Question: Task 7 - GST Time Limits and Adjustments 16} Scenario: The business in this scenario has a current GSTturnover oflessthan $20 million pa. The ATO

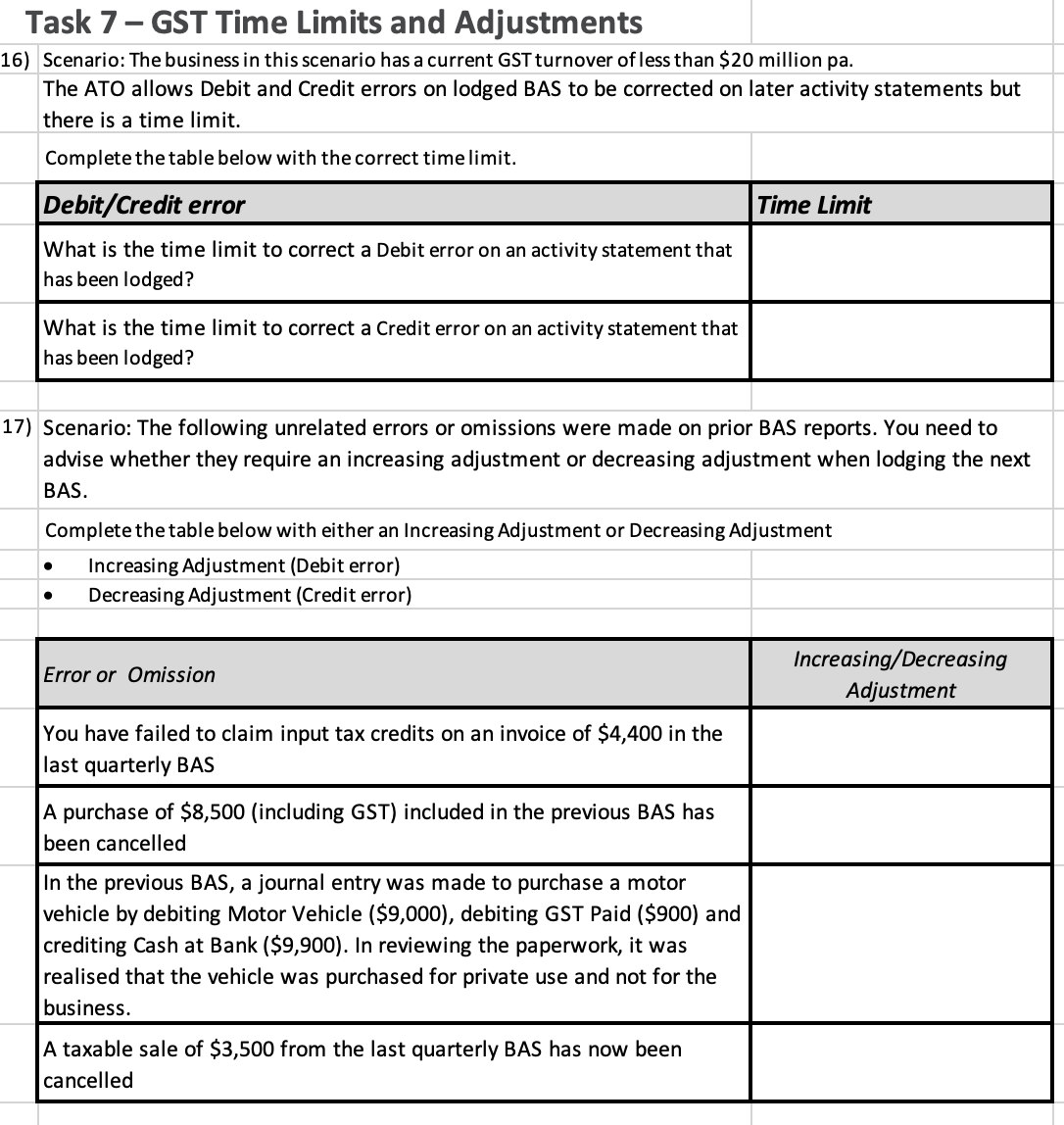

Task 7 - GST Time Limits and Adjustments 16} Scenario: The business in this scenario has a current GSTturnover oflessthan $20 million pa. The ATO allows Debit and Credit errors on lodged BAS to be corrected on later activity statements but there is a time limit. Complete the table below with the correct time limit. Debit/Credit error Time Limit What is the time limit to correct a Debit error on an activityr statement that has been lodged? What is the time limit to correct a Credit error on an activity statement that has been lodged? 17) Scenario: The following unrelated errors or omissions were made on prior BAS reports. You need to advise whether they require an increasing adjustment or decreasing adjustment when lodging the next BAS. Complete the table below with either an Increasing Adjustment or Decreasing Adjustment 0 Increasing Adjustment (Debit error) 0 Decreasing Adjustment (Credit error) Error or Omission increasmg/Decreosmg Adlustment You have failed to claim input tax credits on an invoice of $4,400 in the last quarterly BAS A purchase of $3,500 (including GST) included in the previous BAS has been cancelled In the previous BAS, a journal entry was made to purchase a motor vehicle by debiting Motor Vehicle ($9,000), debiting GST Paid ($900) and crediting Cash at Bank ($9,900). In reviewing the paperwork, it was realised that the vehicle was purchased for private use and not for the business. A taxable sale of $3,500 from the last quarterly BAS has now been canceHed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts