Question: Task 1: The expanded accounting equation Michael Brown opened his law office on June 1, 2013. During the first month of operations. Michael conducted the

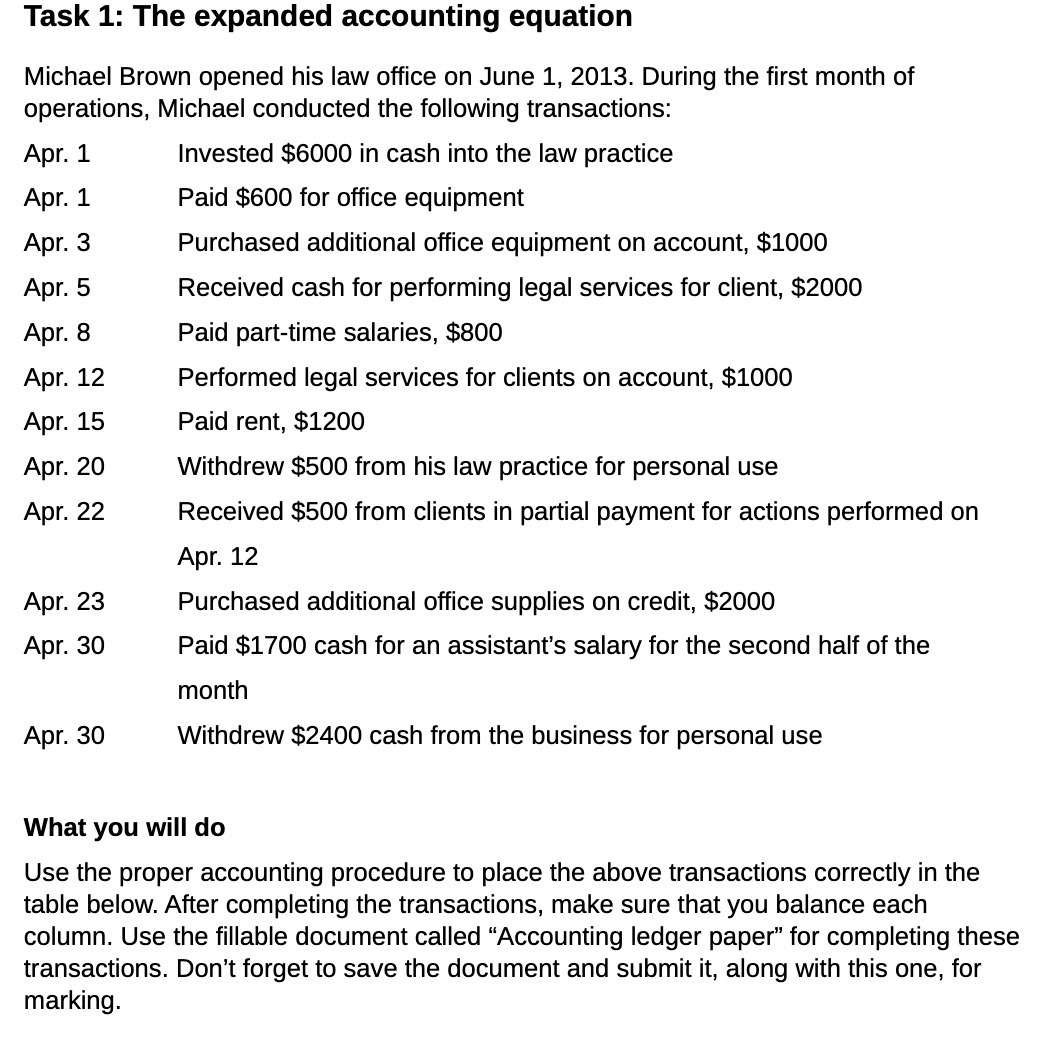

Task 1: The expanded accounting equation Michael Brown opened his law office on June 1, 2013. During the first month of operations. Michael conducted the following transactions: Apr. 1 Invested $6000 in cash into the law practice Apr. 1 Paid $600 for office equipment Apr. 3 Purchased additional office equipment on account, $1000 Apr. 5 Received cash for performing legal services for client. $2000 Apr. 8 Paid part-time salaries, $800 Apr. 12 Performed legal services for clients on account. $1000 Apr. 15 Paid rent, $1200 Apr. 20 Withdrew $500 from his law practice for personal use Apr. 22 Received $500 from clients in partial payment for actions performed on Apr. 12 Apr. 23 Purchased additional office supplies on credit, $2000 Apr. 30 Paid $1700 cash for an assistant's salary for the second half of the month Apr. 30 Withdrew $2400 cash from the business for personal use What you will do Use the proper accounting procedure to place the above transactions correctly in the table below. After completing the transactions. make sure that you balance each column. Use the fillable document called \"Accounting ledger paper\" for completing these transactions. Don't forget to save the document and submit it. along with this one. for marking

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts