Question: Task 2 Background You are working with Complete Business Services on the year-end adjustments for one of your clients, Curate Canvas Ltd. You are required

Task 2

Background

You are working with Complete Business Services on the year-end adjustments for one of your clients, Curate Canvas Ltd. You are required to comply with the following information given by the client to finalize the year-end adjustment entries:

Please follow the extract of the accounting Policies and Procedures of Curate Canvas Ltd. based on accrual accounting as below:

All the prepaid expenses need to be adjusted on the last day of the period to match the revenue for the same period.

The unused portion of the prepaid expenses need to be carried forward as current assets for the following period

Any expenses due but not paid should be recognized as an expense to match the revenue of the respective period.

Any revenue which is accrued in the period should be recognized as income for that period.

Any revenue which is received as advance should be considered as a current liability.

Any shortfalls of stocks / Obsolete stocks need to be written off at the end of the period - expense account " COGS" need to be charged for the profit/loss appropriation.

The amount of bad debts calculated every year, after following up the collection procedures, need to be written off on the balance day of the respective financial year.

The company needs to make a provision for doubtful debts at the rate of 2% of the accounts payable balances each year on the balance day.

Complete the following adjustments using the above Policies and Procedures information.

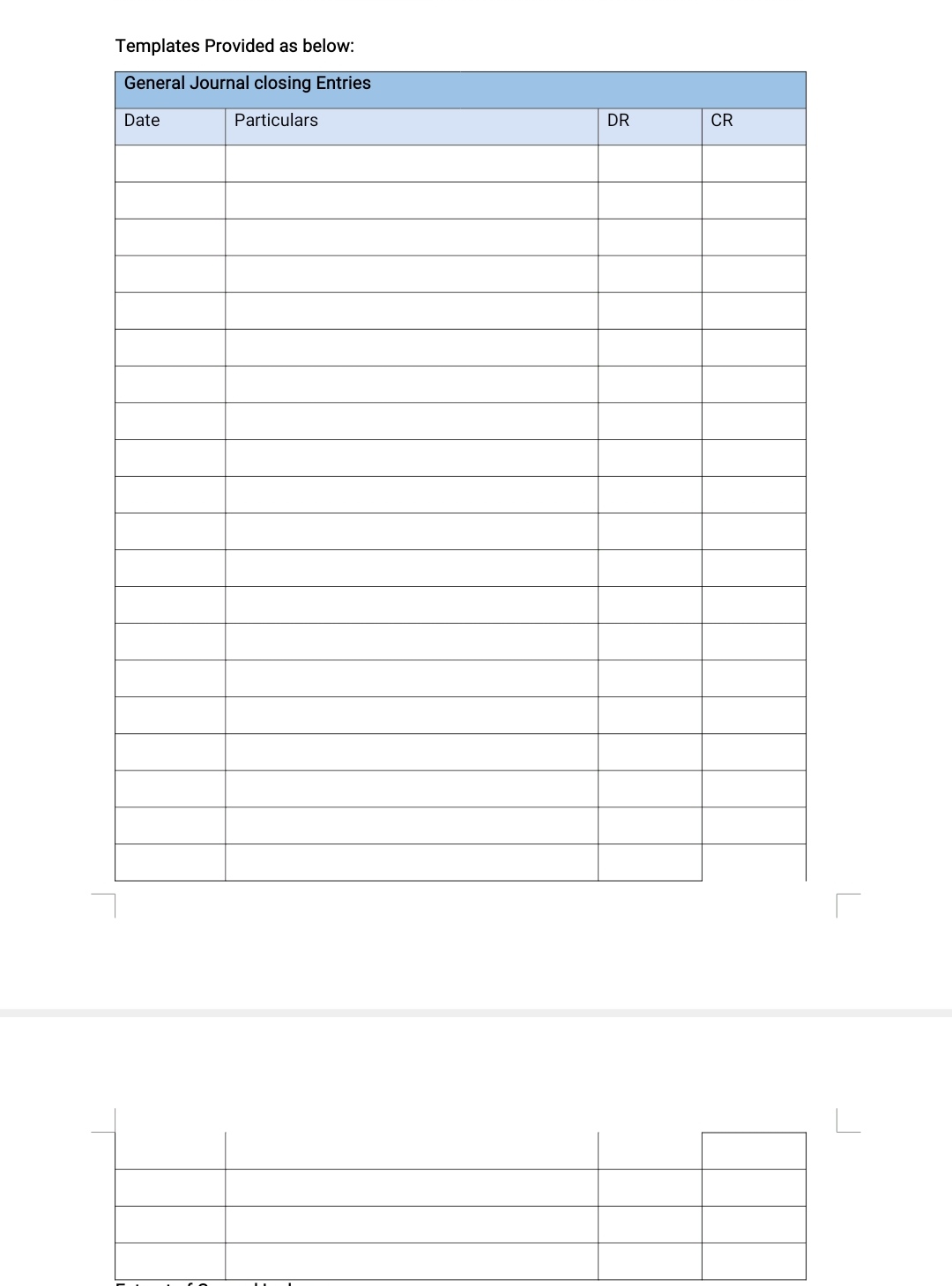

A General Journal template is provided for you to finish the journal entries for the below year-

end adjustments:

a) Wages due but not paid $400

b) Prepaid insurance $220

c) Interest earned but not yet received $600

d) Rent received in advance $400

e) Long service leave provision to be made $1100

f) Long service leave payment made for $700

g) The amount of bad debts to be written off from the current year accounts receivables in amounting to $880

h) Accounts receivables balance on 30 June 2020 is $55000. There is no existing balance in the allowance for doubtful debts.

i) Obsolete stock during stocktake amounting to $550 needs to be written off. State which of the above Policies and Procedures for Curate Canvas Ltd guided you to post the general journal transaction for this adjustment? Why?

j) Credit sales occurring during the current period amounting to $440 (inclusive GST) were not recorded. The cost of sales was $250.

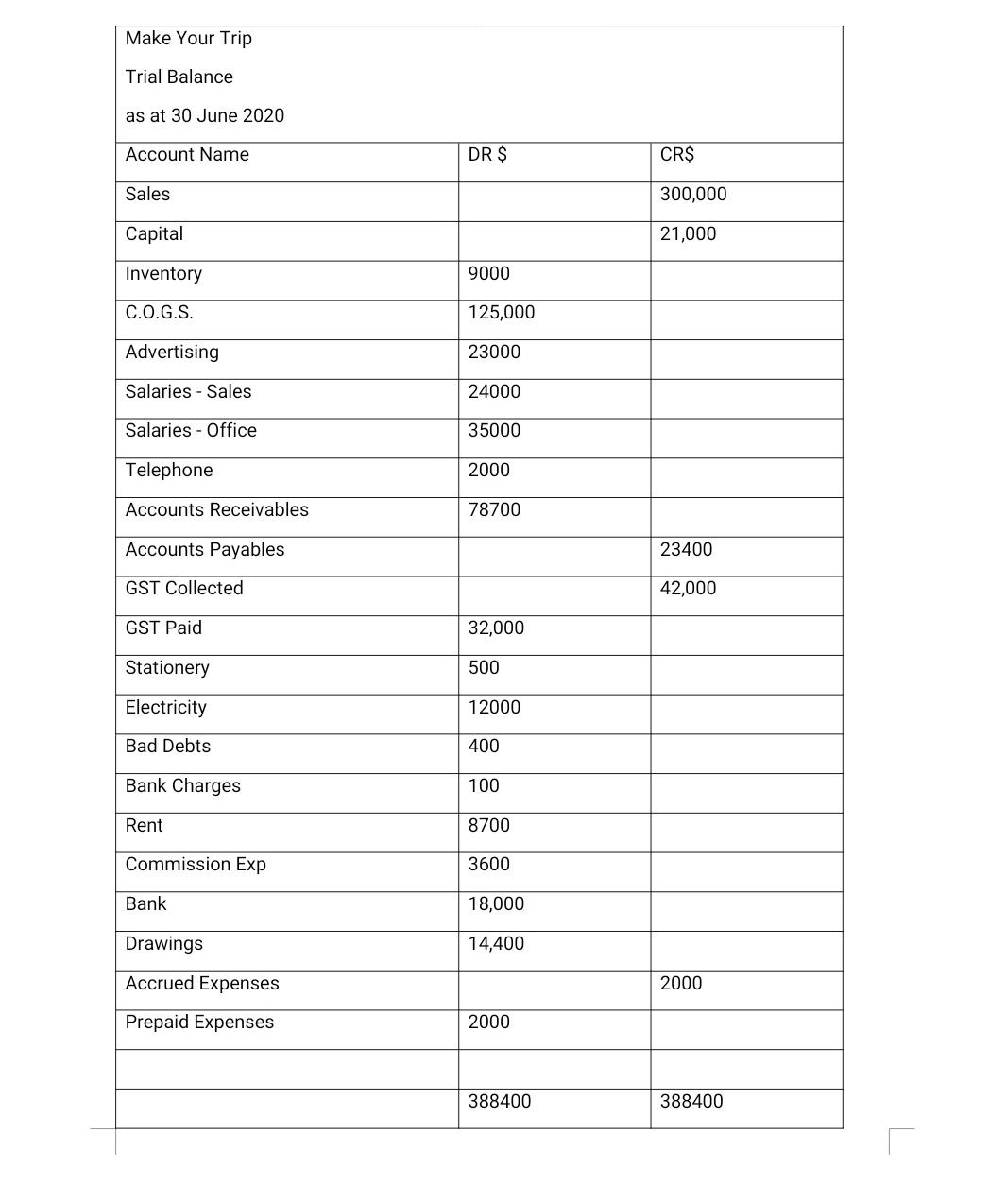

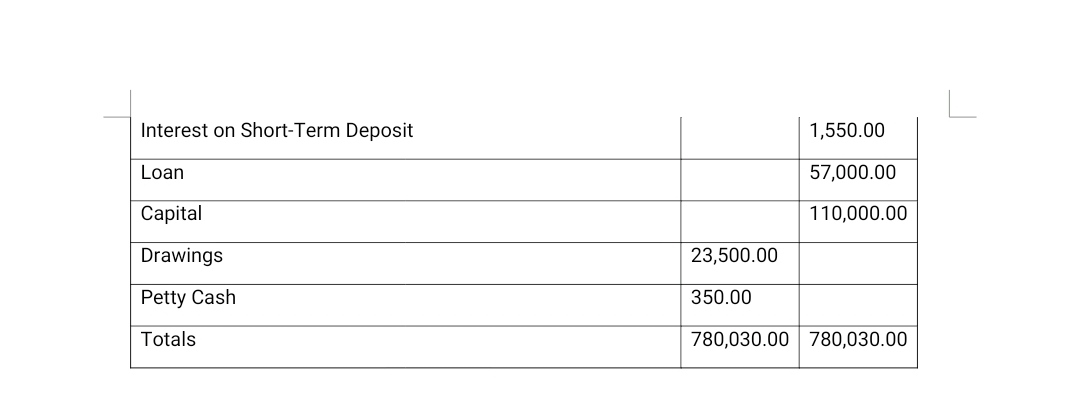

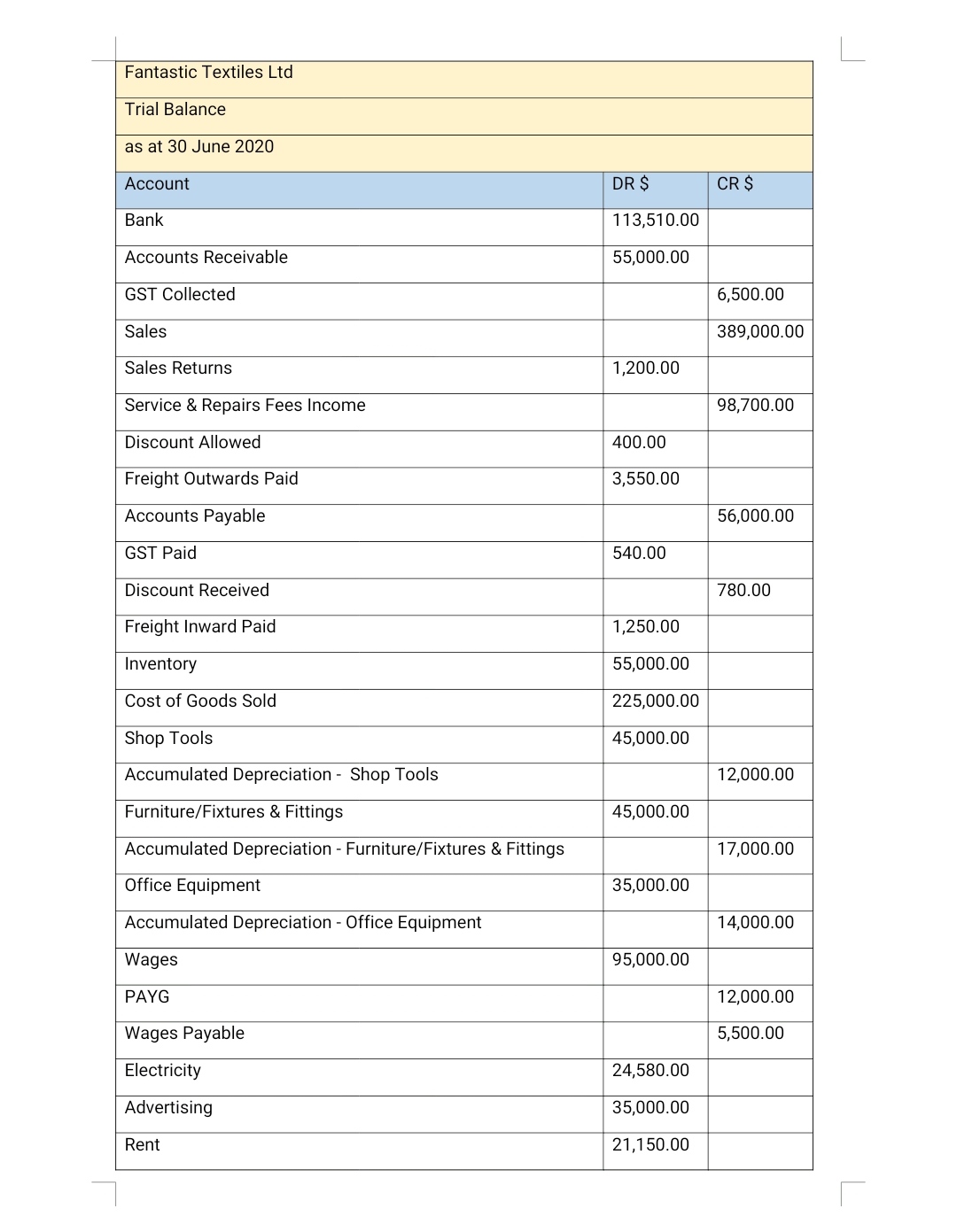

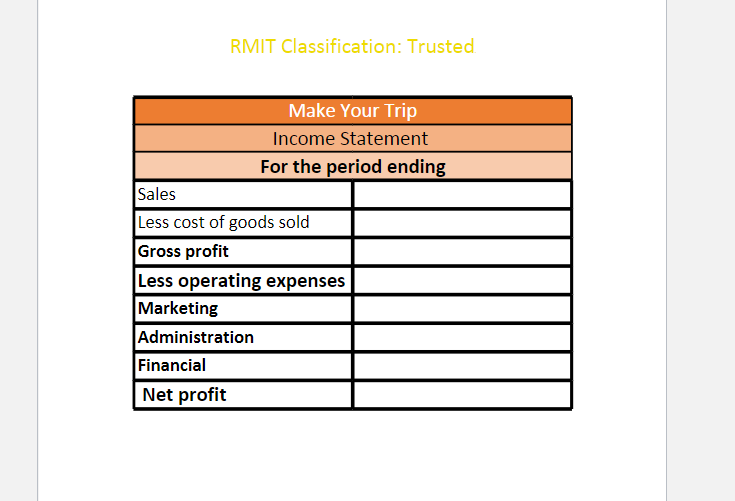

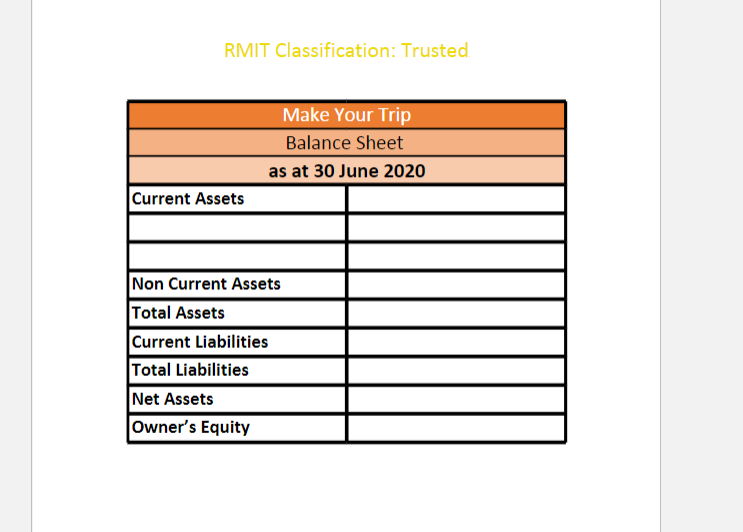

\fMake Your Trip Trial Balance as at 30 June 2020 Account Name DR $ CRS Sales 300,000 Capital 21,000 Inventory 9000 C.O.G.S. 125,000 Advertising 23000 Salaries - Sales 24000 Salaries - Office 35000 Telephone 2000 Accounts Receivables 78700 Accounts Payables 23400 GST Collected 42,000 GST Paid 32,000 