Question: Task 2: Additional Exercise on material from Dixit and Pindyck (1994) Assume that a firm's investment project once completed, will produce a fixed flow of

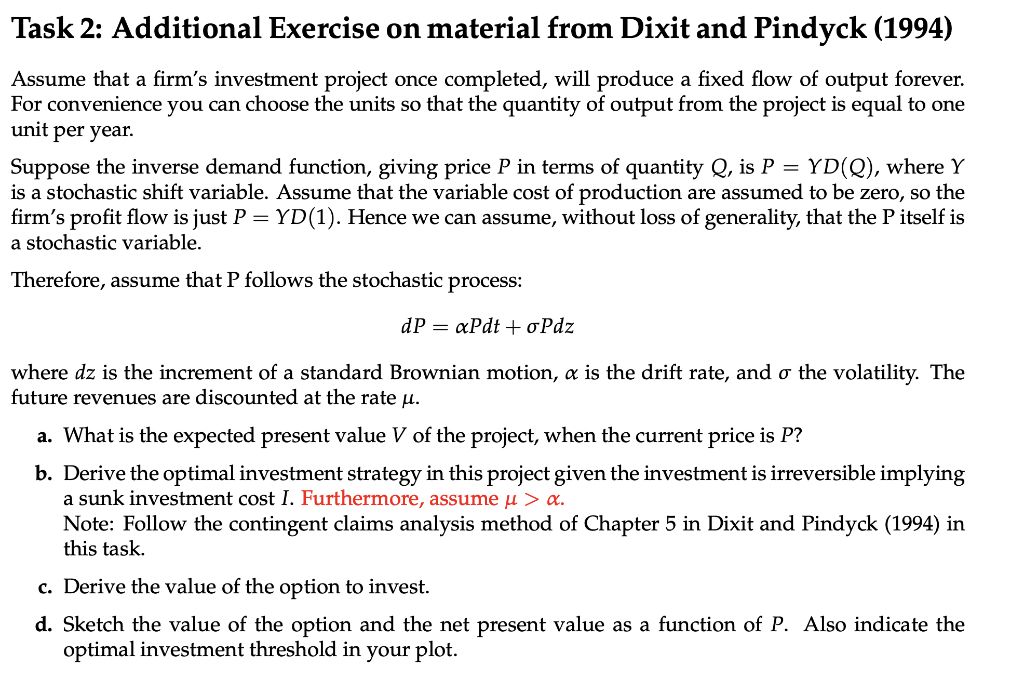

Task 2: Additional Exercise on material from Dixit and Pindyck (1994) Assume that a firm's investment project once completed, will produce a fixed flow of output forever. For convenience you can choose the units so that the quantity of output from the project is equal to one unit per year. Suppose the inverse demand function, giving price P in terms of quantity Q, is P = YD(Q), where Y is a stochastic shift variable. Assume that the variable cost of production are assumed to be zero, so the firm's profit flow is just P = YD(1). Hence we can assume, without loss of generality, that the P itself is a stochastic variable. Therefore, assume that P follows the stochastic process: dP = aPdt + opdz where dz is the increment of a standard Brownian motion, a is the drift rate, and o the volatility. The future revenues are discounted at the rate . a. What is the expected present value V of the project, when the current price is P? b. Derive the optimal investment strategy in this project given the investment is irreversible implying a sunk investment cost I. Furthermore, assume > . Note: Follow the contingent claims analysis method of Chapter 5 in Dixit and Pindyck (1994) in this task. c. Derive the value of the option to invest. d. Sketch the value of the option and the net present value as a function of P. Also indicate the optimal investment threshold in your plot. Task 2: Additional Exercise on material from Dixit and Pindyck (1994) Assume that a firm's investment project once completed, will produce a fixed flow of output forever. For convenience you can choose the units so that the quantity of output from the project is equal to one unit per year. Suppose the inverse demand function, giving price P in terms of quantity Q, is P = YD(Q), where Y is a stochastic shift variable. Assume that the variable cost of production are assumed to be zero, so the firm's profit flow is just P = YD(1). Hence we can assume, without loss of generality, that the P itself is a stochastic variable. Therefore, assume that P follows the stochastic process: dP = aPdt + opdz where dz is the increment of a standard Brownian motion, a is the drift rate, and o the volatility. The future revenues are discounted at the rate . a. What is the expected present value V of the project, when the current price is P? b. Derive the optimal investment strategy in this project given the investment is irreversible implying a sunk investment cost I. Furthermore, assume > . Note: Follow the contingent claims analysis method of Chapter 5 in Dixit and Pindyck (1994) in this task. c. Derive the value of the option to invest. d. Sketch the value of the option and the net present value as a function of P. Also indicate the optimal investment threshold in your plot

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts