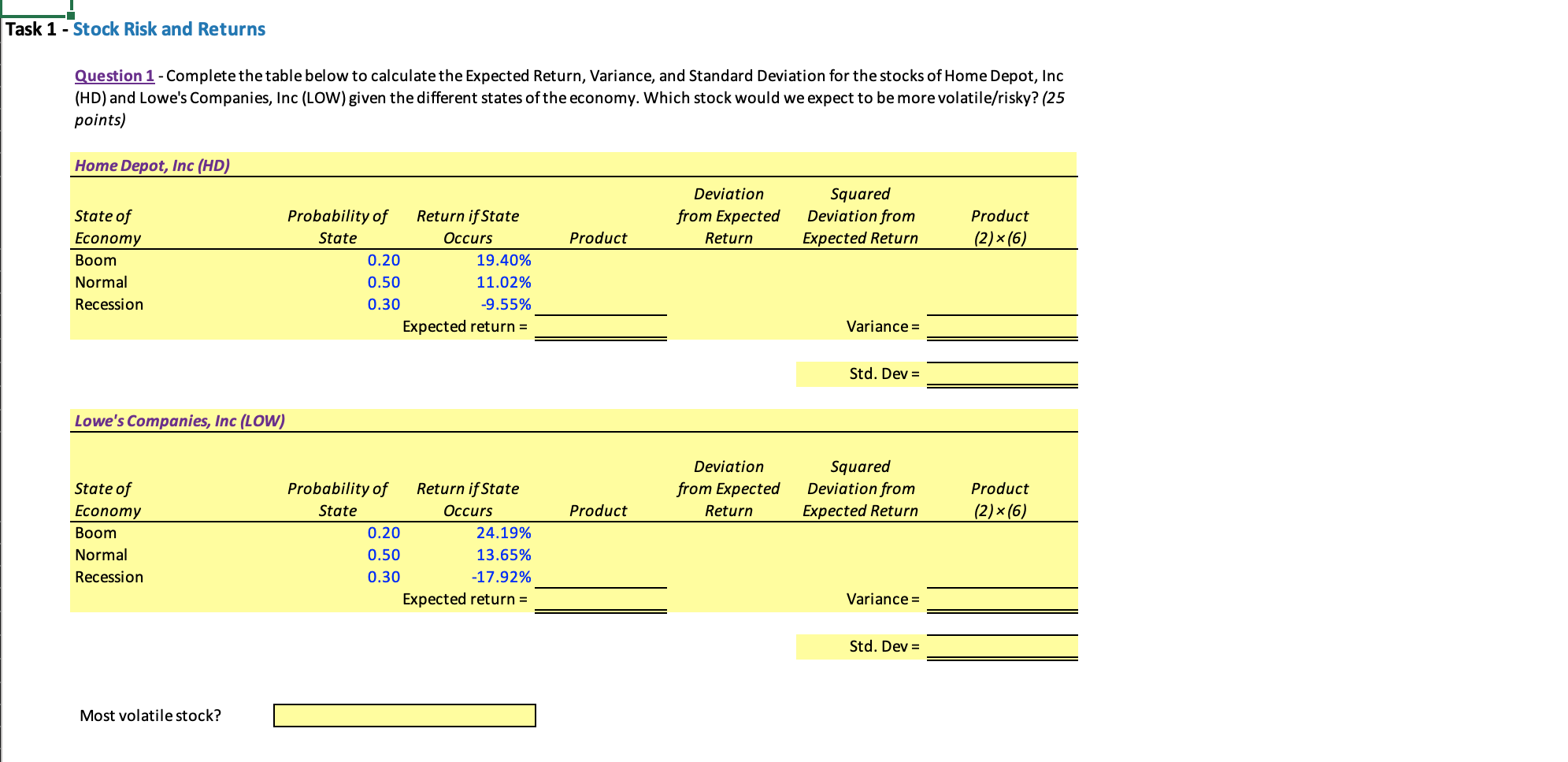

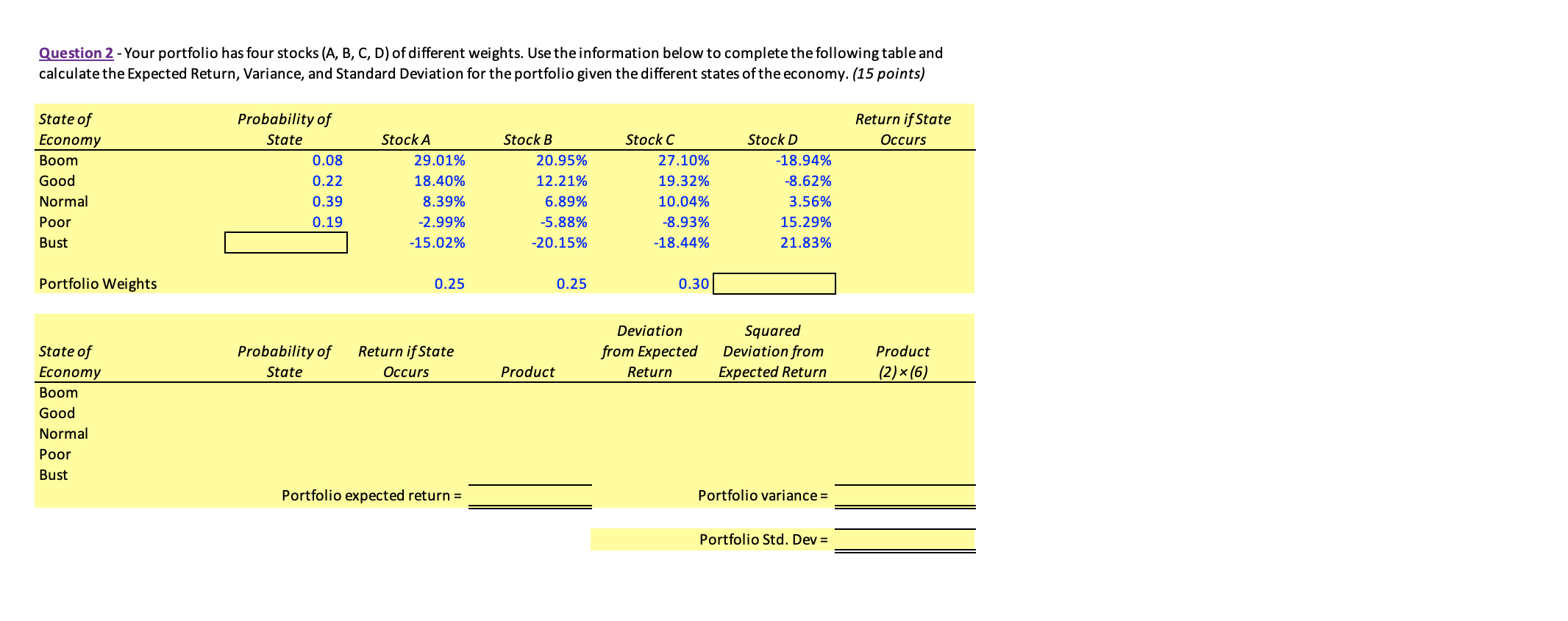

Question: Task 1 - Stock Risk and Returns Question 1 - Complete the table below to calculate the Expected Return, Variance, and Standard Deviation for the

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock