Question: Task 3 : Capital budgeting decisions: NPV analysis ( 2 0 Points ) You are considering a new product launch. The project will cost $

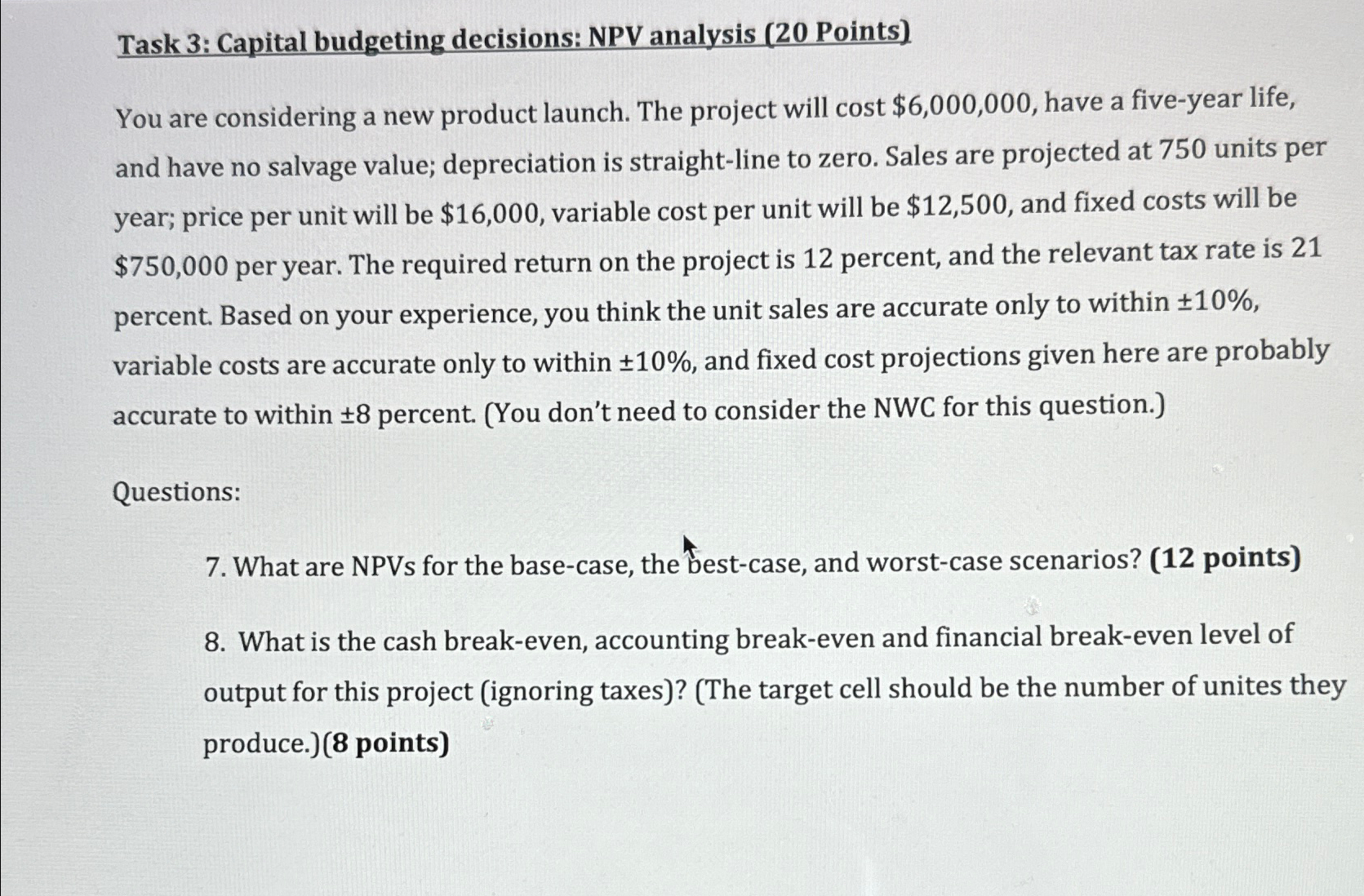

Task : Capital budgeting decisions: NPV analysis Points

You are considering a new product launch. The project will cost $ have a fiveyear life, and have no salvage value; depreciation is straightline to zero. Sales are projected at units per year; price per unit will be $ variable cost per unit will be $ and fixed costs will be $ per year. The required return on the project is percent, and the relevant tax rate is percent. Based on your experience, you think the unit sales are accurate only to within variable costs are accurate only to within and fixed cost projections given here are probably accurate to within percent. You don't need to consider the NWC for this question.

Questions:

What are NPVs for the basecase, the bestcase, and worstcase scenarios? points

What is the cash breakeven, accounting breakeven and financial breakeven level of output for this project ignoring taxesThe target cell should be the number of unites they produce.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock