Question: Task 10 - BAS Case Study - Worksheet method & Cash flow Neptune Sales P/L is registered for GST as a cash payer and has

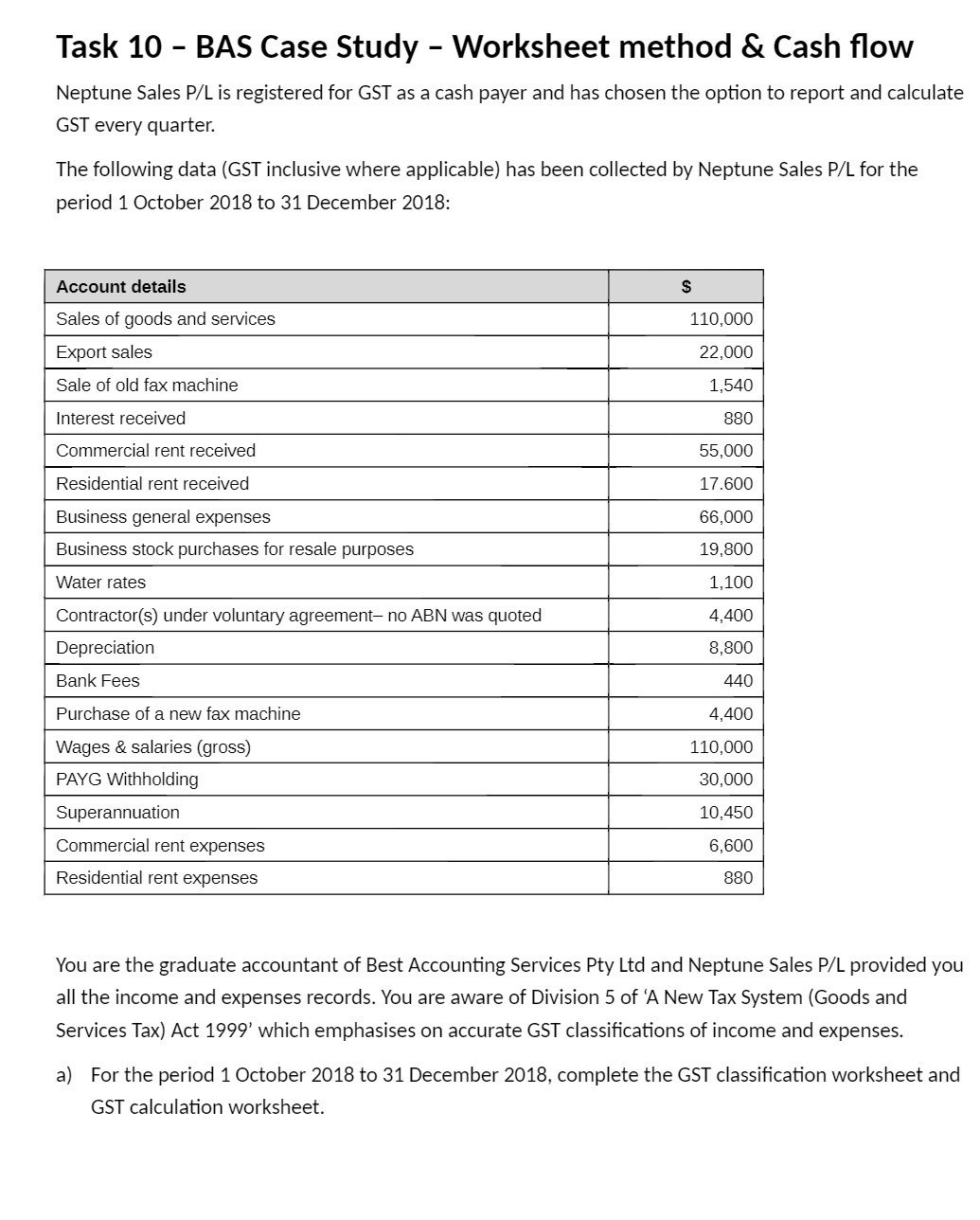

Task 10 - BAS Case Study - Worksheet method & Cash flow Neptune Sales P/L is registered for GST as a cash payer and has chosen the option to report and calculate GST every quarter. The following data (GST inclusive where applicable) has been collected by Neptune Sales P/L for the period 1 October 2018 to 31 December 2018: Account details Sales of goods and services 110,000 Export sales 22,000 Sale of old fax machine 1,540 Interest received 880 Commercial rent received 55,000 Residential rent received 17.600 Business general expenses 66,000 Business stock purchases for resale purposes 19,800 Water rates 1,100 Contractor(s) under voluntary agreement- no ABN was quoted 4,400 Depreciation 8,800 Bank Fees 140 Purchase of a new fax machine 4,400 Wages & salaries (gross 110,000 PAYG Withholding 30,000 Superannuateon 10,450 Commercial rent expenses 6,600 Residential rent expenses 880 You are the graduate accountant of Best Accounting Services Pty Ltd and Neptune Sales P/L provided you all the income and expenses records. You are aware of Division 5 of 'A New Tax System (Goods and Services Tax) Act 1999' which emphasises on accurate GST classifications of income and expenses. a) For the period 1 October 2018 to 31 December 2018, complete the GST classification worksheet and GST calculation worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts