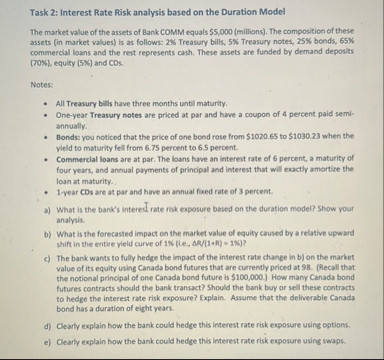

Question: Task 2 : Interest Rate Risk analysis based on the Duration Model The market value of the assets of Bank COMM equals $ 5 ,

Task : Interest Rate Risk analysis based on the Duration Model

The market value of the assets of Bank COMM equals $millions The composition of these assets in market values is as follows: Treasury bills, Treasury notes, bonds, commercial loans and the rest represents cash. These assets are funded by demand deposits equity and CDs

Notes:

All Treasury bills have three months until maturity.

Oneyear Treasury notes are priced at par and have a coupon of percent paid semiannually.

Bonds: you noticed that the price of one bond rose from $ to $ when the yield to maturity fell from percent to percent.

Commercial loans are at par. The loans have an interest rate of percent, a maturity of four years, and annual payments of principal and interest that will exactly amortise the loan at maturity.

year CDs are at par and have an annual foxed rate of percent.

a What is the bank's intered rate risk exposure based on the duration model? Show your analysis.

b What is the forecasted impact on the market value of equity caused by a relative upward shift in the entire vield curve of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock