Question: Task # 2 ( 1 0 points ) a ) Using Yahoo Finance, obtain the summary trading information for Netflix, Inc. ( ticker NFLX )

Task # points

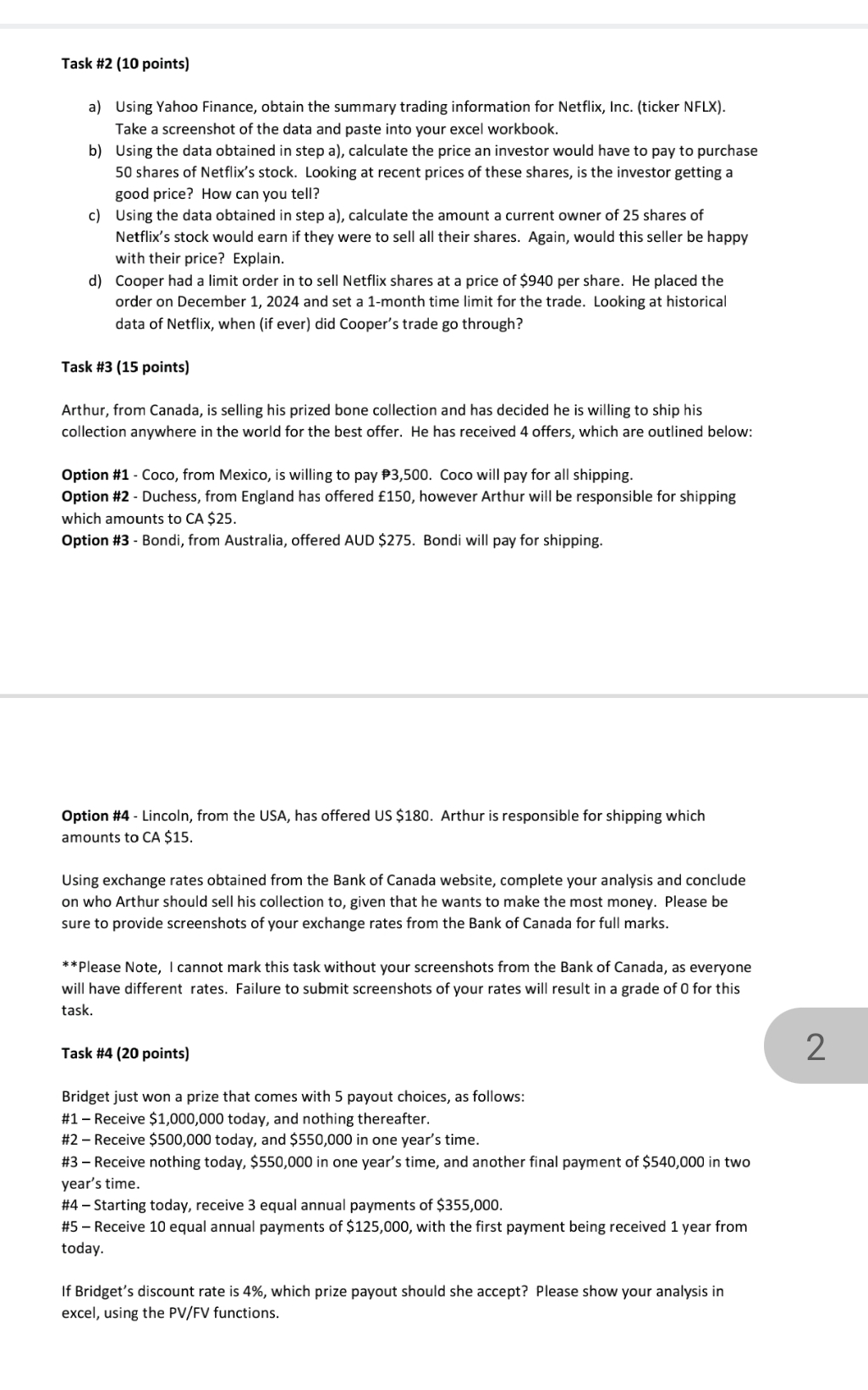

a Using Yahoo Finance, obtain the summary trading information for Netflix, Inc. ticker NFLX Take a screenshot of the data and paste into your excel workbook.

b Using the data obtained in step a calculate the price an investor would have to pay to purchase shares of Netflix's stock. Looking at recent prices of these shares, is the investor getting a good price? How can you tell?

c Using the data obtained in step a calculate the amount a current owner of shares of Netflix's stock would earn if they were to sell all their shares. Again, would this seller be happy with their price? Explain.

d Cooper had a limit order in to sell Netflix shares at a price of $ per share. He placed the order on December and set a month time limit for the trade. Looking at historical data of Netflix, when if ever did Cooper's trade go through?

Task # points

Arthur, from Canada, is selling his prized bone collection and has decided he is willing to ship his collection anywhere in the world for the best offer. He has received offers, which are outlined below:

Option # Coco, from Mexico, is willing to pay Coco will pay for all shipping.

Option # Duchess, from England has offered however Arthur will be responsible for shipping which amounts to CA $

Option # Bondi, from Australia, offered AUD $ Bondi will pay for shipping.

Option # Lincoln, from the USA, has offered US $ Arthur is responsible for shipping which amounts to CA $

Using exchange rates obtained from the Bank of Canada website, complete your analysis and conclude on who Arthur should sell his collection to given that he wants to make the most money. Please be sure to provide screenshots of your exchange rates from the Bank of Canada for full marks.

Please Note, I cannot mark this task without your screenshots from the Bank of Canada, as everyone will have different rates. Failure to submit screenshots of your rates will result in a grade of for this task.

Task # points

Bridget just won a prize that comes with payout choices, as follows:

# Receive $ today, and nothing thereafter.

# Receive $ today, and $ in one year's time.

# Receive nothing today, $ in one year's time, and another final payment of $ in two year's time.

# Starting today, receive equal annual payments of $

# Receive equal annual payments of $ with the first payment being received year from today.

If Bridget's discount rate is which prize payout should she accept? Please show your analysis in excel, using the PVFV functions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock