Question: Task 2 Using the excel file you have already been working on, enter the transactions below into the General Journal and then update the Ledger

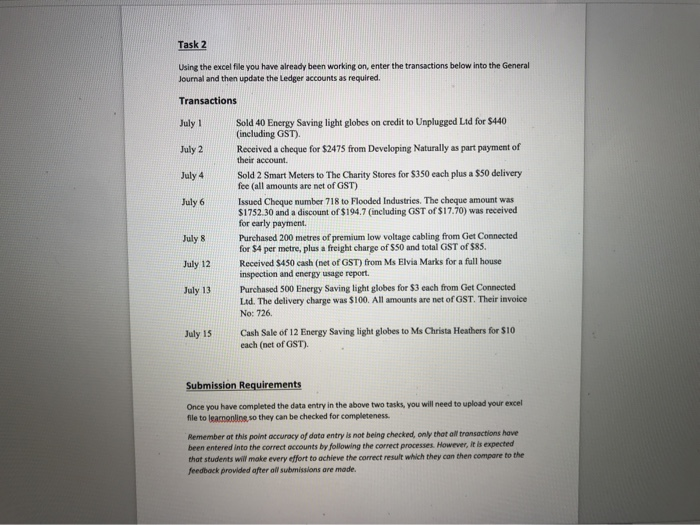

Task 2 Using the excel file you have already been working on, enter the transactions below into the General Journal and then update the Ledger accounts as required. Transactions July 1 Sold 40 Energy Saving light globes on credit to Unplugged Ltd for $440 (including GST). July 2 Received a cheque for $2475 from Developing Naturally as part payment of their account July 4 Sold 2 Smart Meters to The Charity Stores for $350 each plus a $50 delivery fee (all amounts are net of GST) July 6 Issued Cheque number 718 to Flooded Industries. The cheque amount was $1752.30 and a discount of $194.7 (including GST of $17.70) was received for early payment Purchased 200 metres of premium low voltage cabling from Get Connected for $4 per metre, plus a freight charge of $50 and total GST of $85. July 12 Received $450 cash (net of GST) from Ms Elvia Marks for a full house inspection and energy usage report. July 13 Purchased 500 Energy Saving light globes for $3 each from Get Connected Ltd. The delivery charge was $100. All amounts are not of GST. Their invoice No: 726 July 15 Cash Sale of 12 Energy Saving light globes to Ms Christa Heathers for $10 each (net of GST). July 8 Submission Requirements Once you have completed the data entry in the above two tasks, you will need to upload your excel file to leamonline so they can be checked for completeness. Remember of this point accuracy of data entry is not being checked, only that all transactions have been entered into the correct accounts by following the correct processes. However, it is expected that students will make every effort to achieve the correct result which they can then compare to the feedback provided after all submissions are made

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts