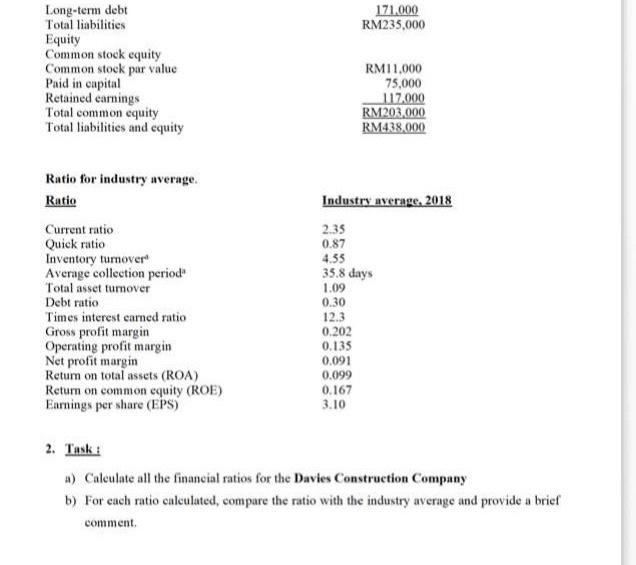

Question: Task 2 (a) and (b) 171.000 RM235,000 Long-term debt Total liabilities Equity Common stock equity Common stock par value Paid in capital Retained earnings Total

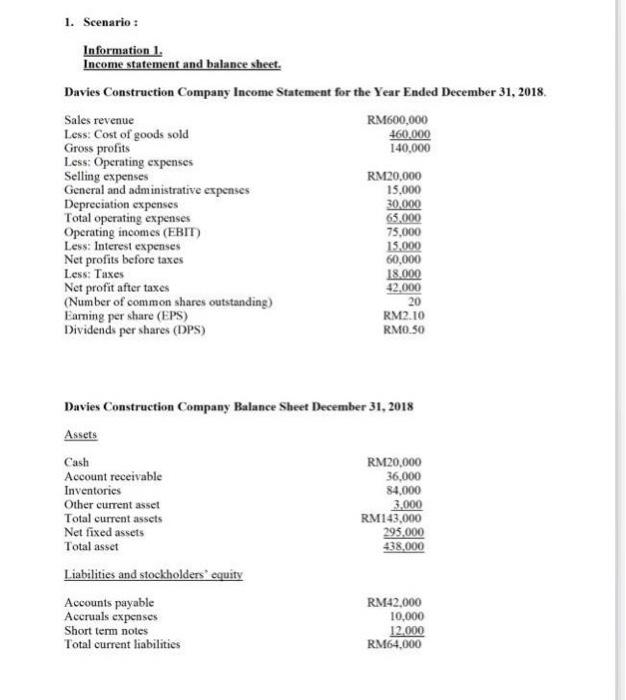

171.000 RM235,000 Long-term debt Total liabilities Equity Common stock equity Common stock par value Paid in capital Retained earnings Total common equity Total liabilities and equity RM11.000 75,000 117.000 RM203.000 RM438,000 Ratio for industry average. Ratio Current ratio Quick ratio Inventory turnover Average collection period Total asset tumover Debt ratio Times interest earned ratio Gross profit margin Operating profit margin Net profit margin Return on total assets (ROA) Return on common equity (ROE) Earnings per share (EPS) Industry average, 2018 2.35 0.87 4.35 35.8 days 1.09 0.30 12.3 0.202 0.135 0.091 0.099 0.167 3.10 2. Task : a) Calculate all the financial ratios for the Davies Construction Company b) For each ratio calculated, compare the ratio with the industry average and provide a briel comment 1. Scenario : Information 1. Income statement and balance sheet. Davies Construction Company Income Statement for the Year Ended December 31, 2018 Sales revenue RM600,000 Less. Cost of goods sold 460,000 Gross profits 140,000 Less: Operating expenses Selling expenses RM20,000 General and administrative expenses 15.000 Depreciation expenses 30.000 Total operating expenses 65,000 Operating incomes (EBIT) 75,000 Less: Interest expenses 15.000 Net profits before taxes 60,000 Less: Taxes 18.000 Net profit after taxes 42.000 (Number of common shares outstanding) 20 Earning per share (EPS) RM2.10 Dividends per shares (DPS) RM0.30 Davies Construction Company Balance Sheet December 31, 2018 Assets Cash RM20,000 Account receivable 36,000 Inventories 84,000 Other current asset 3,000 Total current assets RM143,000 Net fixed assets 295,000 Total asset 438,000 Liabilities and stockholders' equity Accounts payable RM42.000 Accruals expenses 10,000 Short term notes 12.000 Total current liabilities RM64,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts