Question: Task 2 of 2 Decision Making Exercise (3.1, 3.2, 3.3, 3.4, 4.1 &4.2) Instructions Scenario Mr. Neil Down owner of Woody Train, a toy

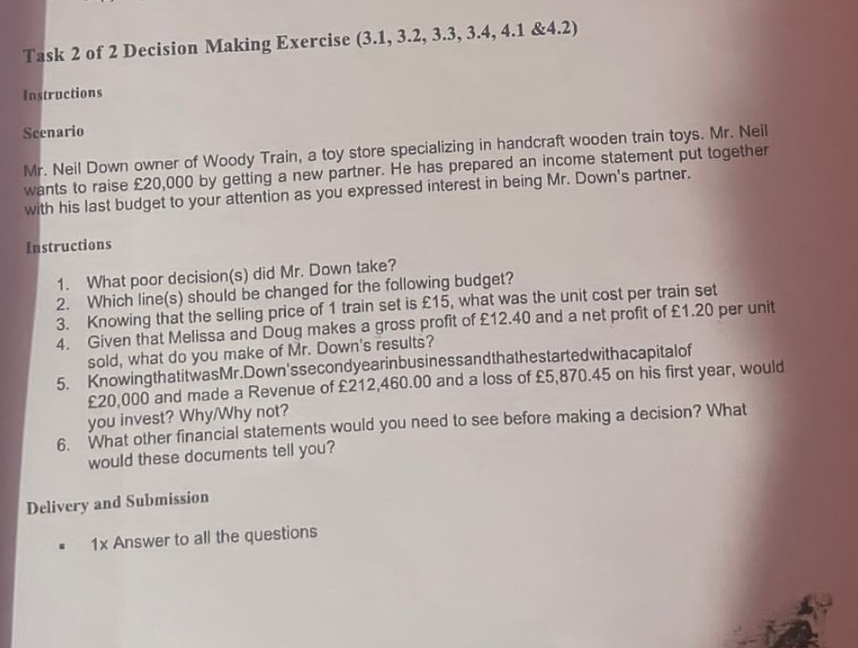

Task 2 of 2 Decision Making Exercise (3.1, 3.2, 3.3, 3.4, 4.1 &4.2) Instructions Scenario Mr. Neil Down owner of Woody Train, a toy store specializing in handcraft wooden train toys. Mr. Neil wants to raise 20,000 by getting a new partner. He has prepared an income statement put together with his last budget to your attention as you expressed interest in being Mr. Down's partner. Instructions 1. What poor decision(s) did Mr. Down take? 2. Which line(s) should be changed for the following budget? 3. 4. 5. Knowing that the selling price of 1 train set is 15, what was the unit cost per train set Given that Melissa and Doug makes a gross profit of 12.40 and a net profit of 1.20 per unit sold, what do you make of Mr. Down's results? KnowingthatitwasMr.Down'ssecondyearinbusinessandthathestarted withacapitalof 20,000 and made a Revenue of 212,460.00 and a loss of 5,870.45 on his first year, would you invest? Why/Why not? 6. What other financial statements would you need to see before making a decision? What would these documents tell you? Delivery and Submission . 1x Answer to all the questions

Step by Step Solution

There are 3 Steps involved in it

Mr Downs poor decision was likely not adequately forecasting expenses and revenue leading to inaccur... View full answer

Get step-by-step solutions from verified subject matter experts