Question: Task B - NPV Project Liquid Grapes Inc. (LGI), a winemaker located in Kelowna, is considering opening a distribution centre in Toronto. LGI provides their

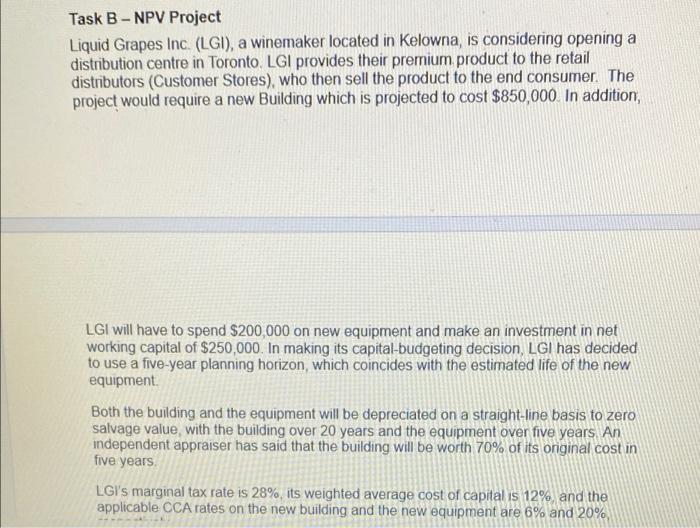

Task B - NPV Project Liquid Grapes Inc. (LGI), a winemaker located in Kelowna, is considering opening a distribution centre in Toronto. LGI provides their premium product to the retail distributors (Customer Stores), who then sell the product to the end consumer. The project would require a new Building which is projected to cost $850,000. In addition, LGI will have to spend $200,000 on new equipment and make an investment in net working capital of $250,000. In making its capital-budgeting decision, LGI has decided to use a five-year planning horizon, which coincides with the estimated life of the new equipment Both the building and the equipment will be depreciated on a straight-line basis to zero salvage value, with the building over 20 years and the equipment over five years An independent appraiser has said that the building will be worth 70% of its original cost in five years LGI's marginal tax rate is 28%, its weighted average cost of capital is 12% and the applicable CCA rates on the new building and the new equipment are 6% and 20% Distribution is considered nskier than making wine, a lot of wine in transit could be damaged by one bad vehicle accident. The risk-adjusted discount rate has been estimated to be 17%. Finally, based on market analysis, LGI has developed the following pro forma income statements for the centre: Year 1 Year 2 Year 3 Year 4 Year 5 Revenues 520,000 650,000 700,000 800,000 850,000 Cost of goods sold 260,000 325,000 350,000 400,000 425,000 Depreciation 57 500 57.500 57 500 57 500 57 500 Income before 202,500 267,500 taxes 292,500 342,500 367,500 Required: a) In Excel, calculate the NPV, and determine if LGI should open the new distribution centre? b) In order to analyze the investment in the centre in Toronto, management needs to understand where LGI's Customer Stores are and what the size of their potential market to help design the trucking routes and determine the number of trucks that might be required a. To assist LGI's management with this analysis, a map visualization of the customer locations using Power BI and the following file. QUESTION1 DATA Xlsx A sample visualization has been provided for you below. This is what your map should look like the bubble size for each city is dependent on the number of potential customers located in that city

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts