Question: Task 2: A firm plans to borrow 50,000 for five years. The local bank will lend the money at a rate of 9% and requires

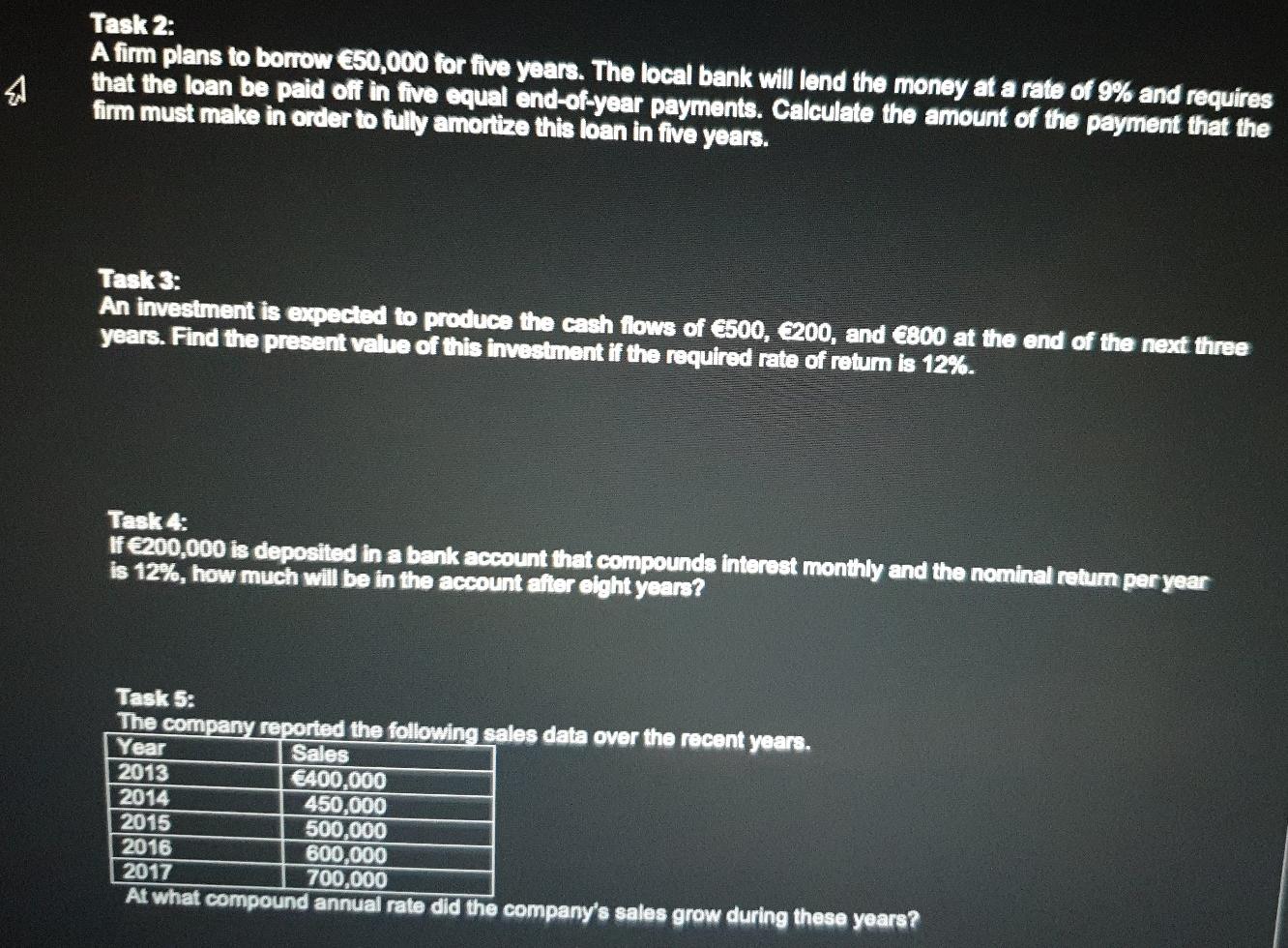

Task 2: A firm plans to borrow 50,000 for five years. The local bank will lend the money at a rate of 9% and requires that the loan be paid off in five equal end-of-year payments. Calculate the amount of the payment that the firm must make in order to fully amortize this loan in five years. 4 Task 3: An investment is expected to produce the cash flows of 500, 200, and 800 at the end of the next three years. Find the present value of this investment if the required rate of return is 12%. Task 4: If200,000 is deposited in a bank account that compounds interest monthly and the nominal retum per year is 12%, how much will be in the account after eight years? Task 5: The company reported the following sales data over the recent years. Year Sales 2013 400,000 2014 450,000 2015 500,000 2016 600,000 2017 700,000 At what compound annual rate did the company's sales grow during these years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts