Question: Task 21: A plain vanilla bond has a par value of 10,000 and a coupon rate of 0.5%. The bond has a maturity of 5

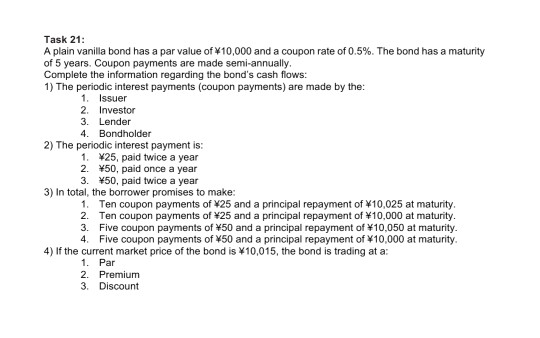

Task 21: A plain vanilla bond has a par value of 10,000 and a coupon rate of 0.5%. The bond has a maturity of 5 years. Coupon payments are made semi-annually. Complete the information regarding the bond's cash flows: 1) The periodic interest payments (coupon payments) are made by the: 1. Issuer 2. Investor 3. Lender 4. Bondholder 2) The periodic interest payment is: 1. 25, paid twice a year 2.450, paid once a year 3. 50, paid twice a year 3) In total, the borrower promises to make: 1. Ten coupon payments of 25 and a principal repayment of 10,025 at maturity. 2. Ten coupon payments of 25 and a principal repayment of $10,000 at maturity. 3. Five coupon payments of 50 and a principal repayment of 10,050 at maturity. 4. Five coupon payments of 50 and a principal repayment of $10,000 at maturity. 4) If the current market price of the bond is $10,015, the bond is trading at a: 1. Par 2. Premium 3. Discount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts