Question: Task 2 A company operates a commercial paper programme to finance its short-term US dollar- denominated borrowing requirements. On 26 January 2018, the company sold

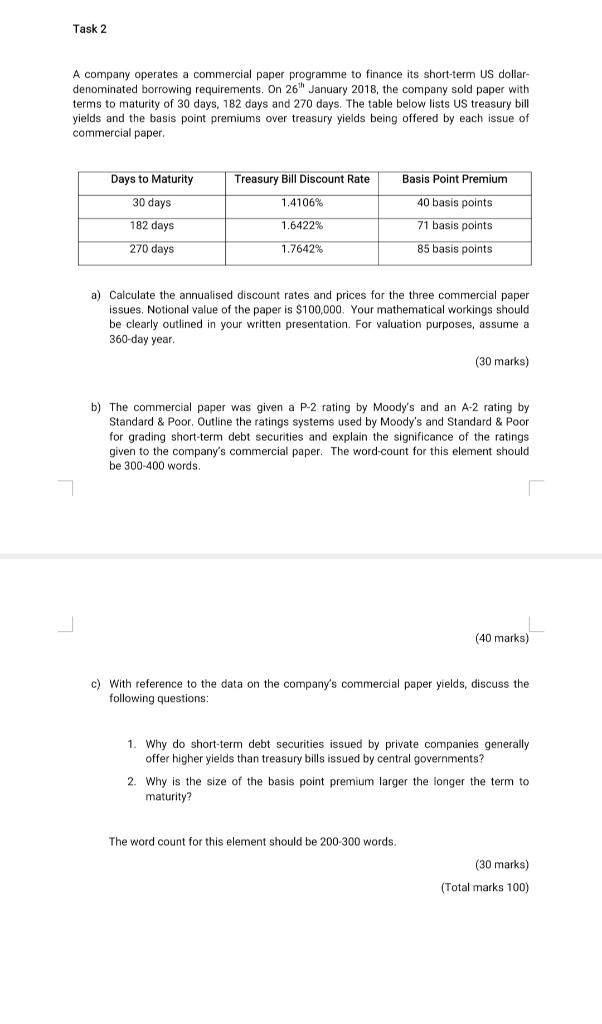

Task 2 A company operates a commercial paper programme to finance its short-term US dollar- denominated borrowing requirements. On 26 January 2018, the company sold paper with terms to maturity of 30 days, 182 days and 270 days. The table below lists US treasury bill yields and the basis point premiums over treasury yields being offered by each issue of commercial paper, Days to Maturity Treasury Bill Discount Rate Basis Point Premium 1.4106% 30 days 182 days 270 days 1.6422% 40 basis points 71 basis points 85 basis points 1.7642% a) Calculate the annualised discount rates and prices for the three commercial paper issues. Notional value of the paper is $100,000. Your mathematical workings should be clearly outlined in your written presentation. For valuation purposes, assume a 360-day year. (30 marks) b) The commercial paper was given a P-2 rating by Moody's and an A-2 rating by Standard Poor, Outline the ratings systems used by Moody's and Standard & Poor for grading short-term debt securities and explain the significance of the ratings given to the company's commercial paper. The word-count for this element should be 300-400 words. (40 marks) c) With reference to the data on the company's commercial paper yields, discuss the following questions: 1. Why do short-term debt securities issued by private companies generally offer higher yields than treasury bills issued by central governments? 2. Why is the size of the basis point premium larger the longer the term to maturity? The word count for this element should be 200-300 words (30 marks) (Total marks 100) Task 2 A company operates a commercial paper programme to finance its short-term US dollar- denominated borrowing requirements. On 26 January 2018, the company sold paper with terms to maturity of 30 days, 182 days and 270 days. The table below lists US treasury bill yields and the basis point premiums over treasury yields being offered by each issue of commercial paper, Days to Maturity Treasury Bill Discount Rate Basis Point Premium 1.4106% 30 days 182 days 270 days 1.6422% 40 basis points 71 basis points 85 basis points 1.7642% a) Calculate the annualised discount rates and prices for the three commercial paper issues. Notional value of the paper is $100,000. Your mathematical workings should be clearly outlined in your written presentation. For valuation purposes, assume a 360-day year. (30 marks) b) The commercial paper was given a P-2 rating by Moody's and an A-2 rating by Standard Poor, Outline the ratings systems used by Moody's and Standard & Poor for grading short-term debt securities and explain the significance of the ratings given to the company's commercial paper. The word-count for this element should be 300-400 words. (40 marks) c) With reference to the data on the company's commercial paper yields, discuss the following questions: 1. Why do short-term debt securities issued by private companies generally offer higher yields than treasury bills issued by central governments? 2. Why is the size of the basis point premium larger the longer the term to maturity? The word count for this element should be 200-300 words (30 marks) (Total marks 100)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts