Question: Task 1: Project Appraisal [40 marks Jackets Ltd is considering expanding its highly successful denim jackets business. The initial investment costs and net annual cash

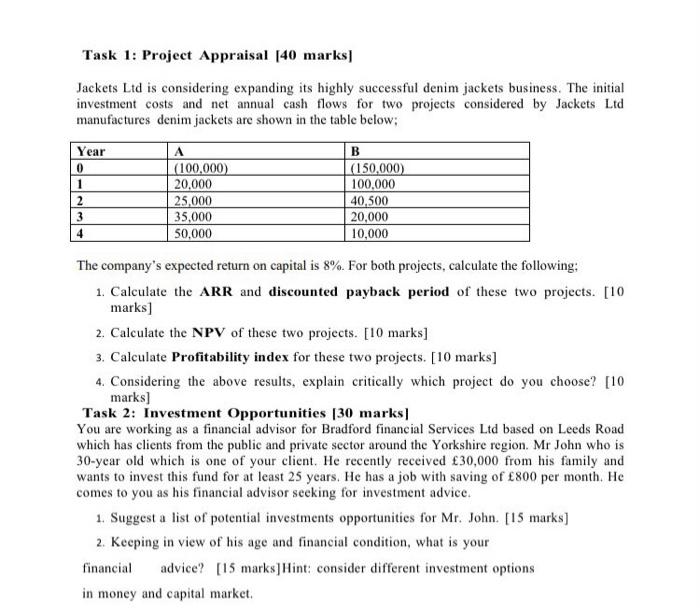

Task 1: Project Appraisal [40 marks Jackets Ltd is considering expanding its highly successful denim jackets business. The initial investment costs and net annual cash flows for two projects considered by Jackets Ltd manufactures denim jackets are shown in the table below; Year 0 1 2 3 4 (100,000) 20,000 25,000 35,000 50,000 B (150.000) 100.000 40.500 20,000 10,000 The company's expected return on capital is 8%. For both projects, calculate the following: 1. Calculate the ARR and discounted payback period of these two projects. [10 marks] 2. Calculate the NPV of these two projects. [10 marks] 3. Calculate Profitability index for these two projects. [10 marks] 4. Considering the above results, explain critically which project do you choose? [10 marks] Task 2: Investment Opportunities (30 marks] You are working as a financial advisor for Bradford financial Services Ltd based on Leeds Road which has clients from the public and private sector around the Yorkshire region. Mr John who is 30-year old which is one of your client. He recently received 30,000 from his family and wants to invest this fund for at least 25 years. He has a job with saving of 800 per month. He comes to you as his financial advisor seeking for investment advice. 1. Suggest a list of potential investments opportunities for Mr. John. [15 marks] 2. Keeping in view of his age and financial condition, what is your financial advice? [15 marks]Hint: consider different investment options in money and capital market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts