Question: Task 23 Develop complex broking options You are required to prepare a full report addressed to Ray and Steve outlining available loan options; the process

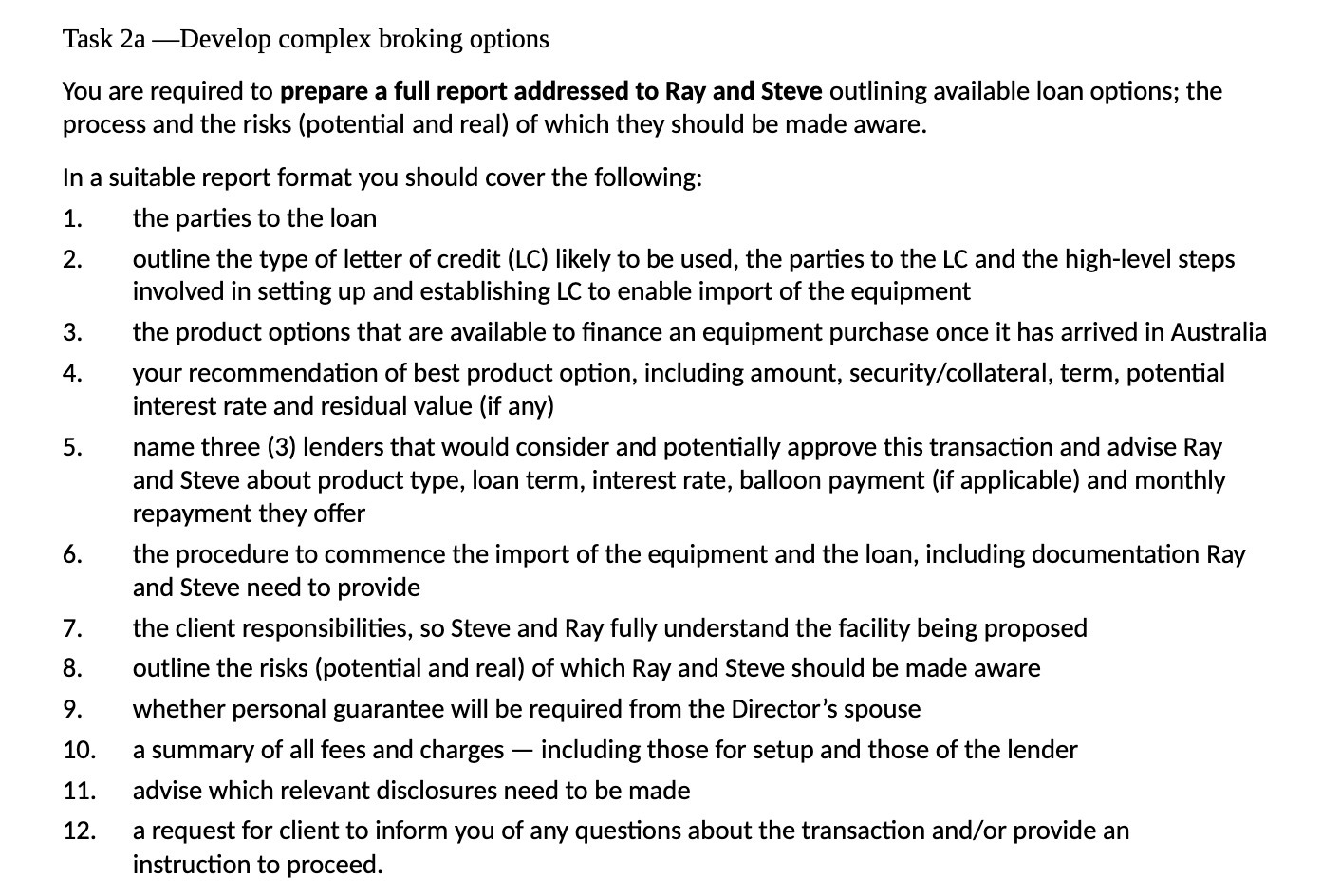

Task 23 Develop complex broking options You are required to prepare a full report addressed to Ray and Steve outlining available loan options; the process and the risks (potential and real) of which they should be made aware. In a suitable report format you should cover the following: 1. the parties to the loan 2. outline the type of letter of credit (LC) likely to be used, the parties to the LC and the high-level steps involved in setting up and establishing LC to enable import of the equipment 3. the product options that are available to nance an equipment purchase once it has arrived in Australia 4. your recommendation of best product option, including amount, security/collateral, term, potential interest rate and residual value (if any) 5. name three (3) lenders that would consider and potentially approve this transaction and advise Ray and Steve about product type, loan term, interest rate, balloon payment (if applicable) and monthly repayment they offer 6. the procedure to commence the import of the equipment and the loan, including documentation Ray and Steve need to provide 7. the client responsibilities, so Steve and Ray fully understand the facility being proposed 8. outline the risks (potential and real) of which Ray and Steve should be made aware whether personal guarantee will be required from the Director's spouse 10. a summary of all fees and charges including those for setup and those of the lender 11. advise which relevant disclosures need to be made 12. a request for client to inform you of any questions about the transaction and/or provide an instruction to proceed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts