Question: Task 4: Email your supervisorPrepare an email to the Head of Bookkeeping & BAS Services as requested. The email must include the following:? The total

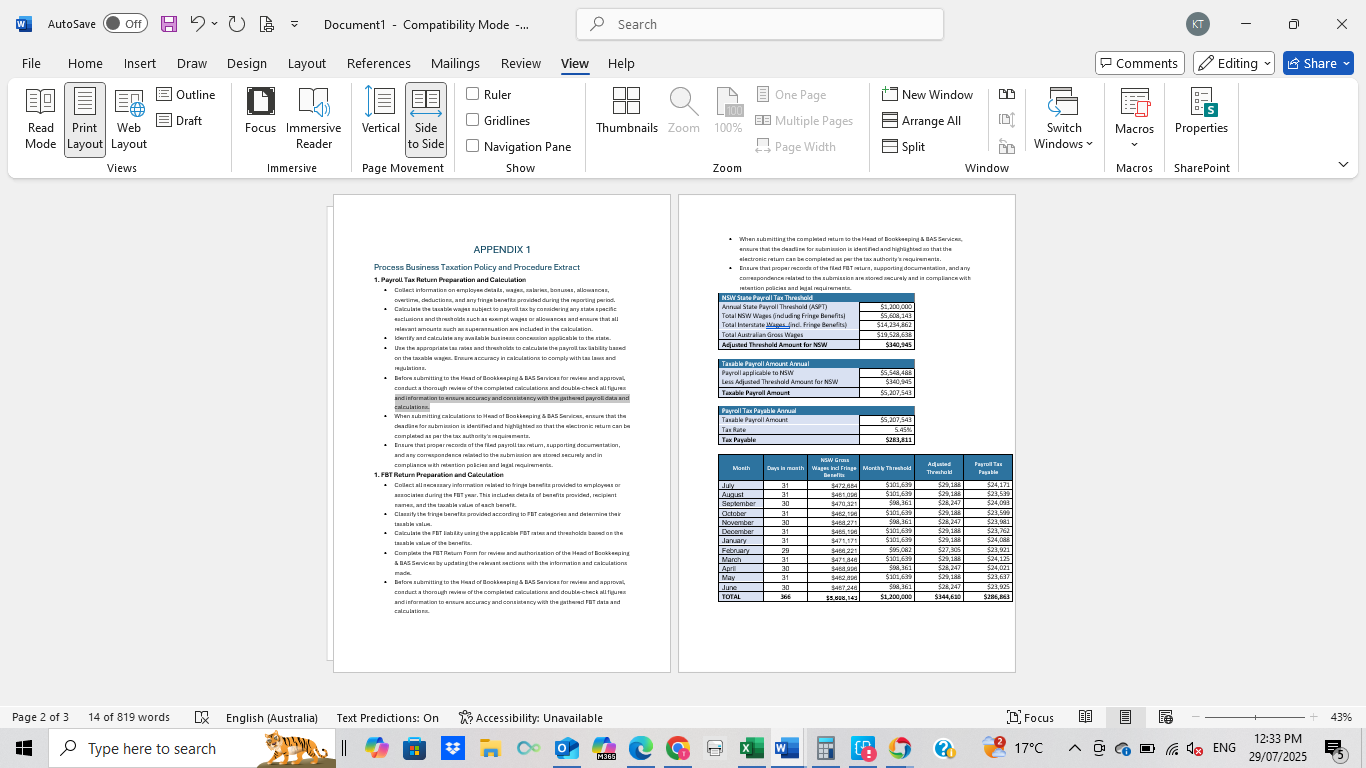

Task 4: Email your supervisorPrepare an email to the Head of Bookkeeping & BAS Services as requested. The email must include the following:? The total annual amount of salaries and wages subject to payroll tax for the year ended 30 June 2024.? The payroll tax payable for the year ended 30 June 2024? the due date for lodgement of the Annual Payroll Tax Return? ensure that the draft lodgement information provided to the Head of Bookkeeping & BAS Services complies with organisational policies and procedures as well as relevant state and territory legislation. Refer to Appendix 1 found in this document for the organisational policies and procedures.

W AutoSave Off H . U Document1 - Compatibility Mode -... Search X File Home Insert Draw Design Layout References Mailings Review View Help Comments Editing Share 39 Outline O Ruler One Page New Window Read Print Web Draft Focus Immersive Vertical Side Gridlines Thumbnails Zoom 100% BE] Multiple Pages Arrange All Switch Macros Properties Mode Layout Layout Reader to Side Navigation Pane Page Width Split Windows Views Immersive Page Movement Show Zoom Window Macros SharePoint When submi airy & DAS Service, APPENDIX 1 ansure that tha daadira for su n is klar mad and highighted an that the alactraric ratum can be charity's raquran ants. Process Business Taxation Policy and Procedure Extract Ensure that proparracode of the filed FIT astura, supporting documentacion, and any 1. Payroll Tax Return Prepara ion and Calculation comsapondence related to the submission are stored aacuraly and in compliance with Collect Information on am as, bonuses, allow Intention polclas and lajal requirem during the reportingt priod. NSW Sure Payroll Tax Thrashold Calculate the tosabia wayjas subject to payroll tax by coraldaring any stats spacific Annual State Payroll Threshold (ASPT) $1,300,800 sure that all Total NSW Wages (inducing Fringe Benefits] $5,608,143 $14,234.862 want amounts such ax x dad In the calculation. Total Interstate Mages Jnel Fringe Benefits) try and calculsinary a spilcable in the stats. Texal Australian Gross Wages 519,538,638 Lew its appropriate tam raw in the payroll tax ability haand Adjusted Threshold Amount for NSW $3401945 is 10 comply with tam lamas and Taxable Payroll Amount Annual Payroll applicable to Balors submitting to the Ha Bookkeping & 1AS Sandcan for mavism and approval Leis Adj.nted Threshold Amount for NSW 5340145 conduct a thorough review of the completed ca tions and double-check all fhuma $5,307.543 and information in ansem accuracy and constancy with the justbend payroll data and Taxable Payroll Amount When submitting calls ing & DAS Sanicar insure that the Payroll Tax Payable Annual Taxable Payroll Amount $6,307,543 had an that the sectionk isturn can ba 5.45M plated as partha tax au. Tax Payable Ensure that proper records of the fled payroll tax rat um, supporting documentation. $283,811 are sinead secursly and in inpliarcs with retention policies and lagal requirements. NEW Grins Marth Days In month Wages Ind Fringe | Monthly Threshold Fagroll Tax . FET Relum Preparation and Calculation Collect all asos smary information related in fringjia bared is provided to employsas or JUM $472 854 $101,635 $25, 188 $24,171 anciaisa during the FuTy August $301,639 $325 185 $23,589 manex, and the taxable value of anch banalit. September 20 $28,247 Clannity the fringja banalis pro soagoriss and daiarmins that October 31 9:482,108 $101,639 525,188 $23,50 thanbla walia. T9E BOS $28,147 $23,98 Calculate the FIT Jab Lay using the applicable and on the 21 $23,76 thanbla walus of the ban $101,635 $25,185 524.08 Complete the FIT Resem Form for racism and $96,082 $23,921 isation of the Head of Bookssspin $27,305 & DAS Services by updating 31 $25.188 $24,125 20 508 361 $28,247 $24,021 made $25,185 $23,637 Balors submitting in the Hand of Bookkeeping & BAS Sandcan for revism and approval, 31 $101 635 June conduct a thorough revism check all Thumx S467 248 508,361 $28,247 $23,925 TOTAL 366 $5 608,149 $1,200,606 $344,616 $286,163 and information in ansure acc cy with the pathand FOT dain and Page 2 of 3 14 of 819 words Ox English (Australia) Text Predictions: On Accessibility: Unavailable [ Focus + 43% MOOG X 2 17.C A D CO D / 10 ENG 12:33 PM Type here to search W 29/07/2025