Question: Task: 1. Create journal entries for the following transactions, 2. Draw up a T-account for each account affected by transactions: 3. Calculate normal balances for

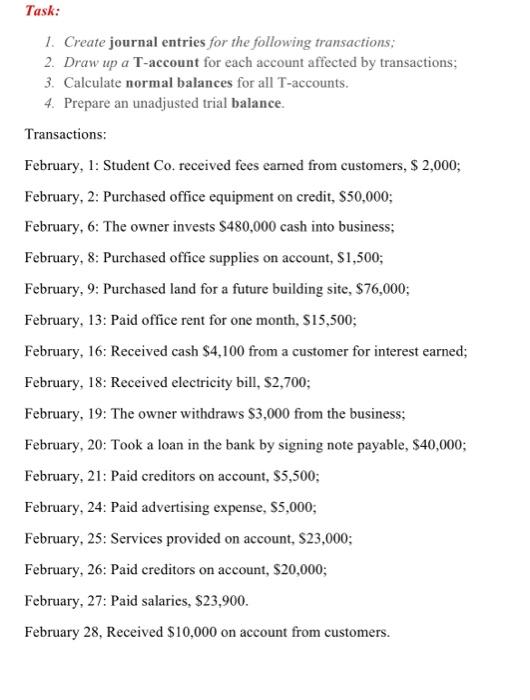

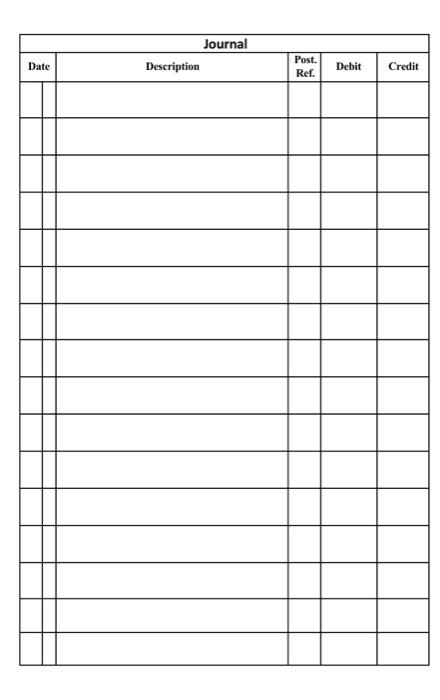

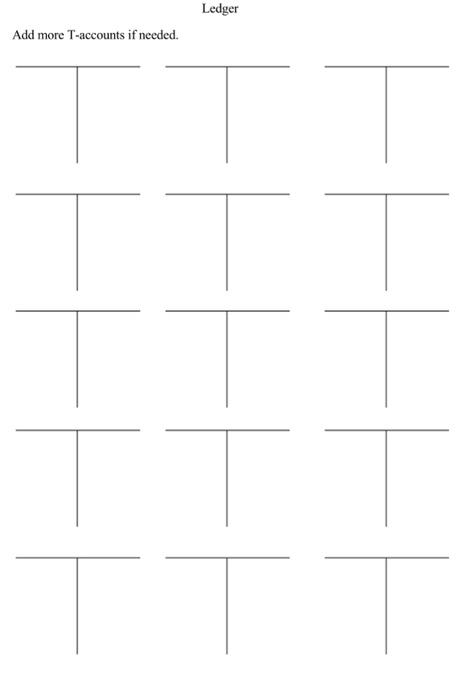

Task: 1. Create journal entries for the following transactions, 2. Draw up a T-account for each account affected by transactions: 3. Calculate normal balances for all T-accounts. 4. Prepare an unadjusted trial balance. Transactions: February, 1: Student Co. received fees earned from customers, $ 2,000; February, 2: Purchased office equipment on credit, $50,000; February, 6: The owner invests S480,000 cash into business; February, 8: Purchased office supplies on account, S1,500; February, 9: Purchased land for a future building site, $76,000; February, 13: Paid office rent for one month, S15,500; February, 16: Received cash $4,100 from a customer for interest earned; February, 18: Received electricity bill, $2,700; February, 19: The owner withdraws $3,000 from the business; February, 20: Took a loan in the bank by signing note payable, $40,000; February, 21: Paid creditors on account, $5,500; February, 24: Paid advertising expense, $5,000; February, 25: Services provided on account, $23,000; February, 26: Paid creditors on account, $20,000; February, 27: Paid salaries, $23,900. February 28, Received $10,000 on account from customers. Journal Description Date Post. Ref. Debit Credit Ledger Add more T-accounts if needed. Student Co. Unadjusted Trial Balance February 30, 2020 Debit Balances Credit Balances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts