Question: TASK 1 TASK 1 (A) Briefly differentiate between Direct Costs and Indirect costs in total Product Cost determination in business (3 marks) Direct costs are

TASK 1

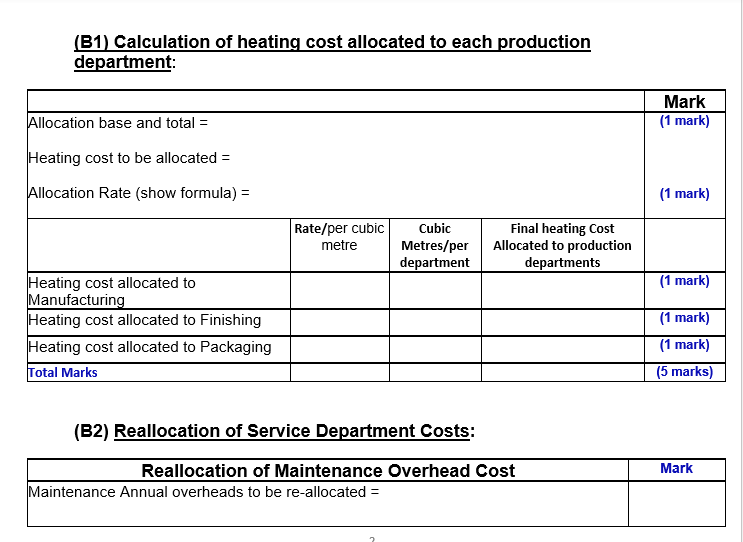

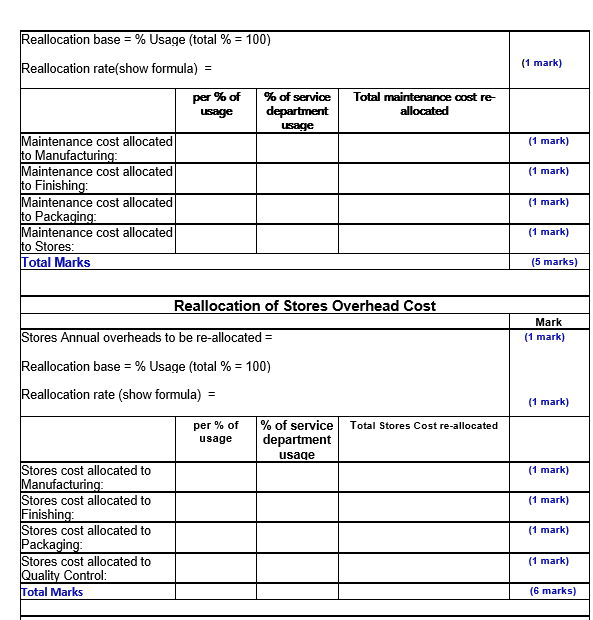

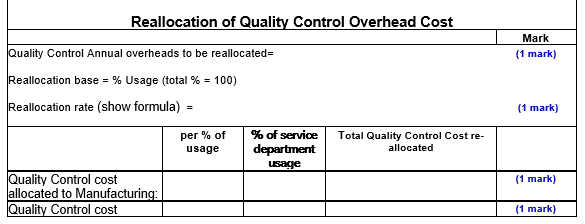

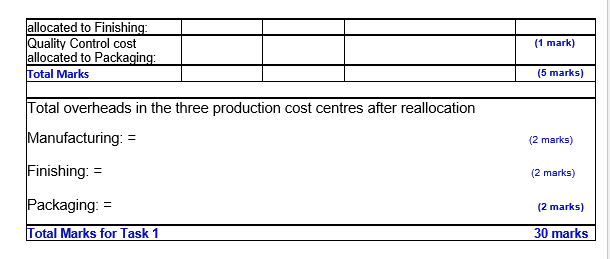

TASK 1 (A) Briefly differentiate between Direct Costs and Indirect costs in total Product Cost determination in business (3 marks) Direct costs are expenses that are directly related to the production of goods or the provision of services, whereas indirect costs are general company expenses that keep you in business. (B1) Calculation of heating cost allocated to each production department: Mark (1 mark) Allocation base and total = Heating cost to be allocated = Allocation Rate (show formula) = (1 mark) Rate/per cubic metre Cubic Metres/per department Final heating Cost Allocated to production departments (1 mark) Heating cost allocated to Manufacturing Heating cost allocated to Finishing Heating cost allocated to Packaging Total Marks (1 mark) (1 mark) (5 marks) (B2) Reallocation of Service Department Costs: Mark Reallocation of Maintenance Overhead Cost Maintenance Annual overheads to be re-allocated = Reallocation base = % Usage (total % = 100) Reallocation rate(show formula) = (1 mark) per % of % of service department usage Total maintenance cost re allocated usage (1 mark) (1 mark) Maintenance cost allocated to Manufacturing: Maintenance cost allocated to Finishing: Maintenance cost allocated to Packaging Maintenance cost allocated to Stores: Total Marks (1 mark) (1 mark) (5 marks) Reallocation of Stores Overhead Cost Mark (1 mark) Stores Annual overheads to be re-allocated = Reallocation base = % Usage (total % = 100) Reallocation rate (show formula) = (1 mark) Total Stores Cost re-allocated per % of usage % of service department usage (1 mark) (1 mark) Stores cost allocated to Manufacturing: Stores cost allocated to Finishing: Stores cost allocated to Packaging Stores cost allocated to Quality Control: Total Marks (1 mark) (1 mark) (6 marks) Reallocation of Quality Control Overhead Cost Mark (1 mark) Quality Control Annual overheads to be reallocated Reallocation base = % Usage (total % = 100) Reallocation rate (show formula) = (1 mark) per % of usage % of service department usage Total Quality Control Cost re- allocated (1 mark) Quality Control cost allocated to Manufacturing: Quality Control cost (1 mark) allocated to Finishing: Quality Control cost allocated to Packaging: Total Marks (1 mark) (5 marks) Total overheads in the three production cost centres after reallocation Manufacturing: = (2 marks) (2 marks) Finishing: = Packaging: - (2 marks) Total Marks for Task 1 30 marks TASK 1 (A) Briefly differentiate between Direct Costs and Indirect costs in total Product Cost determination in business (3 marks) Direct costs are expenses that are directly related to the production of goods or the provision of services, whereas indirect costs are general company expenses that keep you in business. (B1) Calculation of heating cost allocated to each production department: Mark (1 mark) Allocation base and total = Heating cost to be allocated = Allocation Rate (show formula) = (1 mark) Rate/per cubic metre Cubic Metres/per department Final heating Cost Allocated to production departments (1 mark) Heating cost allocated to Manufacturing Heating cost allocated to Finishing Heating cost allocated to Packaging Total Marks (1 mark) (1 mark) (5 marks) (B2) Reallocation of Service Department Costs: Mark Reallocation of Maintenance Overhead Cost Maintenance Annual overheads to be re-allocated = Reallocation base = % Usage (total % = 100) Reallocation rate(show formula) = (1 mark) per % of % of service department usage Total maintenance cost re allocated usage (1 mark) (1 mark) Maintenance cost allocated to Manufacturing: Maintenance cost allocated to Finishing: Maintenance cost allocated to Packaging Maintenance cost allocated to Stores: Total Marks (1 mark) (1 mark) (5 marks) Reallocation of Stores Overhead Cost Mark (1 mark) Stores Annual overheads to be re-allocated = Reallocation base = % Usage (total % = 100) Reallocation rate (show formula) = (1 mark) Total Stores Cost re-allocated per % of usage % of service department usage (1 mark) (1 mark) Stores cost allocated to Manufacturing: Stores cost allocated to Finishing: Stores cost allocated to Packaging Stores cost allocated to Quality Control: Total Marks (1 mark) (1 mark) (6 marks) Reallocation of Quality Control Overhead Cost Mark (1 mark) Quality Control Annual overheads to be reallocated Reallocation base = % Usage (total % = 100) Reallocation rate (show formula) = (1 mark) per % of usage % of service department usage Total Quality Control Cost re- allocated (1 mark) Quality Control cost allocated to Manufacturing: Quality Control cost (1 mark) allocated to Finishing: Quality Control cost allocated to Packaging: Total Marks (1 mark) (5 marks) Total overheads in the three production cost centres after reallocation Manufacturing: = (2 marks) (2 marks) Finishing: = Packaging: - (2 marks) Total Marks for Task 1 30 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts