Question: TASK 1 Makeit Pty Ltd is a local manufactures. The company wishes to use all available small business concessions to minimise taxable income. Makeit

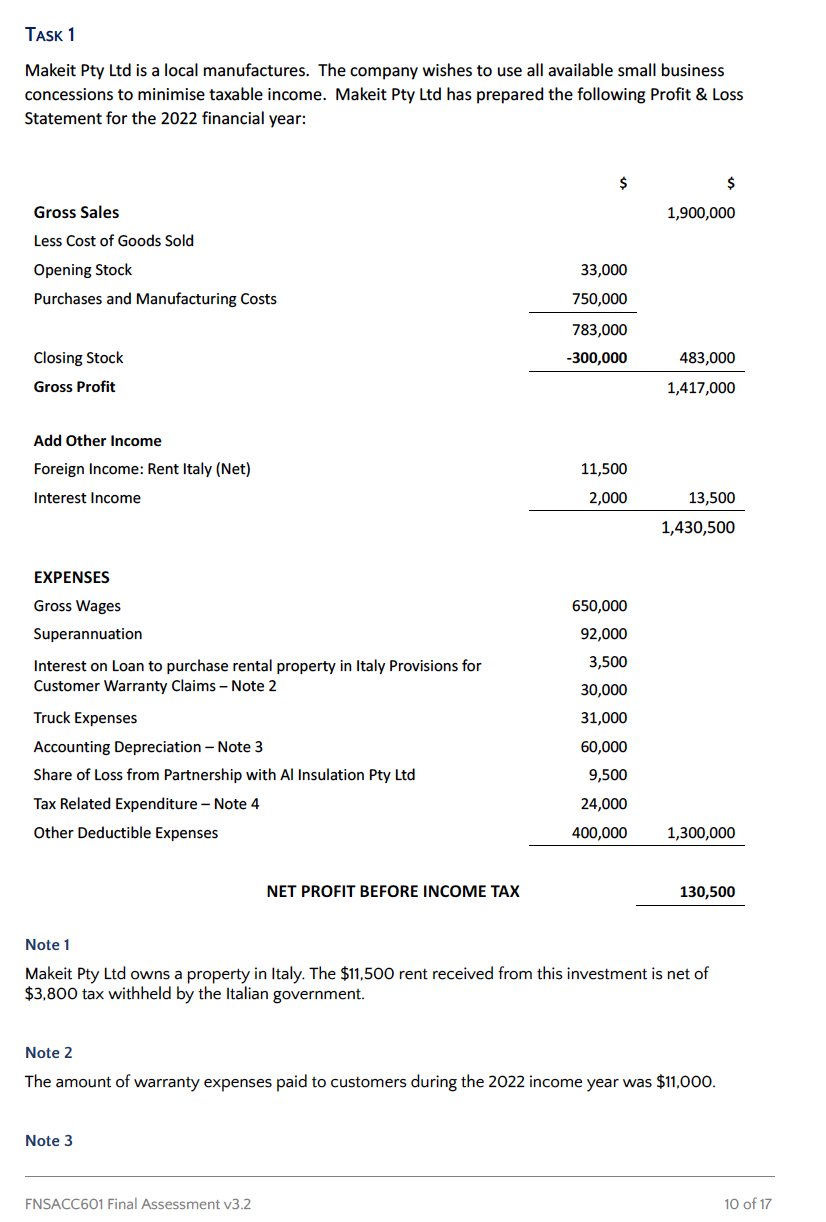

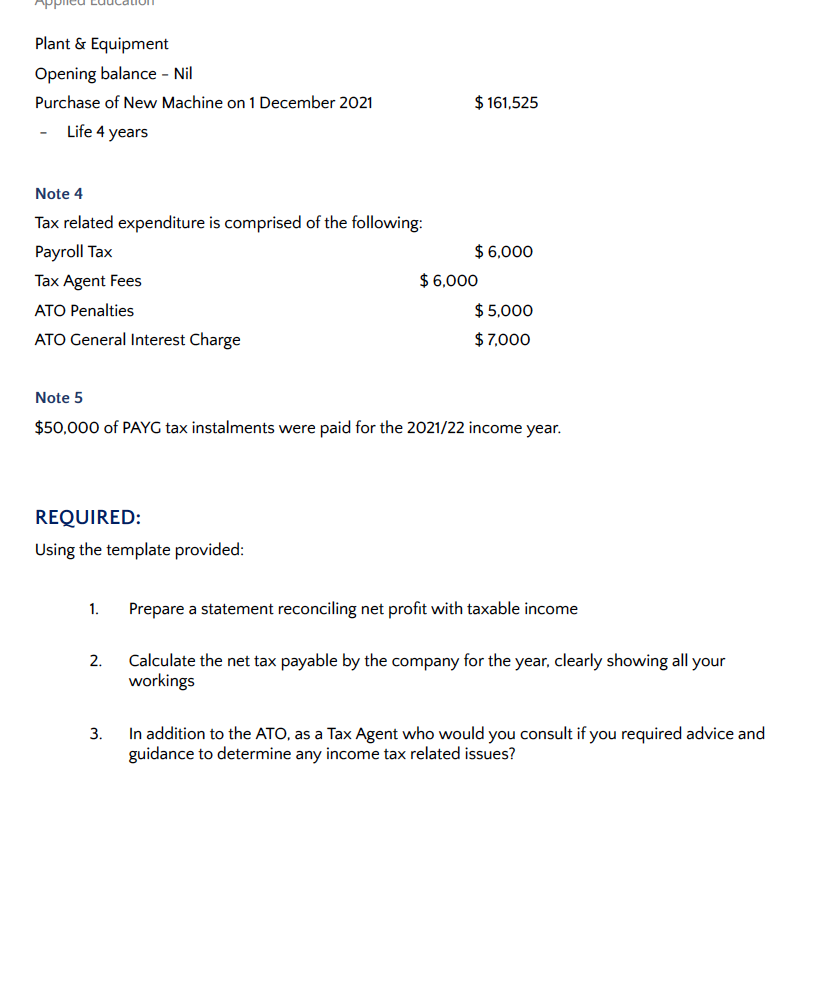

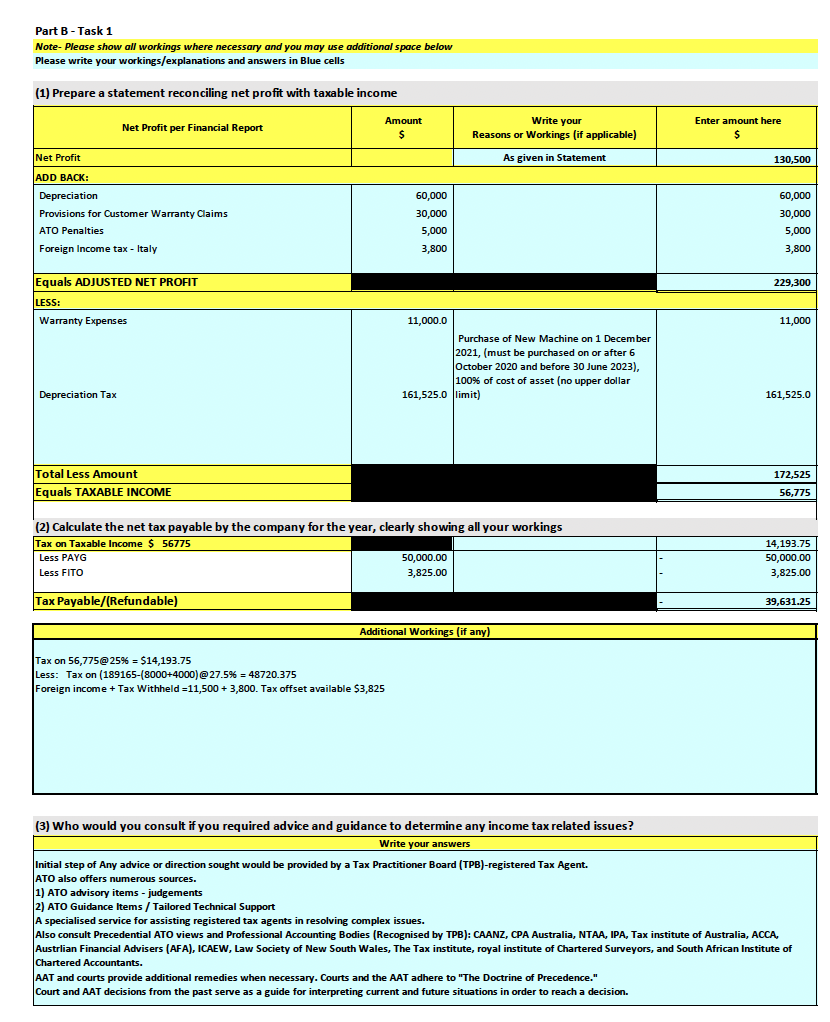

TASK 1 Makeit Pty Ltd is a local manufactures. The company wishes to use all available small business concessions to minimise taxable income. Makeit Pty Ltd has prepared the following Profit & Loss Statement for the 2022 financial year: Gross Sales $ $ 1,900,000 Less Cost of Goods Sold Opening Stock 33,000 Purchases and Manufacturing Costs 750,000 783,000 Closing Stock Gross Profit -300,000 483,000 1,417,000 Add Other Income Foreign Income: Rent Italy (Net) Interest Income 11,500 2,000 13,500 1,430,500 EXPENSES Gross Wages 650,000 Superannuation 92,000 Interest on Loan to purchase rental property in Italy Provisions for 3,500 Customer Warranty Claims - Note 2 30,000 Truck Expenses 31,000 Accounting Depreciation - Note 3 60,000 Share of Loss from Partnership with Al Insulation Pty Ltd 9,500 Tax Related Expenditure - Note 4 24,000 Other Deductible Expenses 400,000 1,300,000 NET PROFIT BEFORE INCOME TAX 130,500 Note 1 Makeit Pty Ltd owns a property in Italy. The $11,500 rent received from this investment is net of $3,800 tax withheld by the Italian government. Note 2 The amount of warranty expenses paid to customers during the 2022 income year was $11,000. Note 3 FNSACC601 Final Assessment v3.2 10 of 17 Plant & Equipment Opening balance - Nil Purchase of New Machine on 1 December 2021 - Life 4 years Note 4 Tax related expenditure is comprised of the following: Payroll Tax Tax Agent Fees ATO Penalties ATO General Interest Charge $161,525 $6,000 $6,000 $5,000 $7,000 Note 5 $50,000 of PAYG tax instalments were paid for the 2021/22 income year. REQUIRED: Using the template provided: 1. Prepare a statement reconciling net profit with taxable income 2. Calculate the net tax payable by the company for the year, clearly showing all your workings 3. In addition to the ATO, as a Tax Agent who would you consult if you required advice and guidance to determine any income tax related issues? Part B - Task 1 Note- Please show all workings where necessary and you may use additional space below Please write your workings/explanations and answers in Blue cells (1) Prepare a statement reconciling net profit with taxable income Net Profit ADD BACK: Net Profit per Financial Report Amount $ Write your Enter amount here Reasons or Workings (if applicable) As given in Statement $ Depreciation 60,000 Provisions for Customer Warranty Claims 30,000 ATO Penalties 5,000 Foreign Income tax - Italy 3,800 Equals ADJUSTED NET PROFIT LESS: Warranty Expenses 11,000.0 Depreciation Tax Total Less Amount Equals TAXABLE INCOME Purchase of New Machine on 1 December 2021, (must be purchased on or after 6 October 2020 and before 30 June 2023), 100% of cost of asset (no upper dollar 161,525.0 limit) (2) Calculate the net tax payable by the company for the year, clearly showing all your workings Tax on Taxable Income $ 56775 Less PAYG Less FITO Tax Payable/(Refundable) 50,000.00 3,825.00 Additional Workings (if any) Tax on 56,775@25% = $14,193.75 Less: Tax on (189165-(8000+4000) @27.5% = 48720.375 Foreign income + Tax Withheld =11,500+ 3,800. Tax offset available $3,825 (3) Who would you consult if you required advice and guidance to determine any income tax related issues? Write your answers Initial step of Any advice or direction sought would be provided by a Tax Practitioner Board (TPB)-registered Tax Agent. ATO also offers numerous sources. 1) ATO advisory items - judgements 2) ATO Guidance Items / Tailored Technical Support 130,500 60,000 30,000 5,000 3,800 229,300 11,000 161,525.0 172,525 56,775 14,193.75 50,000.00 3,825.00 39,631.25 A specialised service for assisting registered tax agents in resolving complex issues. Also consult Precedential ATO views and Professional Accounting Bodies (Recognised by TPB): CAANZ, CPA Australia, NTAA, IPA, Tax institute of Australia, ACCA, Austrlian Financial Advisers (AFA), ICAEW, Law Society of New South Wales, The Tax institute, royal institute of Chartered Surveyors, and South African Institute of Chartered Accountants. AAT and courts provide additional remedies when necessary. Courts and the AAT adhere to "The Doctrine of Precedence." Court and AAT decisions from the past serve as a guide for interpreting current and future situations in order to reach a decision.

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

1 Statement Reconciling Net Profit with Taxable Income Item Adjusted Net Profit Net Profit 130500 Ad... View full answer

Get step-by-step solutions from verified subject matter experts