Stationery 500 Electricity 12000 Bad Debts 400 Bank Charges 100 Rent 8700 Commission Exp 3600 Bank 18,000 Drawings 14,400 Accrued Expenses 2000 Prepaid Expenses 2000 388400 388400Capital Date Particulars DR CR BALANCEExtract of General Ledgers: Trading Account Date Particulars DR CR BALANCE Profit & Loss Account Date Particulars DR CR BALANCETemplates Provided as below: General Journal closing Entries Date Particulars DR CR\fFantastic Textiles Ltd Trial Balance as at 30 June 2020 Account DR $ CR $ Bank 113,510.00 Accounts Receivable 55,000.00 GST Collected 6,500.00 Sales 389,000.00 Sales Returns 1,200.00 Service & Repairs Fees Income 98,700.00 Discount Allowed 400.00 Freight Outwards Paid 3,550.00 Accounts Payable 56,000.00 GST Paid 540.00 Discount Received 780.00 Freight Inward Paid 1,250.00 Inventory 55,000.00 Cost of Go 225,000.00 Shop Tools 45,000.00 Accumulated Depreciation - Shop Tools 12,000.00 Furniture/Fixtures & Fittings 45,000.00 Accumulated Depreciation - Furniture/Fixtures & Fittings 17,000.00 Office Equipment 35,000.00 Accumulated Depreciation - Office Equipment 14,000.00 Wages 95,000.00 PAYG 12,000.00 Wages Payable 5,500.00 Electricity 24,580.00 Advertising 35,000.00 Rent 21,150.00Make Your Trip For the period ending Sales Less cost of goods sold Less operating expenses RMIT Classification: Trusted Make Your Trip Balance Sheet as at 30 June 2020 Current Assets Non Current Assets Total Assets Current Liabilities Total Liabilities Net Assets Owner's Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts