Question: Task 3: Multiple choice ( 20 points; 5 points per question) The multiple-choice question sets comprise multiple answer alternatives each. To approve an altemative, mark

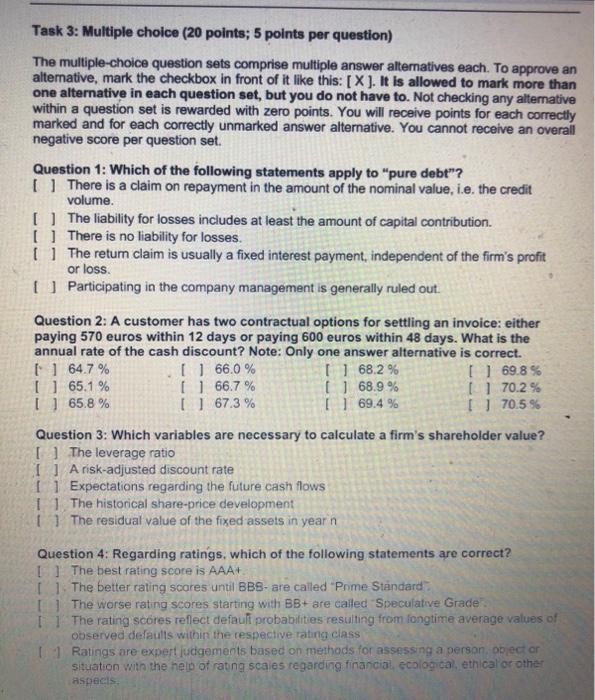

Task 3: Multiple choice ( 20 points; 5 points per question) The multiple-choice question sets comprise multiple answer alternatives each. To approve an altemative, mark the checkbox in front of it like this: [X]. It is allowed to mark more than one alternative in each question set, but you do not have to. Not checking any altemative within a question set is rewarded with zero points. You will receive points for each correctly marked and for each correctly unmarked answer alternative. You cannot receive an overall negative score per question set. Question 1: Which of the following statements apply to "pure debt"? [ ] There is a claim on repayment in the amount of the nominal value, i.e. the credit volume. [ ] The liability for losses includes at least the amount of capital contribution. [] There is no liability for losses. [ ] The retum claim is usually a fixed interest payment, independent of the firm's profit or loss. [ ] Participating in the company management is generally ruled out. Question 2: A customer has two contractual options for settling an invoice: either paying 570 euros within 12 days or paying 600 euros within 48 days. What is the annual rate of the cash discount? Note: Only one answer alternative is correct. Question 3: Which variables are necessary to calculate a firm's shareholder value? [ ] The leverage ratio I ] A risk-adjusted discount rate i ] Expectations regarding the future cash flows 1) The historical share-price development I ] The residual value of the fixed assets in year n Question 4: Regarding ratings, which of the following statements are correct? [ ] The best rating score is AAAt [ 1. The better rating scares until BBS- are called 'Pnme Stndard: [ ] The worse rating scores starting with BB+ are called Speculative Grade: [ ] The rating scores reflect defaulf probabilites resulting from fongtime average values of observed defaulis within the respective rating class I I Ratings are expert fucgements based on methods for assessing a person, object or situation with the help of rating sca les regarding financiah ecological, eth cal or other aspecis, Task 3: Multiple choice ( 20 points; 5 points per question) The multiple-choice question sets comprise multiple answer alternatives each. To approve an altemative, mark the checkbox in front of it like this: [X]. It is allowed to mark more than one alternative in each question set, but you do not have to. Not checking any altemative within a question set is rewarded with zero points. You will receive points for each correctly marked and for each correctly unmarked answer alternative. You cannot receive an overall negative score per question set. Question 1: Which of the following statements apply to "pure debt"? [ ] There is a claim on repayment in the amount of the nominal value, i.e. the credit volume. [ ] The liability for losses includes at least the amount of capital contribution. [] There is no liability for losses. [ ] The retum claim is usually a fixed interest payment, independent of the firm's profit or loss. [ ] Participating in the company management is generally ruled out. Question 2: A customer has two contractual options for settling an invoice: either paying 570 euros within 12 days or paying 600 euros within 48 days. What is the annual rate of the cash discount? Note: Only one answer alternative is correct. Question 3: Which variables are necessary to calculate a firm's shareholder value? [ ] The leverage ratio I ] A risk-adjusted discount rate i ] Expectations regarding the future cash flows 1) The historical share-price development I ] The residual value of the fixed assets in year n Question 4: Regarding ratings, which of the following statements are correct? [ ] The best rating score is AAAt [ 1. The better rating scares until BBS- are called 'Pnme Stndard: [ ] The worse rating scores starting with BB+ are called Speculative Grade: [ ] The rating scores reflect defaulf probabilites resulting from fongtime average values of observed defaulis within the respective rating class I I Ratings are expert fucgements based on methods for assessing a person, object or situation with the help of rating sca les regarding financiah ecological, eth cal or other aspecis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts