent Services Act 2009 (TASA) describes the 'Eligibility for registration' as registered BAS agent? Your answer should be between 3 and 6 words. b) As per TASA 2009 subdivision that you found in part a, an individual, aged 18 years or more, is eligible for registration as a registered BAS agent if the Board is satisfied with four criteria. Write those four criteria for registering as an individual tax agent, BAS agent or tax (financial) adviser? Your answer should be between 100 and 140 words. c) Professional associations may be accredited by TPB as a recognised tax agent, BAS agent or tax (financial) adviser association if they meet certain requirements in the Tax Agent Services Regulations 2009 (TASR). To maintain its recognition, an association must ensure it continues to satisfy these requirements on an ongoing basis. List two recognised professional BAS Agent associations. Your answer should be between 60 and 80 words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts