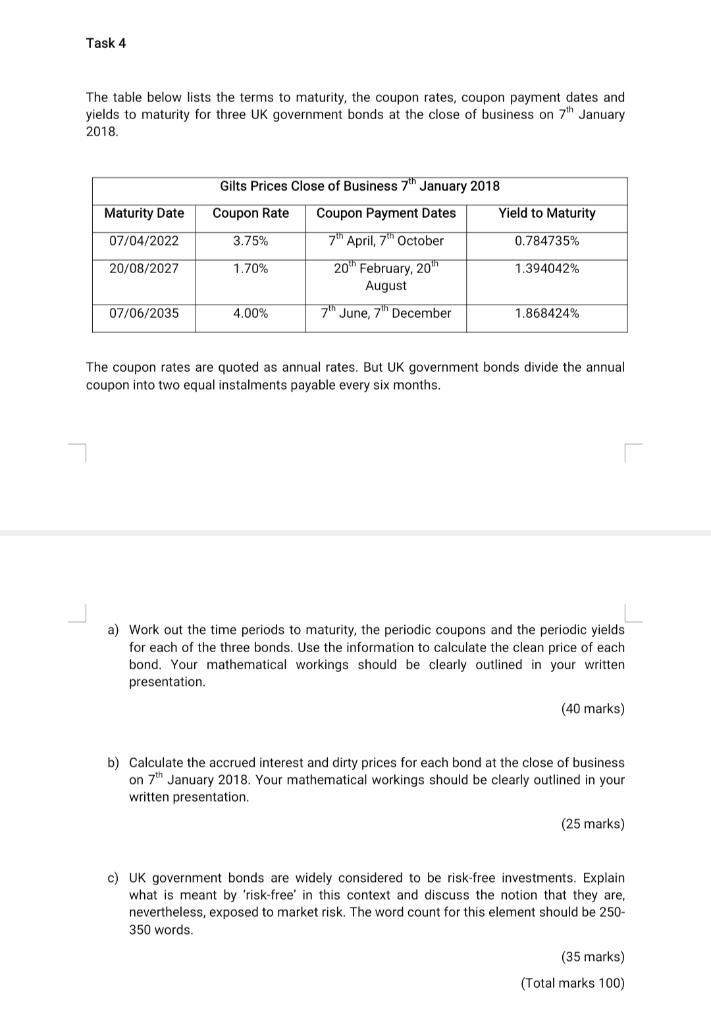

Question: Task 4 The table below lists the terms to maturity, the coupon rates, coupon payment dates and yields to maturity for three UK government bonds

Task 4 The table below lists the terms to maturity, the coupon rates, coupon payment dates and yields to maturity for three UK government bonds at the close of business on 7th January 2018 Maturity Date 07/04/2022 Gilts Prices Close of Business 7 January 2018 Coupon Rate Coupon Payment Dates Yield to Maturity 3.75% 7th April, 7 October 0.784735% 1.70% 2015 February, 20 1.394042% August 4.00% 7th June, 7 December 1.868424% 20/08/2027 07/06/2035 The coupon rates are quoted as annual rates. But UK government bonds divide the annual coupon into two equal instalments payable every six months. a) Work out the time periods to maturity, the periodic coupons and the periodic yields for each of the three bonds. Use the information to calculate the clean price of each bond. Your mathematical workings should be clearly outlined in your written presentation (40 marks) b) Calculate the accrued interest and dirty prices for each bond at the close of business on 7th January 2018. Your mathematical workings should be clearly outlined in your written presentation. (25 marks) c) UK government bonds are widely considered to be risk-free investments. Explain what is meant by 'risk-free' in this context and discuss the notion that they are, nevertheless, exposed to market risk. The word count for this element should be 250- 350 words. (35 marks) (Total marks 100) Task 4 The table below lists the terms to maturity, the coupon rates, coupon payment dates and yields to maturity for three UK government bonds at the close of business on 7th January 2018 Maturity Date 07/04/2022 Gilts Prices Close of Business 7 January 2018 Coupon Rate Coupon Payment Dates Yield to Maturity 3.75% 7th April, 7 October 0.784735% 1.70% 2015 February, 20 1.394042% August 4.00% 7th June, 7 December 1.868424% 20/08/2027 07/06/2035 The coupon rates are quoted as annual rates. But UK government bonds divide the annual coupon into two equal instalments payable every six months. a) Work out the time periods to maturity, the periodic coupons and the periodic yields for each of the three bonds. Use the information to calculate the clean price of each bond. Your mathematical workings should be clearly outlined in your written presentation (40 marks) b) Calculate the accrued interest and dirty prices for each bond at the close of business on 7th January 2018. Your mathematical workings should be clearly outlined in your written presentation. (25 marks) c) UK government bonds are widely considered to be risk-free investments. Explain what is meant by 'risk-free' in this context and discuss the notion that they are, nevertheless, exposed to market risk. The word count for this element should be 250- 350 words. (35 marks) (Total marks 100)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts