Question: Task #1 The Audit Work paper Purpose: To ascertain whether service revenue recognized during December, year 7, is complete and accurate in all material respects

Task #1 The Audit Work paper

Purpose: To ascertain whether service revenue recognized during December, year 7, is complete and accurate in all material respects in relation to the financial statements taken as a whole

As needed, prepare the required adjusting entry in good form (showing debits and credits) for each tick-mark

| Client: Griffin, Inc. | Prepared by: Staff Accountant J - 1/24/2008 | ||

| Service Revenue December 31, 2007 | Reviewed by: Senior Auditor K - 2/2/2008 | ||

| Date | Customer | Amount ($) | Tick-marks |

| 12/2 | Slate Co. | 22,000 | A |

| 12/4 | Crater, Inc. | 63,500 | A |

| 12/15 | Globe, Inc. | 50,000 | C |

| 12/16 | Ash Corp. | 48,750 | A |

| 12/17 | Valley, LLP | 32,500 | X |

| 12/23 | Magnolia Corp. | 22,750 | X |

| 12/27 | Marble Co. | 55,500 | E |

| 12/28 | Delta, LLP | 95,000 | A |

| 12/30 | Chestnut, Inc. | 75,000 | B |

| 12/30 | Honeycomb Corp. | 43,000 | D |

| 12/31 | Globe, Inc. | 75,400 | A |

| Total | $ 583,400 F | G/L | |

| Explanation of Tick-marks | |||

| A | Per review of contract, invoice, and service records, we recalculated the amount of revenue earned and verified that revenue was recognized in the correct period. | ||

| B | Per review of the contract and service records, service was finalized and invoiced as of December 31, 2007. Per review of ledger detail the receivable balance was recorded in unbilled receivables at year end. | ||

| C | Per review of the $50,000 contract and invoice, service was for the period December 15, year 7, through January 14, 2008, and should be recognized equally between 2007 and 2008 based on the terms of the contract. | ||

| D | Per physical inventory observation, this was a consignment sale. The product is at the customers warehouse on 12/31/2007 | ||

| E | Per the customers purchase order, the invoice payment is not due for 90 days. This product was delivered to a public warehouse and the storage fee will be paid by Griffin | ||

| G/L | Agreed amount to general ledger balance at December 31, 2007 | ||

| F | Amount foots, without exception. | ||

| X | Product was invoiced although there is no record of delivery/receipt by the customer | ||

Task #2

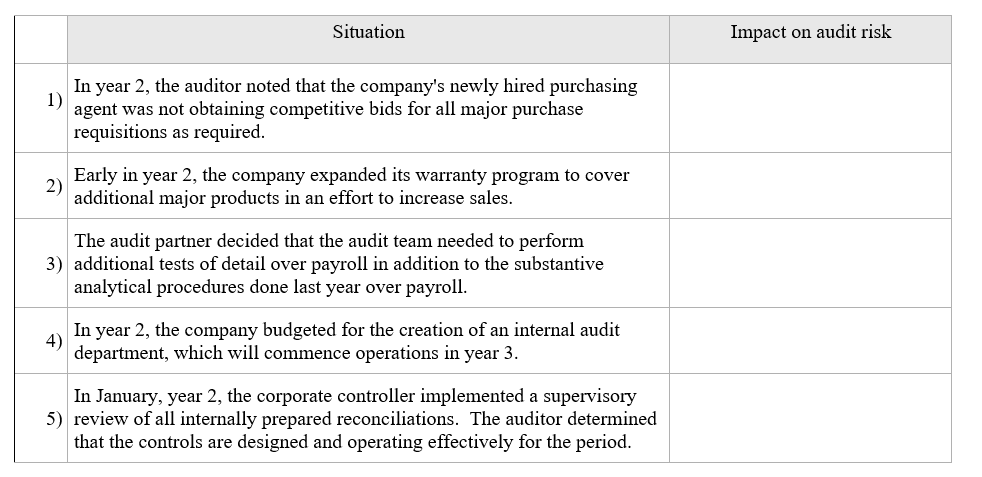

Best Wood Furniture, Inc., a non-issuer that produces wood furniture, is undergoing a year 2 audit. The situations below describe changes made during year 2 that may or may not contribute to audit risk. For each situation, select the impact, if any, that the situation has on a specific component of audit risk for the year 2 audit. Selections are for once, more than once, or not at all. Consider each situation independently.

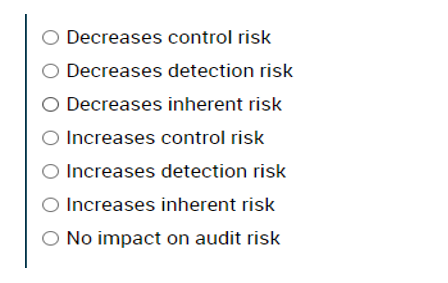

Choices for Impact on the Risk Category

Situation Impact on audit risk 1) In year 2, the auditor noted that the company's newly hired purchasing agent was not obtaining competitive bids for all major purchase requisitions as required. 2) Early in year 2, the company expanded its warranty program to cover additional major products in an effort to increase sales. The audit partner decided that the audit team needed to perform 3) additional tests of detail over payroll in addition to the substantive analytical procedures done last year over payroll. 4) In year 2, the company budgeted for the creation of an internal audit department, which will commence operations in year 3. In January, year 2, the corporate controller implemented a supervisory 5) review of all internally prepared reconciliations. The auditor determined that the controls are designed and operating effectively for the period. Decreases control risk Decreases detection risk Decreases inherent risk Increases control risk O Increases detection risk Increases inherent risk O No impact on audit risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts