Question: Task 1a: Demand Forecasting (1) - Demand for GeForce RTX 4090 graphic card at NVIDIA from its North and South America markets for the last

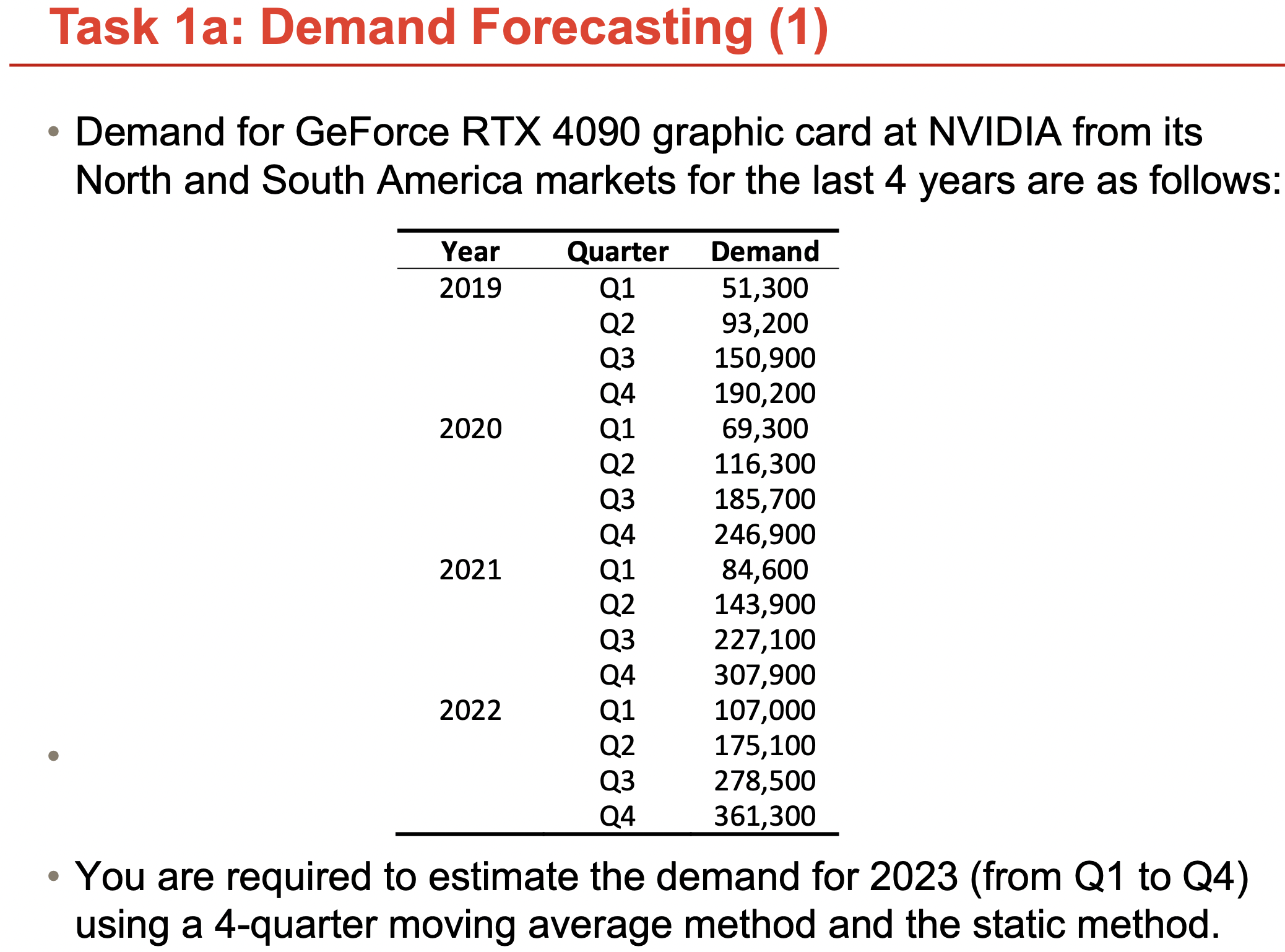

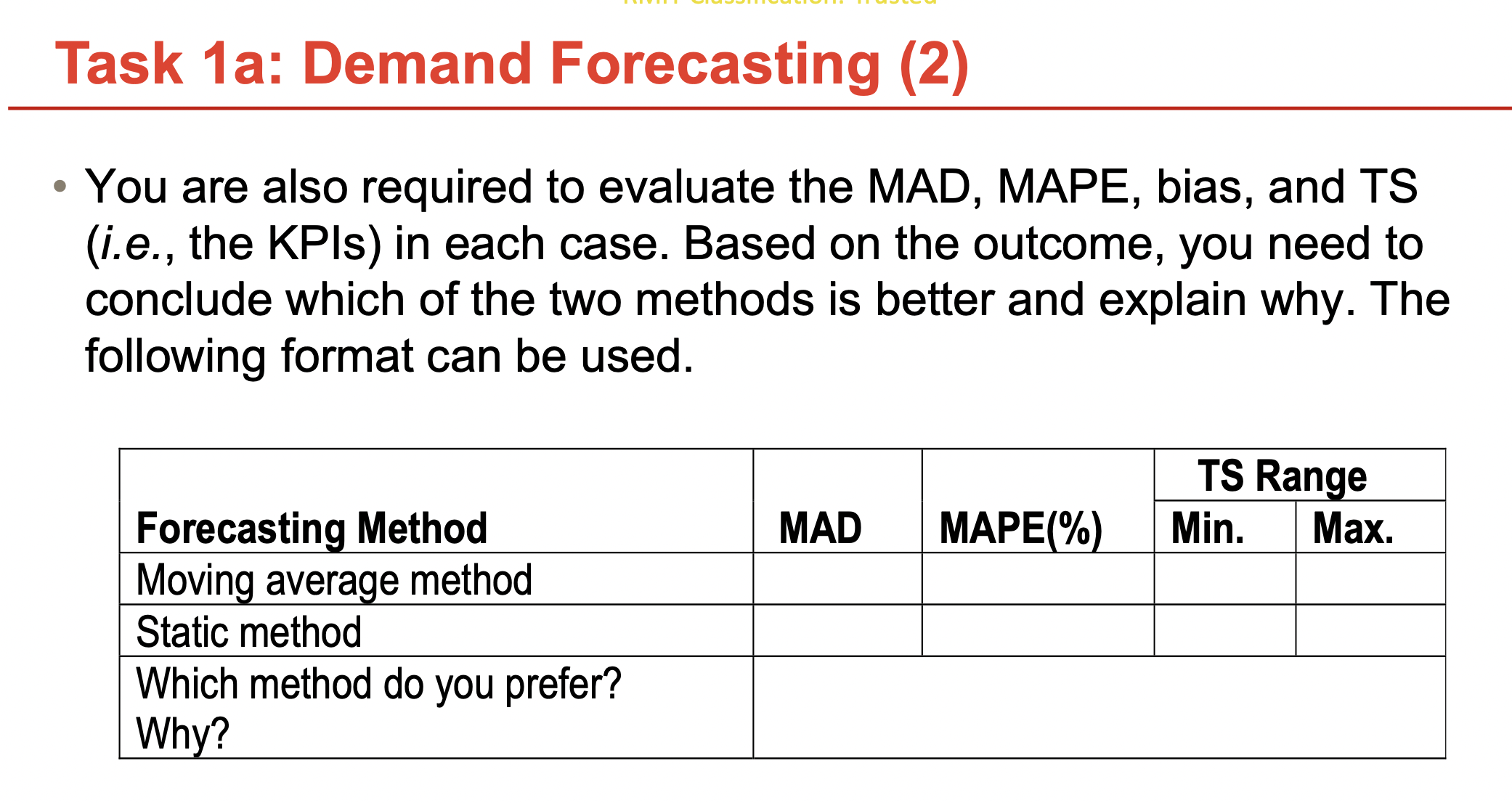

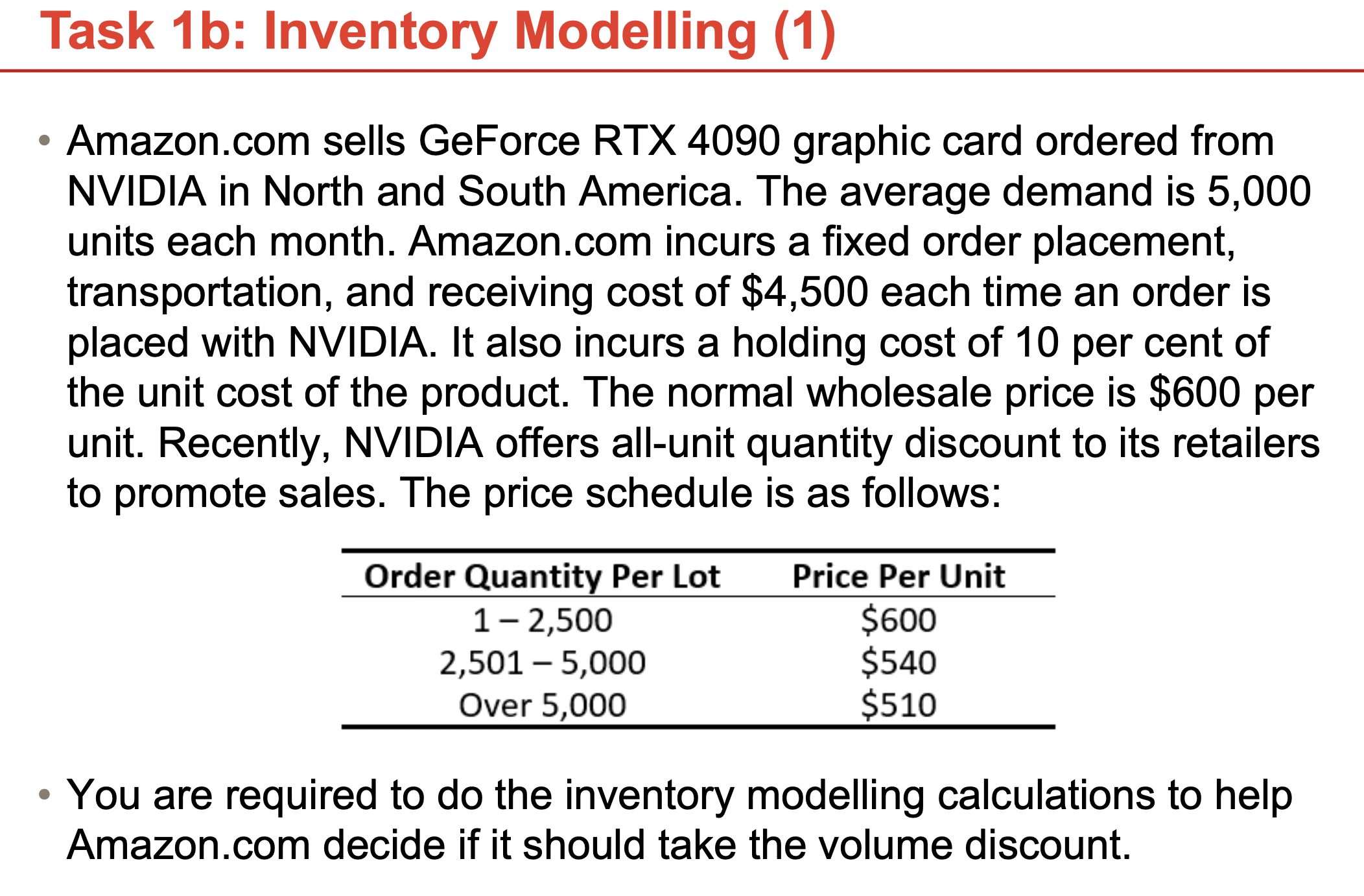

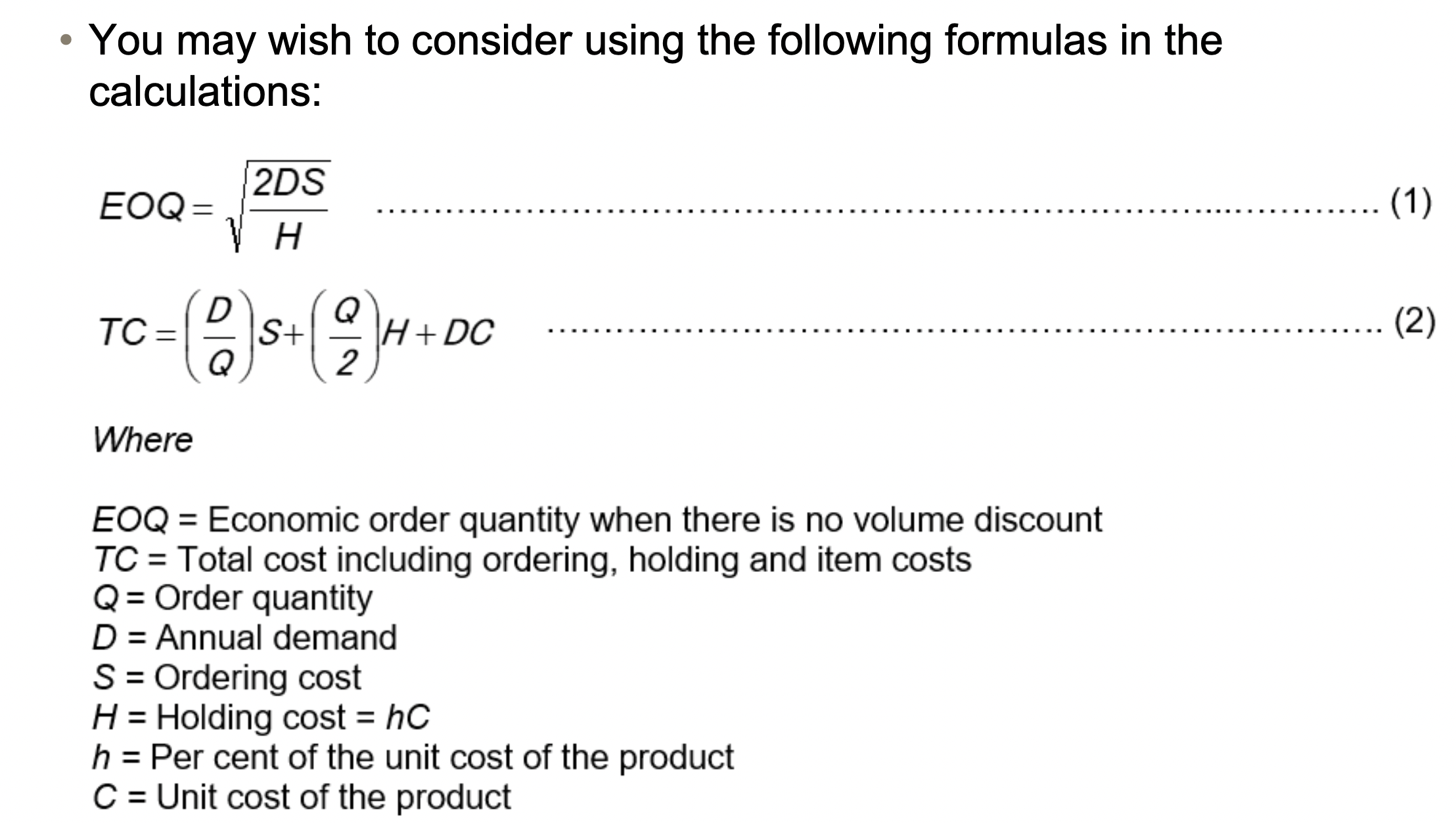

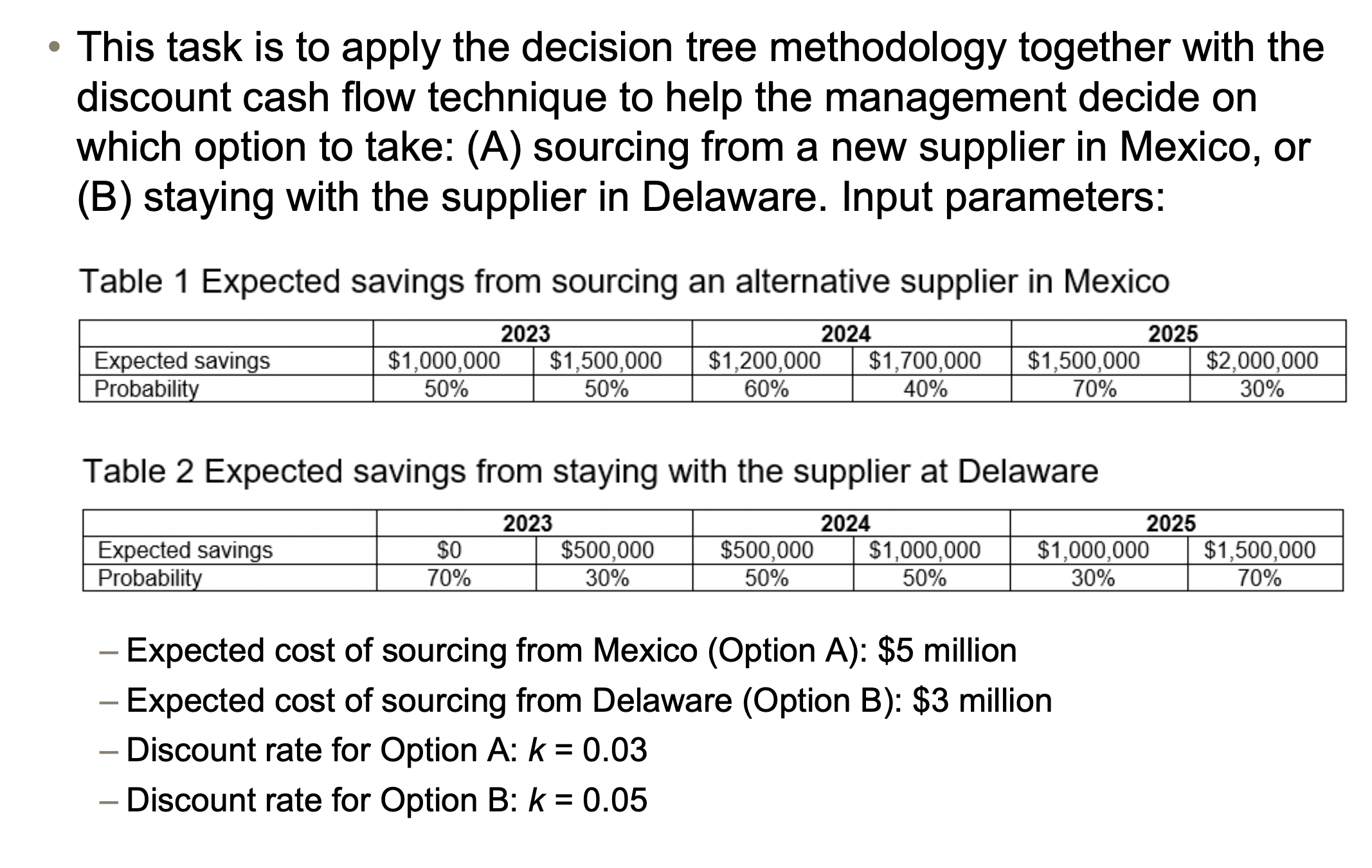

Task 1a: Demand Forecasting (1) - Demand for GeForce RTX 4090 graphic card at NVIDIA from its North and South America markets for the last 4 years are as follows - You are required to estimate the demand for 2023 (from Q1 to Q4) using a 4-quarter moving average method and the static method. You are also required to evaluate the MAD, MAPE, bias, and TS (i.e., the KPIs) in each case. Based on the outcome, you need to conclude which of the two methods is better and explain why. The following format can be used. Amazon.com sells GeForce RTX 4090 graphic card ordered from NVIDIA in North and South America. The average demand is 5,000 units each month. Amazon.com incurs a fixed order placement, transportation, and receiving cost of $4,500 each time an order is placed with NVIDIA. It also incurs a holding cost of 10 per cent of the unit cost of the product. The normal wholesale price is $600 per unit. Recently, NVIDIA offers all-unit quantity discount to its retailers to promote sales. The price schedule is as follows: - You are required to do the inventory modelling calculations to help Amazon.com decide if it should take the volume discount. - You may wish to consider using the following formulas in the calculations: EOQ=H2DSTC=(QD)S+(2Q)H+DC Where EOQ= Economic order quantity when there is no volume discount TC= Total cost including ordering, holding and item costs Q= Order quantity D= Annual demand S= Ordering cost H= Holding cost =hC h= Per cent of the unit cost of the product C= Unit cost of the product This task is to apply the decision tree methodology together with the discount cash flow technique to help the management decide on which option to take: (A) sourcing from a new supplier in Mexico, or (B) staying with the supplier in Delaware. Input parameters: Table 1 Expected savings from sourcing an alternative supplier in Mexico Table 2 Expected savings from staying with the supplier at Delaware - Expected cost of sourcing from Mexico (Option A): $5 million - Expected cost of sourcing from Delaware (Option B ): $3 million - Discount rate for Option A:k=0.03 - Discount rate for Option B:k=0.05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts