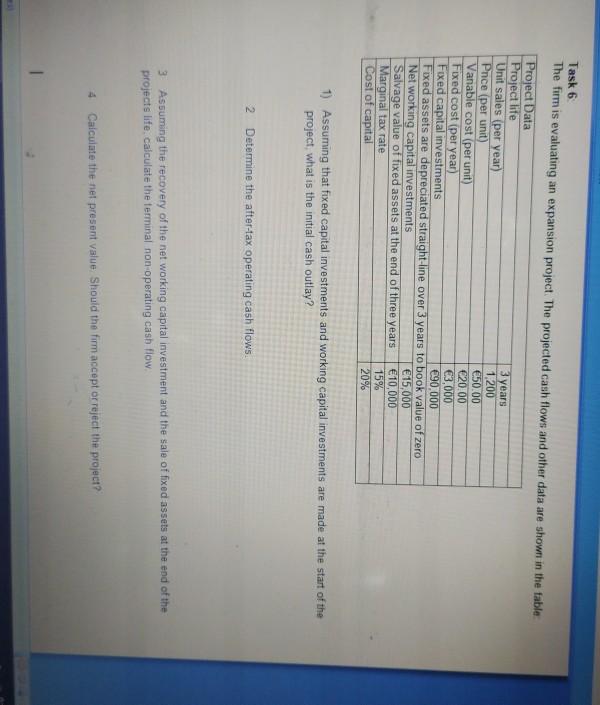

Question: Task 6 The firm is evaluating an expansion project. The projected cash flows and other data are shown in the fable Project Data Project life

Task 6 The firm is evaluating an expansion project. The projected cash flows and other data are shown in the fable Project Data Project life 3 years Unit sales (per year) 1,200 Pnce (per unit) 50.00 Vanable cost (per unit) 20.00 Fixed cost per year) 3,000 Fixed capital investments 90,000 Fixed assets are depreciated straight-line over 3 years to book value of zero Net working capital investments 15,000 Salvage value of fixed assets at the end of three years 10,000 Marginal tax rate 15% Cost of capital 20% 1) Assuming that fixed capital investments and working capital investments are made at the start of the project, what is the initial cash outlay? 2 Determine the after-tax operating cash flows. 3 Assuming the recovery of the networking capital investment and the sale of fixed assets at the end of the projects life, calculate the terminal non operating cash flow 4 Calculate the net present value. Should the firm accept or reject the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts