Question: Task 5: Bond evaluation A company has issued a fixed-rate bond with a term of six years for financing purposes. An investor purchased the fixed-rate

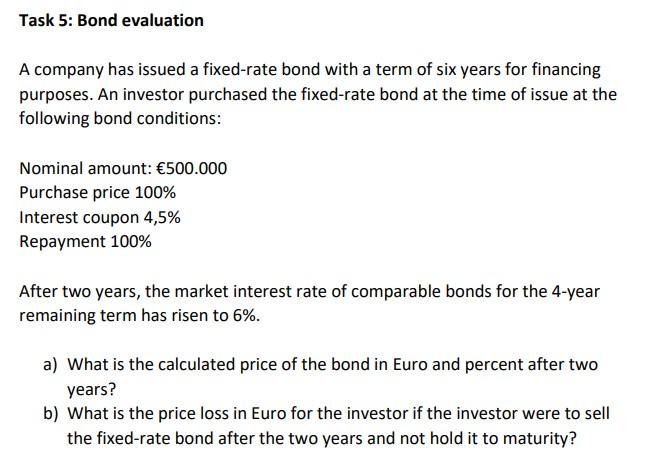

Task 5: Bond evaluation A company has issued a fixed-rate bond with a term of six years for financing purposes. An investor purchased the fixed-rate bond at the time of issue at the following bond conditions: Nominal amount: 500.000 Purchase price 100% Interest coupon 4,5% Repayment 100% After two years, the market interest rate of comparable bonds for the 4-year remaining term has risen to 6%. a) What is the calculated price of the bond in Euro and percent after two years? b) What is the price loss in Euro for the investor if the investor were to sell the fixed-rate bond after the two years and not hold it to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts